- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

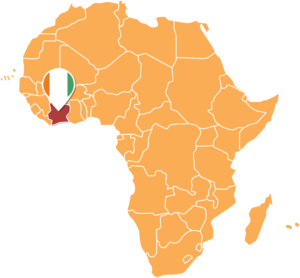

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Africa received its highest proportion of private sector investment in infrastructure in 2020

- African Development Bank has revealed that the greater private sector investment came as most governments contended with the Covid-19 pandemic and limited fiscal space

- Private sector investment in Africa’s infrastructure rose to $19 billion in 2020, representing 23 per cent, the highest since 2016

A new finding by the African Development Bank has revealed that the continent of Africa received its highest proportion of private sector investment in infrastructure in 2020.

The bank’s Vice President for the Private Sector, Infrastructure and Industrialization, Solomon Quaynor said the finding sends an important signal to governments and investors.

Quaynor said the greater private sector investment came as most African governments contended with the Covid-19 pandemic, limited fiscal space and high debt-to-GDP ratios.

He noted that private sector investment into Africa’s infrastructure rose to $19 billion in 2020, representing 23 per …

- National Housing Cooperation (NHC) is seeking to raise KSh 7 billion through the International Finance Corporation (IFC) for an affordable housing project in Kenya

- NHC will use the investment to fund the construction of 3,500 housing units in Athi River, Machakos County

- The housing units are part of the KSh 20 billion Stoni Athi Waterfront City project, comprising 10,500 units to be developed on a 150 acres piece of land.

Kenya’s National Housing Cooperation (NHC) is seeking to raise KSh 7 billion through the International Finance Corporation (IFC) under the Public Private Partnership (PPP) model to fund the construction of 3,500 housing units in Athi River, Machakos County.

The housing units are part of the KSh 20 billion Stoni Athi Waterfront City project, comprising 10,500 units to be developed on a 150 acres piece of land.

The affordable housing project comprises one, two and three-bedroom units targeting the low, middle, …

Caledonia’s chief executive, Mark Learmoth, speaking of the Bilboes Project called it a “premier gold development project in Zimbabwe and one of the best gold development projects in Africa”.

Through its acquisition strategy, Caledonia is steadily and certainly transforming itself from being a single mine operator to one where it produces a single commodity but operating various mines and mining projects. The company’s boss called this transaction a “transformational asset” and said it was the next step in Caledonia’s journey to becoming a multi-asset mid-tier gold producer.

Prior to its acquisition strategy Caledonia operated a single mine in Zimbabwe which is the Blanket Mine situated in Gwanda, in the Matabeleland South province of Zimbabwe. The company targeted producing 80,000 ounces of gold from its mine in 2022. The acquisition of the Bilboes project, considering that it will produce 168,000 ounces of gold annually over its 10-year life of mine, means …

- KCB Group PLC has reported a 28.4 per cent rise in its net earnings to reach KSh 19.6 billion for the six months ending June 30, 2022

- KCB said the growth from KSh 15.3 billion was driven by improvement in both the funded and non-funded income streams

- Group businesses increased their profit contribution to 16.8 per cent, driven by new business growth and the impact of BPR Bank

KCB Group PLC has reported a net earning of KSh 19.6 billion for the six months ending June 30, 2022, to mark a 28.4 per cent rise from last year.

The growth from KSh 15.3 billion was driven by improvement in both the funded and non-funded income streams.

Additionally, the international subsidiaries increased their overall contribution to the Group’s performance.

Total operating income increased by 16.8 per cent, mainly driven by a 29.9 per cent growth in Non- Funded Income.

Group businesses …

- Kenya Airways (KQ) narrowed its half-year loss to KSh 9.88 billion, less than the KSh 11.48 billion loss it reported in the same period in 2021.

- Kenya Airways (KQ) has revealed that its total revenue rose to KSh 48,104 million in the six months ending June 2022, recording a 76 per cent increase compared to the same period last year

- KQ said the increase is mainly attributed to significant growth in passenger revenue, which grew by 109 per cent, and cargo revenue which increased by 18 per cent

Kenya Airways (KQ) narrowed its half-year loss to KSh 9.88 billion, less than the KSh 11.48 billion loss it reported in the same period in 2021.

During the review period, the airline revealed that its total revenue rose to KSh 48,104 million in the six months ending June 2022, recording a 76 per cent increase compared to the same period last year.…

- There has been a decline in bank visits across Kenya, with customers opting to deposit cash via mobile money platforms and transfer bank deposits to their mobile money wallets

- In the latest Kenya Banking Sentiment Index, Deloitte reveals that this has posed a challenge to banks, which have made significant investments in their brick-and-mortar businesses

- Deloitte recommends banks to consider leveraging innovations in technology such as cloud platforms, analytical capabilities and augmented intelligence which can generate levels of customer engagement

A new report has revealed that there has been a decline in bank visits across Kenya, with customers opting to deposit cash via mobile money platforms and transfer bank deposits to their mobile money wallets.

In the latest Kenya Banking Sentiment Index, Deloitte reveals that this has posed a challenge to banks, which have made significant investments in their brick-and-mortar businesses.

Has the rise of mobile transactions in Kenya affected …