- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Mergers & Acquisitions

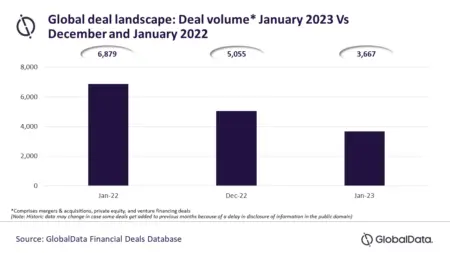

- Global deal activity down 27.5 percent Month-on-Month (M-o-M) and 46.7 percent Year-on-Year (Y-o-Y) in January 2023.

- All the deal types under coverage witnessed massive double-digit decline

- According to the data, a total of 3,667 deals* were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 percent Y-o-Y (Year on Year) decline over January 2022.

Mergers and acquisitions, private equity, and venture financing deal activity is off to a slow start in 2023 globally as the first month of the year itself saw a significant contraction in deals volume according to the latest data from GlobalData, data and analytics company.

According to the data, a total of 3,667 deals were announced globally during January 2023, which is a decline of 27.5 percent compared to 5,055 deals announced during the previous month and a massive 46.7 …

This comes after the National Treasury exempted the digital lender from a law limiting individual shareholding in microfinance to 25 per cent.

In a gazette notice signed by the Cabinet Secretary National Treasury, Ukur Yatani, the San-Francisco based fintech has been exempted from Section 19 of the Microfinance Act (for 4 years through 2025).

Currently, individuals or single entities are barred from holding more than a 25 per cent stake in a microfinance institution.…

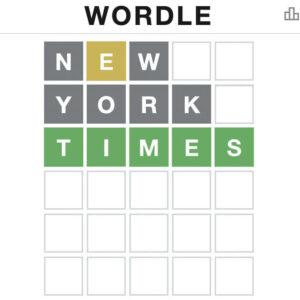

- The game has been acquired for an undisclosed price in the “low seven figures.”

- This adds to the publications growing portfolio of word games including The Crossword, The Mini, and Spelling Bee

- As of December 2021, The NYT had over one million games subscriptions

It has now become common for one to come across a post on different social media platforms with the title Wordle accompanied by a specific figure and what appears to be a strange-looking yellow, green and black graph.

This growing phenomenon is courtesy of a puzzle known as Wordle created by Brooklyn-based software engineer Josh Wardle in October 2021.

The game initially created for Wardle and his partner Ms. Palak Shah has now been purchased by the New York Times (NYT) Company. According to the NYT, the game has been acquired for an undisclosed price in the “low seven figures.”

Read: Piecing the Puzzle of African …

Kenya has seen five American multinational corporations enter its territory setting base in what is a challenging time for the East African economic hub.

The latest entrants who entered the Kenyan market in the last 12 months are an indication that US private-sector businesses are bold enough to dive into the economy that has been decelerating.

Among these companies that will create opportunities and transform the business landscape in Kenya and the region include Cigna, an American health services organization and Abbot Laboratories.

The two have already set up regional offices in Nairobi. This is Abbot Labs’ second regional office in Africa after decades of being present in South Africa.

American agricultural chemical and seed company Corteva and the American Tower Corporation (ATC) have also set up regional offices in Kenya.

ATC has already acquired 723 towers from Telkom with another acquisition in the pipeline which will make ATC Kenya …

Adenia Partners, a private equity firm investing in Sub-Saharan Africa, and headquartered in Mauritius has been making inroads into the supermarket sector in Kenya through strategic buy-outs in the last one year.

Last month, Adenia Partners announced that it completed a majority investment in Quick Mart Limited, a major supermarket chain, operating a chain of 11 supermarkets in Kenya with 9 stores located in neighbourhood estates in Nairobi, and another 2 stores in the town of Nakuru. The transaction has been structured through Adenia Capital (IV), a EURO230mn fund.

Immediately, the buy-out managers announced that they will use the funds to expand to new locations as well as merging it with another upcoming store, Tumaini Self Service Limited which runs a supermarket by the same name.

The PE announced in December 2018, that it had completed an investment in Tumaini Self Service Limited through a special purpose vehicle, Sokoni Retail …

Bowmans Law firm, a leading pan African legal entity specializing in business deals, merger and acquisitions (M&A) is set to launch its base in Ethiopia and Mauritius at the beginning of October 2019. The move is seen as an expansion of the company to two countries where FDIs have remained high coupled with financial growth.

Bowmans is opening a fully-fledged office in Mauritius, having joined forces with FirmWise, a local firm that specialises in corporate law, mergers and acquisitions, banking and finance, investment funds, tax, compliance and private equity.

Robert Legh, chairman, and senior partner, says ‘This move, which is effective from 1 October 2019, is an investment in the ambitions and success of our clients across Africa. Mauritius and Ethiopia are key jurisdictions for many of our clients and our presence on the ground there will help us to better support them.’

The law firm already has a presence …

Societe Bic, the global owner of the Bic brand has announced that it has signed a definitive agreement to acquire 100% of Lucky Stationery Nigeria Ltd (LSNL). The transaction has been reviewed and approved by the Nigerian Federal Competition and Consumer Protection Commission (“FCCPC”). The closing is expected end of 2019.

LSNL is Nigeria’s number one Writing Instruments manufacturer, with approximately 5 million euros in Net Sales and approximately 30% market share in volume. Its main Writing Instrument manufacturing facility is currently located in Ilupeju-Lagos and will be relocated to a new modern facility north of Lagos in Shagamu.

BIC has been operating in Nigeria for more than forty years through a distribution partnership with CFAO – Nipen. LSNL’s brand, product portfolio, and distribution network will strengthen BIC’s current position in Nigeria.

This acquisition is consistent with BIC’s continued growth strategy in Africa. Nigeria is the largest economy and most …

Jervois has completed its merger with eCobalt after receiving eCobalt’s nod from its Canadian shareholders and Supreme Court of British Columbia approvals. According to a joint announcement, following the successful completion of the Arrangement, all conditions precedent have been met and settlement of the A$16.5 million equity placement in Jervois has occurred.

The expanded company has projects in Australia, East Africa, and the US, including eCobalt’s Idaho Cobalt project, which boasts the highest combination of cobalt grade and scale in North America.

The acquisition of M2 Cobalt gave Jervois an entry into Uganda, complementing its East African strategy looking at opportunities around the historic Kilembe mine and Kasese cobalt refinery.

Idaho Cobalt Project has been renamed Idaho Cobalt Operations (“ICO”) to reflect its advanced stage of development and Jervois’s intention to transform the site into a mining operation. The site has had an estimated US$100 million invested to date in …