- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

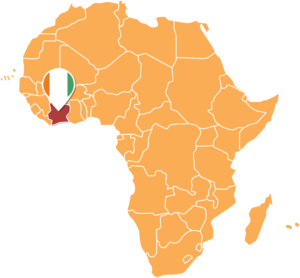

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

Kenya mainly imports frozen tilapia, frozen mackerels, sardines, prawns and salmon, while the country exports frozen Nile perch, tuna, octopus, whole tilapia and lobsters notably to the European Union.

On the other hand, avocado has been a significant contributor to the earnings in the horticulture sector. Last Year, Kenya topped Africa’s avocado exports and was among the world’s top 10 producers. Avocado farmers earned Sh14.48 billion between January to November 2021.

KenTrade is in partnership with GIZ in this simplification exercise.…

- UN’s Food and Agriculture Organization (FAO) says that an extended, multi-season drought is driving acute food insecurity in the region

- FAO said that 12 to 14 million people are now at risk as crops continue to wither and animals weaken

- Resource-based conflicts are escalating as competition for water and pasturelands increases, and malnutrition rates are rising in affected areas of Ethiopia, Kenya and Somalia

Multiple data, including that of the African Development Bank (AfDB) indicates that Africa holds the key for feeding the nine billion people that will be on Earth by 2050.

While delivering a passionate speech at Iowa State University in the US in 2017, AfDB’s President Akinwumi Adesina noted that the continent sits on 65 percent of the uncultivated arable land left in the world.

He said that what Africa does with agriculture will determine the future of food in the world. Adesina also noted that the …

- Ghana has several opportunities for investors including abundant raw materials including gold, cocoa, and oil/gas

- It however faces several challenges that hinder foreign direct investment, among them costly and difficult financial services and lack of government transparency

- Low-cost labour, a national airline with well over 100 passenger connections and growing consumer markets are key elements attracting foreign investment into Ethiopia

- Companies often face long lead-times importing goods and dispatching exports due to logistical bottlenecks, corruption, high land-transportation costs, and bureaucratic delays

Ghana remains a favourable investment destination in Africa in 2022, despite the impact of the challenges the economy faces including the COVID-19 pandemic.

Data by the US Department of State indicates that the economy has continued to rebound from the negative impact of the virus, and has made attracting foreign direct investment a priority.

The economy has expanded at an average of 7 per cent since 2017 to 2020, …

The global economy has come back strongly. So has inflation. Commodity prices are also making a strong comeback; however, their resurgence is causing stress in other economies.

Rising demand has pushed oil prices to a rising trend which may, in the long run, prove to be unsustainable. Food price inflation has reportedly reached the highest level since 2011. Further compounding the problem for households and businesses is the fact that in the United States consumer inflation has reached 5.5 per cent annually which is the highest it has been in 31 years.

Companies operating in Africa and the rest of the world need to consider these developments into their expectations and decisions. The question is how? How can companies inflation-proof, as it were, their finances to protect their viability?

Cash is always king in times of uncertainty and inflation. There are six ways that companies are well-advised to adapt to …

Adding debt of leverage to the capital structure of a company, also in the right instances can increase the return on equity and/or return on investment for shareholders. Chief executives of listed companies and their chief finance officers tend to wax lyrical about these metrics.

They do so for good reason because they are judged to either be doing a good job or poor job depending on whatever these numbers read. The better this metric looks the more likely a company executive can look forward to a fat bonus and pay package! In addition to being a tax shield for a company’s profits, debt can enhance the returns a company generates for its shareholders.

Take the following scenarios that take place under the exact same set of circumstances.…

There is a lot of hype around the Zimbabwe Stock Exchange (ZSE).

For instance, it is said to have had the best performance of African stock market indices over the first nine months of 2020, according to a consolidated report by the African Markets platform. During that period the Zimbabwe All-Share Index, the main index of this financial market, grew by 612 per cent.

This was when values were calculated using local currency. When the values are calculated using US$ and Euros the market still posted some very impressive returns of 46.6 per cent and 40 per cent respectively. This implies that investors who made hard currency investments in African markets made the most money from their investments in Zimbabwe… A caveat is in order here because these are merely statistics…

In 2020, only Malawi and Rwanda had their stock markets post positive returns albeit marginal with returns of 6.8 …