- KCB Group Plc has recorded a historic 74 per cent rise in profit after tax for the full year ending December 2021, to hit KSh 34.2 billion compared to KSh 19.6 billion a year earlier

- The bank attributed the performance to increased income, cost management and lower credit provisions which saw the Group post higher returns to shareholders

- Provisions for the period reduced by 52% to close at KSh 13.0 billion from KSh 27.2 billion a similar period in 2020

KCB Group Plc has recorded a historic 74 per cent rise in profit after tax for the full year ending December 2021, riding on an economic recovery across its key markets.

During the period under review, net profit grew to KSh 34.2 billion compared to KSh 19.6 billion a year earlier, on

the back of increased income, cost management and lower credit provisions which saw the Group post higher returns to shareholders.

KCB Bank’s revenues increased by 13.5 per cent to KSh 108.6 billion on account of a rise in net interest income which was up 15.0% to KSh 77.7 billion. Nonfunded income grew by 9.9 per cent to KSh 30.9 billion on increased customer transactions, FX income and income from accelerated loan growth.

Its costs went up by 11.9 per cent to KSh 47.8 billion from KSh 42.8 billion on account of an increase in staff and organisational costs, consolidation of Banque Populaire du Rwanda (BPR) and inflationary adjustments across the group.

Other operating expenses increased marginally by 2.8 per cent to close at KSh 22.9 billion from KSh 22.3 billion in 2020 with improved cost management across the Group.

The ratio of non-performing loans (NPL) increased from 14.7 per cent to 16.5 per cent, signalling the longer-term effects of COVID-19 impact. Several key sectors, largely construction, hospitality, and manufacturing, continued to come under pressure with slow recovery.

Provisions at KCB Bank for the period reduced by 52% to close at KSh 13.0 billion from KSh 27.2 billion a similar period in 2020. The decrease is largely due to lower corporate and digital lending impairment charge after the deliberate action on covid related provisions absorbed in the previous year.

Commenting on the results, KCB Group CEO Joshua Oigara said they had made significant progress in achieving our 2021 strategic targets which delivered a strong financial performance that was in line with gradual economic recovery across all markets.

“The third and fourth quarters were the turning point with a pick-up in lending activity even as the COVID-19 pandemic continued to impact on economic activity,” he said.

KCB further grew its balance sheet with total assets rising by 15.4 per cent to KSh 1.139 trillion, driven by organic growth across our businesses and acquisition of BPR.

Customer deposits went up by 9.1% through acquisitions and additional customers in corporate and retail franchises across the Group.

The net loan book clocked KSh 675.5 billion on increased lending to key segments such as Micro Small and Medium Enterprises (MSMES), consumer and corporate.

Shareholders’ funds grew 20.6% from KShs.142.4billion to KSh 171.7 billion on improved profitability for the period.

KCB Group maintained healthy buffers on its capital ratios over the minimum regulatory requirement, giving the Group a strong headroom for growth.

Core capital as a proportion of total risk-weighted assets closed the period at 18.0 per cent against the Central Bank of Kenya statutory minimum of 10.5 per cent. Total capital to risk-weighted assets ratio was at 21.7 per cent against a regulatory minimum of 14.5 per cent.

The Board of Directors of the bank has recommended a final dividend of KSh 2.00 per share. This follows an interim dividend of KSh 1.00 paid out in January this year.

According to the lender, the final dividend will be payable to the members of the company on the share register at the close of the business on Monday 25 April 2022.

If approved, the full dividend per share for the year ended 31 December 2021 will be KSh 3.00 for each ordinary share.

Acquisition

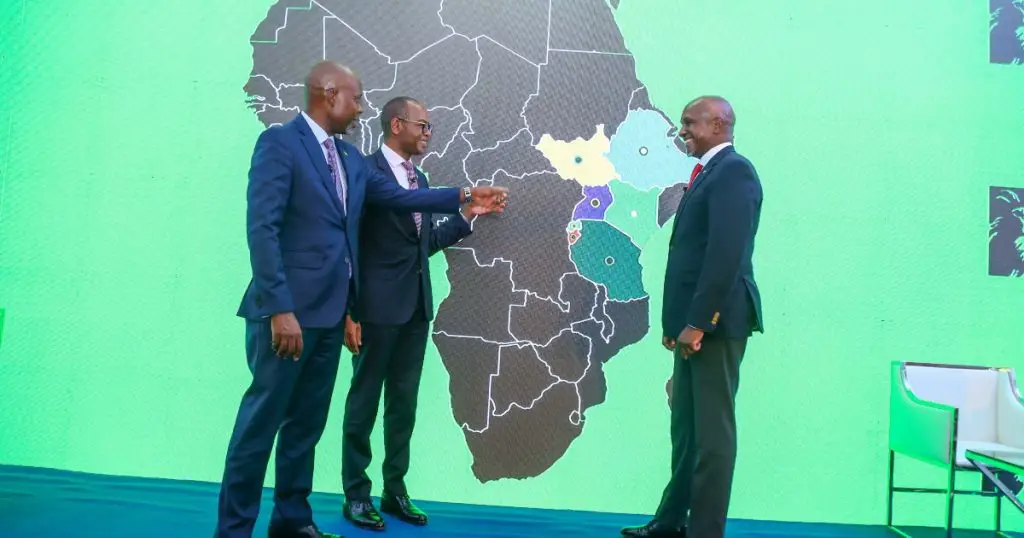

The bank revealed it had successfully completed the acquisition of BPR on July 31, 2021 and has kicked off integration activities that will see the amalgamation of BPR and KCB Bank Rwanda into a single banking business.

“The benefits of our regional expansion continue to positively contribute to the KCB’s performance. In 2021, the profit before-tax contribution from Group businesses went up to 13.7%, putting us on track towards our 20% target this year. KCB will continue exploring and pursuing attractive regional expansion opportunities to enhance our regional participation, accelerate growth, and maintain sustainable long-term performance,” said KCB Group Chairman Andrew Wambari Kairu.

“Our future has additional opportunities to exploit, details of which will be communicated as they develop” he added.

KCB continued to pursue growth initiatives within its Beyond Banking Strategy (2020-2023) which is anchored on delivering the very best in customer experience and driving a digital future. KCB is optimistic of better prospects this year on the back of a projected economic recovery in East Africa.

“We are optimistic about the East African economy’s inherent medium and long-term potential despite the looming effects of the geopolitical crisis in Europe, lurking threats of COVID-19 and other local developments, including the upcoming General Elections in Kenya,” said Kairu.