- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Money Deals

- A key component of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively.

- The USDT/SOL exchange pair refers to the trading of Tether (USDT) against Solana (SOL) on a cryptocurrency exchange.

- Solana, on the other hand, is a blockchain platform designed for decentralized applications and crypto-native projects.

Cryptocurrency investments have gained significant popularity in recent years, providing individuals with opportunities to grow their capital in the digital asset space. One of the key components of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively. In this blog, we will explore the concept of using exchanges to grow your capital, with a specific focus on the USDT/SOL exchange pair.

What is the USDT/SOL exchange pair?

The USDT/SOL exchange pair refers to the trading of Tether (USDT) against Solana (SOL) on a cryptocurrency exchange. Tether is a stablecoin pegged to the value of the US dollar, providing investors with a stable and reliable cryptocurrency …

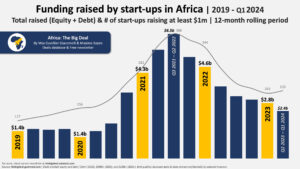

- 121 African startups secured $466M, marking a 27 per cent drop from the previous quarter; women-led startups got 6.5 per cent of the capital.

- About 87 per cent of startup funding in the three months to March went to entities in Nigeria, Kenya, Egypt, and South Africa.

- Gender imbalance persists as only 6.5 per cent of the financing went to female-led startups in Africa.

The big four economies of Nigeria, South Africa, Kenya, and Egypt continue to attract the highest share of funding going to startups in Africa, even as the ecosystem suffered a 27 per cent drop in financing to $466 million in the three months to March 2024.

The latest analysis from Africa: The Big Deal shows that 87 per cent of startup funding in the three months to March went to upcoming entities in Nigeria, Kenya, Egypt and South Africa.

Attracting $160 million, Nigeria’s economy accounted for …

- mTek, an insurtech innovation platform, has secured a $1.25 million investment from Verod-Kepple Africa Ventures and Founders Factory Africa to fuel its expansion across East Africa.

- The firm aims to streamline the insurance process, enhance customer experiences, and improve operational efficiency.

- This investment and expansion plans underscore mTek’s commitment to making insurance more accessible and affordable.

The insurance sector across East Africa is poised to experience intense activity following plans by the digital platform mTek to revamp the industry. mTek, a pioneering digital insurance platform, has secured $1.25 million (approximately Sh167.8 million) in funding from Verod-Kepple Africa Ventures (VKAV) and Founders Factory Africa (FFA) to spearheaded this investment, which is poised to catalyze its strategic expansion across East African region.

This capital infusion will strengthen mTek’s position as a leader in insurtech innovation, using state-of-the-art technology to revolutionize the uptake of cover services.

At the heart of mTek’s mission is …

Competition in the remittance space has intensified with the entry of new players as the race for a share of the annual $95.6 billion in cross-border remittances flowing into Africa heats up. Airtel Africa has partnered with MasterCard to unveil a new service for cross-border remittances. Their deal will see customers in Kenya and 14 other African nations become the first beneficiaries of the service.

Airtel Africa and MasterCard will provide a seamless digital experience for consumers, connecting them with millions of peers worldwide. With a mushrooming diaspora community, remittances are now the largest source of forex in many African economies.…

- PROPARCO and the IFC, are scaling up of renewable energy production in both Kenya and DRC.

- The two organisations will support Nuru, an early-stage company that provides decentralized and low-carbon power solutions in DRC.

- PROPARCO will invest in the first close of E3 Low Carbon Economy Fund I (LCEF), which based in Kenya.

Two renewable energy investments in the Democratic Republic of Congo (DRC) and Kenya will receive financial backing to enhance their low-carbon power solutions.

The move comes after PROPARCO and IFC announced plans to support scale up of renewable energy in the two countries. PROPARCO and IFC are members of the Alliance for Entrepreneurship in Africa.

The two organizations declared support for Nuru, an early-stage startup that offers decentralized and low-carbon electricity solutions in the DRC, during the Paris summit for a new global funding agreement.

“Our support for Nuru, delivered with partners through the Alliance for Entrepreneurship …

- Last year, about 90 percent of climate change-related disaster losses in Africa were not insured.

- Global insurance broker Gallagher Re says affordability of premiums, quality of data, and technical capacity is hindering insurance uptake.

- DRC has appointed Gallagher Re to find ways to enhance the country’s insurance penetration rate in mining industry.

Climate change has led to an increase in the frequency and intensity of extreme weather events such as droughts, and floods in many parts of Africa. These extreme weather events are resulting in significant damage to property, infrastructure, and livelihoods.

Flooding induced by climate change

Last year, for instance, at least 2,000 people died in Africa as a result of unprecedented flooding, which was partly induced by climate change. South Africa (Durban) and Nigeria were particularly hit hard following above-average rains in the year under focus.

Storm Issa, which is now regarded as one of the greatest storms …

- Angola has become Africa Trade Insurance Agency’s (ATI) 21st member state by paying $25 million in capital subscription fees.

- ATI’s gross exposure in Angola currently stands at $467 million.

- The membership was funded the Angolan National Treasury and proceeds from the landmark BITA water project.

Oil-rich Angola has become the 21st African member state joining pan-African insurer, Africa Trade Insurance Agency (ATI) after paying $25 million in subscription fees. The deal will also see Angola become first Lusophone member country in the underwriter.

ATI was established in 2001 by seven Comesa countries and with technical and financial backing of the World Bank. The agency’s core mandate is to provide insurance against political and commercial risks. This is considered necessary in order to attract foreign direct investments across member states.

Luanda’s membership was funded by the Angolan National Treasury resources and proceeds from the landmark BITA water project. BITA …

- The GSMA’s State of the Industry Report on Mobile Money 2023 shows adoption rates are even more significant than expected.

- Registered accounts, transaction values, and deployments exceeded industry predictions.

- In 2022, daily transactions via mobile money reached $3.45 billion, exceeding the $3 billion amount predicted in 2021.

- Total transaction value for mobile money grew by an incredible 22 percent between 2021 and 2022, from $1 trillion to around $1.26 trillion.

Mobile money services are growing faster than predicted around the globe, as digital services continue to rise in popularity, according to the GSMA’s annual State of the Industry Report on Mobile Money 2023.

The report, published annually by the GSMA and funded by the Bill and Melinda Gates Foundation, demonstrates that rates of adoption are even quicker than expected, with the number of registered mobile money accounts growing by 13 percent year on year.

This is from 1.4 billion …

- Insurance industry paid claims worth $400Mn in three months from October 2022 to December 2022 representing a 3percent increase compared to the third Quarter of 2022 that paid claims worth $391Mn.

- Latest statistics from the Insurance Regulatory Authority (IRA) indicate that the number of claims reported to the insurers were 2,040,600, a 12.6 percent increase compared to 1,811,141 claims reported in Q3,2022.

- General liability claims paid went up by 16.8 percent to 14,085 claims worth $42Mn from 12,055 claims paid worth $40Mn billion in the previous quarter. Non – Liability claims paid hit 1,714,723 claims worth $170Mn representing a 1.8 percent from 1,684,698 claims worth $160.31Mn reported in Q3 2022.

Insurance industry paid claims worth $400Mn in three months from October 2022 to December 2022 representing a 3 percent increase compared to the third Quarter of 2022 that paid claims worth $391Mn.

According to the Quarter 4 of 2022 claims …