- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

- State of journalism survey 2024 shows media houses are lagging in AI adoption

- Forum sets the stage to unleash global potential for startups during AIM Congress 2024

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

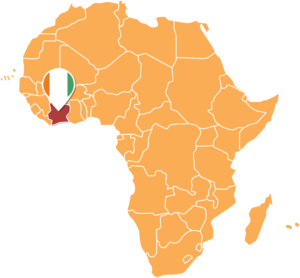

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

The case for investment in Africa is compelling. At no time before in history has the continent formerly and perhaps harshly referred to as the dark continent been so promising in terms of its economic potential.

The continent has been home to some of the fastest growing economies in the world. The continent according to research conducted by Standard Bank Group published in a report titled “Infrastructure Financing in Sub Saharan Africa for Institutional Investors”, states that in the last decade there have been 4 notable trends in Africa:

1. A larger, younger, and more affluent population

2. Africa’s transformational urban swell

3. Technological advances that have caused the continent to leapfrog

4. A deepening financial sector

These four trends have acted as structural drivers of Africa’s renewed economic promise. Over the last 10 year, specifically between 2010 and 2019 the collective economy of Africa grew by 55%. In monetary …

Emerging markets have become an asset class which investors need to consider to optimize their portfolios. In 2000 investment flows into the 30 markets characterized as emerging markets were at least US$ 250 billion. Institutional investors have been cited by Africa’s largest banking groups as a critical component of the development of these emerging markets especially in terms of infrastructure development and funding. Investment in emerging markets has been driven primarily by the sluggish growth of the US and other advanced economies. These economies characterized as emerging economies have recorded impressive growth rates in their respective GDPs however deploying capital in them can be lucrative but also poses significant risks. One of the most poignant cases in point is that of Russia which is counted among the BRICS countries or emerging markets has in the space of being an investment darling to and investment pariah. The value of the currency

- The United Arab Emirates (UAE) has announced interest in investing in the Democratic Republic of Congo (DRC)’s solar energy sector

- The MoU was signed between DRC’s state electricity company Société Nationale d’Électricité (SNEL) and AMEA Power

- World Bank data indicates that DRC has a population of 84 million people, but only 19 to 20 per cent of the population have access to electricity

The United Arabs Emirates (UAE) has announced interest in investing in the Democratic Republic of Congo (DRC)’s solar energy sector.

The countries, through two companies, entered into a Memorandum of Understanding (MoU) to pave way for the production of 30 megawatts in DRC.

The MoU was signed between DRC’s state electricity company Société Nationale d’Électricité (SNEL) and AMEA Power.

SNEL Director-General Jean-Bosco Kayombo Kayan said the deal would see millions of people get connected to the national power grid.

According to the DG, UAE plans on exploring …

- Since he became the CEO in 2011 to his retirement in 2022, yearly turnover grew from US$1 billion to US$4.5 billion

- Ethiopian Airlines’ fleet increased from 33 to 131 planes, and passengers grew from 3 million to 12 million passengers a year

- Tewolde explained that his decision to resign came after advice from his doctors to concentrate on his health

Last week, Mr Ato Tewolde Gebremariam, The Chief Executive of Ethiopian Airlines, retired for undisclosed health reasons. The Airlines will remember the honourable man for the revolution he brought from the day he got the main man job. Since he became the CEO in 2011 to his retirement in 2022, yearly turnover grew from US$1 billion to US$4.5 billion. The fleet increased from 33 to 131 planes, and passengers grew from 3 million to 12 million passengers a year.

He started working for the Ethiopian in 1985 as a transportation …

- Equity has recorded a 99 per cent rise of its net profit to reach KSh 40.1 billion from KSh 20.1 billion

- Net interest income grew by 25 per cent to KSh 68.8 billion, up from KSh 55.1 billion, driven by a 23 per cent growth in loan book to KSh 587.8 billion

- Equity Group CEO James Mwangi said the bank has now strategically positioned itself as a systemic regional diversified business in six countries

Equity Group has recorded superior performance for the year ended 31st December 2021 despite the challenging operating environment of a global COVID-19 pandemic.

Profit After Tax increased by 99 per cent to KSh 40.1 billion from KSh 20.1 billion, with Profit Before Tax recording a growth of 134% to KSh 51.9 billion, up from KSh 22.2 billion the previous year.

The Group has recommended a record dividend pay-out of KSh 3 per share totalling KSh …

The returned items include the Shiva and his Disciples, Worshipping Shakti and Lord Vishnu and his Forms.

The news portal noted that the artefacts date from as early as the ninth to the tenth century.

The artefacts are primarily made of sandstone, marble, bronze and brass.

According to the publication, the antiques are from various places In India, including Rajasthan, Gujarat, and West Bengal.…