- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

- State of journalism survey 2024 shows media houses are lagging in AI adoption

- Forum sets the stage to unleash global potential for startups during AIM Congress 2024

Search Results: Zimbabwe (636)

- Zimbabwe is phasing out ZWL as it ushers a new gold-backed currency, ZiG, starting today, Monday, 8 April 2024.

- The ZiG is anchored by 2.5 tonnes of gold in the central bank’s vault and a basket of foreign currencies held as reserves.

- Zimbabwe’s new Central Bank Governor has announced sweeping reforms as the new currency enters everyday use.

Zimbabwe launched a new currency on Friday, 5 April 2024, called the Zimbabwe Gold or the ZiG. The launch of the new currency occurred during the announcement of the country’s latest Monetary Policy Statement (MPS) in an event presided over by newly appointed central bank governor John Mushayavanhu.

The MPS introduced measures and interventions to anchor the local currency and ensure exchange rate and price stability. The old currency, the ZWL, had depreciated to its lowest against the US dollar, roughly ZWL 32,000. It lost over 90 per cent of its …

- The Biden administration has refined US sanctions on Zimbabwe targeting specific leaders linked to human rights abuses and corruption.

- New sanctions leverage the Global Magnitsky Act, and they focus on individuals and entities undermining democracy and involved in graft.

- The strategy supports the objectives of the Zimbabwe Democracy and Economic Recovery Act, emphasizing the need for political and economic reforms in Zimbabwe.

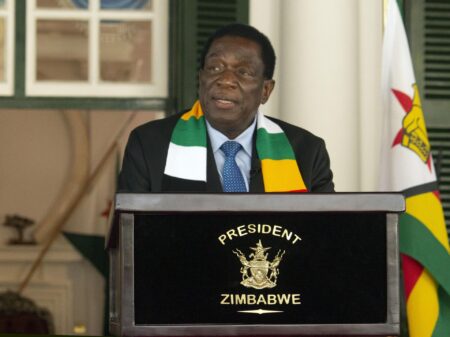

In a policy shift, President Joe Biden has overhauled the United States’ sanctions strategy towards Zimbabwe, introducing a set of measures aimed directly at key figures within President Emmerson Mnangagwa’s administration.

This move marks a departure from a broader sanctions regime that has been in place for over two decades, focusing instead on those at the heart of human rights abuses and corruption within the Zimbabwean government.

This restructuring of sanctions is part of the US’s ongoing commitment to fostering accountability for human rights abuses and corruption in …

- Zimbabwe is the worst hit in Africa with food inflation at 26% YoY, followed closely by Egypt at 18%, Malawi at 9%, and Guinea at 7%.

- The persistent weakness of the Zimbabwe dollar has been a driving force behind the steep price growth throughout 2023.

- Real food inflation, calculated as the difference between food inflation and overall inflation, provides a dire picture of the strain on households’ budgets in these countries.

The economies of Zimbabwe, Egypt, and Guinea are facing significant challenges due to soaring food inflation, placing them among the top 10 countries globally most affected by this roiling crisis.

According to the World Bank’s February 2024 update, Zimbabwe leads the pack in Africa, with food inflation at a staggering 26 per cent year-on-year, followed closely by Egypt at 18 per cent and Guinea at 7 per cent.

Real food inflation, calculated as the difference between food inflation …

- Zimbabwe earned US$209 million from lithium exports in the first nine months of 2023.

- The country’s lithium potential has captured significant attention, particularly from Chinese investors who have injected over US$1 billion in the mineral’s value chain.

- Lithium is a critical component in the production of electric vehicle (EV) batteries. Global electric vehicle (EV) car sales increased by 60 per cent in 2022, reports the International Energy Agency.

Zimbabwe is emerging as a pivotal player in satisfying the surging demand for lithium, a vital element used in the production of electric vehicle (EV) batteries. Zimbabwe has the largest lithium reserves and mines in Africa, while globally the country ranks high amongst the leading lithium producing and supply countries after Chile, Australia, China, Argentina and Brazil.

According to an article by Reuters published on November 1, 2023, Lithium is set to become Zimbabwe’s third biggest mineral export after gold and …

- Reduced commodity prices will hamper Zimbabwe’s economic growth aspirations in 2024. Commodities produced by Zimbabwe include platinum, gold, and diamonds.

- Over the last two years, the country earned record foreign exchange export receipts due to booming commodity prices. However, exports have started to slow and are expected to continue into 2024.

- Zimbabwe will face a perfect storm of economic headwinds, combining factors such as persistent soft commodity prices, anticipated El Nino conditions leading to reduced agricultural output, and lower power generation, all contributing to a reduction in economic growth.

Zimbabwe’s economic growth in 2024 will face challenges due to headwinds within its economy, compounded by external factors undermining its growth aspirations. Global commodity prices have recently decreased, posing a significant concern for countries dependent on producing these commodities for economic sustenance.

Over the last two decades, mining has increased significantly in Zimbabwe’s economy. While agriculture was once central to the …

- CBZ Holdings, FBC Holdings, and ZB Financial Holdings have all played a pivotal role in shaping Zimbabwe’s banking sector this year.

- One of the most notable transactions in 2023 involves CBZ’s acquisition of a 36.35 per cent stake in First Mutual Holdings Limited.

- 2023 saw FBC Holdings execute a strategic move by acquiring Standard Chartered Bank Zimbabwe Limited.

This year has proven to be a transformative period for Zimbabwe’s banking sector, witnessing significant acquisitions that have reshaped the landscape. In particular, three major players, CBZ Holdings Limited (CBZ), FBC Holdings Limited (FBC), and ZB Financial Holdings (ZB), have played a pivotal role in these developments.

These acquisitions signify a dynamic shift in Zimbabwe’s banking sector, with key players strategically positioning themselves for growth and market dominance.

Acquisitions shaping Zimbabwe’s banking sector

One of the most notable transactions in 2023 involves CBZ’s acquisition of a 36.35 per cent stake in First …

- Zimbabwe’s Minister of Finance, Economic Development, and Investment Promotion has unveiled a significant policy shift regarding the levy on sugar content in beverages.

- This measure is scheduled to take effect from January 1, 2024, to discourage the consumption of high-sugar beverages.

- While introducing the sugar content levy is presented as a measure to address health concerns, its impact on consumers, beverage industries, and the healthcare sector remains uncertain.

The 2024 National Budget Speech, presented to the Parliament of Zimbabwe by Prof. Mthuli Ncube, Zimbabwe’s Minister of Finance, Economic Development, and Investment Promotion, has unveiled a significant policy shift regarding the taxation of sugar content in beverages.

Citing global concerns about the health implications of high sugar consumption, especially in beverages, Minister Ncube acknowledged the worldwide trend of implementing sugar taxes, including in the Southern African Development Community (SADC) region. The proposed policy change is driven by the adverse health effects …

- Econet Wireless Zimbabwe, a Telecommunications company founded by Strive Masiyiwa, has introduced the country’s first eSIM service.

- eSIM is a digital SIM card embedded in smartphones, eliminating the need for a physical SIM card and allowing users to have multiple phone numbers on one device.

- Econet’s adoption of eSIM technology aligns with global trends and promises to bring numerous benefits to both consumers and the company itself.

Econet Wireless Zimbabwe, one of the country’s leading telecommunications companies, has taken a bold step by introducing the country’s first eSIM service. This innovative technology, known as eSIM (Embedded Subscriber Identification Module), is a digital SIM card that is embedded in smartphones, eliminating the need for a physical SIM card.

Econet Wireless Zimbabwe’s introduction of eSIM technology is not merely a technological advancement but a strategic move to provide its customers with a better, more flexible, and sustainable communication experience.

Econet’s eSIM technology

…- Zimbabwe’s economic history has been turbulent with hyperinflation, currency devaluation, and a shortage of the Zimbabwean dollar.

- To cope with these challenges, Zimbabweans embraced digital payments.

- In H1 2023, digital payment values rose by 40%, with transaction volumes seeing a slight 4% decline.

- Mobile money services such as EcoCash, OneMoney, Innbucks, O’mari, and Telecash are now crucial for transactions in Zimbabwe.

For years, Zimbabwe has grappled with a severe shortage of physical currency. The nation’s economic turmoil commenced with hyperinflation, forcing the abandonment of its own currency in 2009. Instead, a mix of foreign currencies, primarily the US dollar, came in helping to steady the economy.

However, by 2015, the US dollar began vanishing from formal banks, resulting in a significant scarcity. Consequently, individuals and businesses started hoarding US dollars. The USD was considered a safe investment rather than a means of exchange.

Introduction of Bond Notes in Zimbabwe

To …

- RBZ Governor John Mangudya revealed that as of July 21st, the bank had conducted 11 issuances of GBDT.

- The Governor noted that the bank received 590 applications to purchase tokens equivalent to 325.02Kg of gold.

- In 2022, as the international economic environment worsened, Zimbabwe turned to gold coins were introduced to tame runaway inflation.

Zimbabwe’s struggles with hyperinflation has since been making headlines for decades. In 2009, inflation was so devastating that the country issued a new Zimbabwean dollar (ZWL), shedding twelve zeros from the earlier currency (ZWD).

By November 2022, the annual consumer price inflation for a compressed basket of goods was at 107 per cent in the country and in June, inflation rose to 175.8 per cent following devaluations of the local currency.

According to the Reserve Bank of Zimbabwe (RBZ) mid-term monetary policy statement, inflation increased to 86.5 per cent and 175.8 per cent in May and …