- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

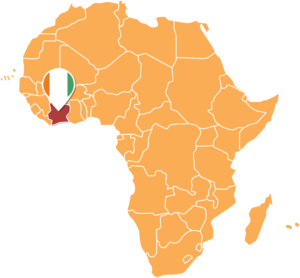

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

For historic reasons, bilateral and regional trade in Africa has been hampered by trade routes designed for export away from the continent rather than for facilitating intra-Africa trade. Obstacles include long distances, inadequate transport services, and inefficient institutional and transit regimes.

In many landlocked African countries, economic centres are located several hundred kilometres away from the closest seaport. Overcoming geographic constraints or the lack of economies of scale caused by small transportation volumes is key for all countries, particularly transit countries. A renewed focus on the efficiency of transport and logistics services is long overdue, given that many countries retain policies that favour closed, small, and inefficient services markets.

By committing to no new barriers to services trade during the progressive liberalization process, at least in the five priority sectors—business, communication, financial, transport, and tourism services, and with declining trade costs—the transport sector is bound to expand.…

While massive and spectacular infrastructure projects seem to point that East Africa’s largest and most vibrant economy remains in the right direction, increasing state debt, soaring fuel and commodity prices and high unemployment threaten to water down the economic footprint of Kenya’s fourth president Kenyatta.…

- KenGen and Toshiba Energy Systems & Solutions Corporation have concluded a memorandum of understanding (MOU), paving the way for a new partnership

- The two parties said the MoU focuses on an Operation and Maintenance (O&M) services partnership for geothermal power plants in developing countries, including East African countries

- This will be done through a combination of KenGen and Toshiba ESS’s know-how and networks. The MoU was signed during TICAD 8 held in Tunisia on August 27 and 28

Kenya Electricity Generating Company PLC (KenGen) and Toshiba Energy Systems & Solutions Corporation have concluded a memorandum of understanding (MOU), paving the way for a new partnership.

On August 31, 2022, the two parties said the MoU focuses on an Operation and Maintenance (O&M) services partnership for geothermal power plants in developing countries, including East African countries.

This will be done through a combination of KenGen and Toshiba ESS’s know-how and networks. …

- Safaricom has officially kicked off a large-scale customer pilot of its network in Ethiopia as part of ongoing plans to officially launch operations in Ethiopia

- The telco has launched the trial network in Dire Dawa, Ethiopia’s second largest city after its capital Addis Ababa

- The launch of the network is part of Safaricom’s phased city-by-city regional network roll-out and rigorous service tests building towards its national launch in October

Safaricom Ethiopia has officially kicked off a large-scale customer pilot of its network in Ethiopia as part of ongoing plans to officially launch operations in the Horn of Africa country.

The telco has launched the trial network in Dire Dawa, Ethiopia’s second largest city after its capital Addis Ababa.

The launch of the network is part of Safaricom’s phased city-by-city regional network roll-out and rigorous service tests building towards its national launch in October.

Safaricom Ethiopia said the customer pilot would …

- Jubilee Holdings Limited has reported a half-year profit before tax of KES 4.1 billion ($34.1 million) for the period ended 30th June 2022

- The Kenyan-headquartered insurer said its profitability had declined compared to the KSh 5.2 billion ($43.3 million) it posted in a similar period a year earlier

- The NSE-listed insurer blamed the decline on a tough economic environment characterised by uncertainty arising from elections in Kenya and rising interest rates

- Jubilee Holdings Board declared an interim dividend of KSh 1 per share, payable on 11 October 2022

Jubilee Holdings Limited has reported a half-year profit before tax of KES 4.1 billion ($34.1 million) for the period ended 30th June 2022 to defy a tough economic environment characterised by uncertainty arising from elections in Kenya and rising interest rates.

On August 30, 2022, the Kenyan-headquartered insurer said its profitability had declined compared to the KSh 5.2 billion ($43.3) …

With a population of over 60 million and a high mobile penetration rate of 180 per cent, there’s a ready market for the money lending business. Financial inclusion in the country is still a challenge as 32 per cent of the population has no access to financial services, including bank accounts and loans.

South Africa’s banking sector has largely been controlled by four major banks with over 80 per cent market share. The lenders have not been unwilling to take risks to lend to small and medium enterprises (SMEs), disadvantaging them. This has resulted in almost a third of the population being locked out of credit needs.

The gap left by banks has been filled by alternative lenders targeting low-income earners. 89 per cent of this section of the market have mobile phones, with 39 per cent being smartphones. This means they can access online financial services.…