- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

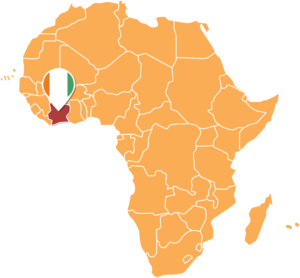

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

President Uhuru Kenyatta has announced a minimum wage increase of 12 per cent from 1st May 2022 to cushion workers against further erosion of their purchasing power.

Noting that there has been no review of the minimum wages for over three years while the cost of living has increased with inflation ranging between 5 to 6 per cent annually, the President said the Government has found it necessary to increase the minimum wages.

“In that regard, and in full appreciation of the critical contribution of workers to the economy; following the recommendation of various stakeholders; as a caring Government, we find that there is a compelling case to review the minimum wages to cushion our workers against further erosion of their purchasing power while also guaranteeing the competitiveness of our economy,” the President said.

President Kenyatta spoke on Sunday at Nyayo National Stadium in Nairobi when he led Kenyan workers …

- The African firm which provides shared transportation services for both intracity and intercity movement acquired the Turkish firm at around US$40 million

- Swvl currently repurposes underutilized, privately owned buses or minivans for different purposes throughout the day

- Swvl said the acquisition of Volt Lines would add an incremental US$4.3 million of annualized revenue to its balance sheet

Egyptian startup Swvl has expanded into Turkey after it recently acquired B2B transportation-as-a service operator Volt Lines.

The African firm which provides shared transportation services for both intracity and intercity movement acquired the Turkish firm at around US$40 million.

The acquisition now gives Swvl access to Volt Line’s tech as well as over 110 corporate client contracts.

Swvl currently repurposes underutilized, privately owned buses or minivans for different purposes throughout the day.

Some of these include shuttling intercity commuters along fixed routes, providing rides between cities and driving corporate employees to work …

- Rwanda will receive two loans amounting to $180 million from the African Development Bank

- The funds will support a major energy project that will extend electricity access to rural areas and reduce greenhouse gas emissions

- It entails the construction of over 1,000 km of medium voltage and 3,300 km of low voltage lines to boost last-mile access

- The project is expected to connect 77,470 households to the electricity network for the first time and connect 75 schools, eight health centres and 65 administration centres

Rwanda will receive two loans amounting to $180 million from the African Development Bank (AfDB) to co-finance a major energy project that will extend electricity access to rural areas and reduce greenhouse gas emissions.

In a statement seen by The Exchange Africa, the AfDB said the new funding follows the approval for $84.2 million made in May 2021 for the same project.

According to the lender, …

- Sub-saharan Africa now faces new economic growth challenges, compounded by the Russian invasion of Ukraine

- A World Bank report estimates growth at 3.6 per cent in 2022, down from 4 per cent in 2021 as the region continues to deal with new COVID-19 variants, global inflation, supply disruptions and climate shocks

- Resource-rich countries, especially their extractive sectors, will see improved economic performance due to the war in Ukraine, while non-resource-rich countries will experience a deceleration in economic activity

As the Sub-Saharan African economy struggles to recover from the 2020 recession induced by the COVID-19 (coronavirus) pandemic, the region now faces new economic growth challenges, compounded by the Russian invasion of Ukraine.

The World Bank’s latest Africa’s Pulse, a biannual analysis of the near-term regional macroeconomic outlook, estimates growth at 3.6 per cent in 2022, down from 4 per cent in 2021 as the region continues to deal with new COVID-19 …

- African Development Fund has approved $5.5 million technical assistance grant to support projects Eastern Sahel region countries of Djibouti, Eritrea, Ethiopia and Sudan

- The East Africa Regional Energy Project will be financed through the ADF-15 Regional Public Good window of the African Development Fund, the concessional arm of the African Development Bank Group

- It will develop technical studies for regional solar parks and associated battery storage near regional energy inter-connectors, high-voltage cables that connect the electricity systems of neighbouring countries

The African Development Fund has approved a $5.5 million technical assistance grant to begin the roll-out of the flagship Desert to Power initiative in the Eastern Sahel region countries of Djibouti, Eritrea, Ethiopia and Sudan.

Dubbed the East Africa Regional Energy Project, it will be financed through the ADF-15 Regional Public Good window of the African Development Fund, the concessional arm of the African Development Bank Group.

The project will …

- Kenya’s PesaLink payments ecosystem has signed a Memorandum of Understanding (MoU) with Mastercard to create innovative, digital-first payment solutions

- PesaLink will leverage Mastercard’s technology, expertise, partnerships, and cyber intelligence solutions to diversify its payment capability beyond person-to-person payments

- Mastercard will collaborate with PesaLink to expand its services to include a direct-to-consumer digital proposition, agent banking and solutions for business and government payments

Integrated Payment Services Limited (IPSL) which runs the PesaLink payments ecosystem has signed a Memorandum of Understanding (MoU) with Mastercard to create innovative, digital-first payment solutions designed to boost the adoption and usage of digital payments and accelerate Kenya’s transition to a cash-lite economy.

Established by the Kenya Bankers Association, the PesaLink ecosystem continues to grow and today, comprises 31 banks in Kenya and several payment service providers, Savings and Credit Cooperatives (SACCOs) and a telco, enabling over 9.5 million customers to connect to a secure, fast, efficient, …