- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

Business

- In the past two years, short-term rentals in Nairobi have been the new trend.

- Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023.

- Trappler highlights that hospitality is a key economic driver, employment creator, and focal property type in regions throughout East Africa.

Hospitality has bounced back remarkably after the challenges posed by the COVID-19 pandemic, emerging as one of the best-performing asset classes in 2023. This resurgence is particularly notable in Nairobi, especially with the renewed demand for short-term rentals.

The strategic position of Kenya’s capital city serves as an East African hub for various industries, including corporate, government, MICE (Meetings, Incentives, Conferences, and Exhibitions), embassies, and tourism, which makes it an attractive destination for hospitality and residence brands.

The increasing and diversifying demand for accommodation creates meaningful opportunities for market expansion and business growth.…

- The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

- G&A has built a strong reputation in Africa, delivering on transformational projects like the recent Eurobond

- In February last year, the two countries pledged to continue to nurture and expand ties

A law firm in Nairobi is championing a plan to see Kenya and South Korea strengthen legal services for companies in Africa. Kenya’s G&A Advocates LLP has signed a partnership agreement with South Korea-based law firm Jipyong ahead of the Korea-African Summit. The partnership will enable Kenya and South Korea to strengthen legal services and networks for African companies.

The Korean African Summit is set to take place between June 4 and June 5 in Seoul, South Korea, under the theme: “The Future We Make Together, Shared Growth, Sustainability and Solidarity.”

The summit, which will be the first-ever, aims to strengthen the …

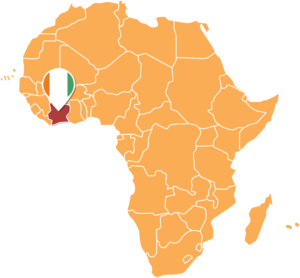

- The upcoming US-Africa green and sustainable financing forum in Côte d’Ivoire aims to mobilize funding for infrastructure projects across Africa.

- Set for March 19–20, the workshop will feature industry leaders, US technical experts, and key financiers.

- The event highlights the critical need for renewable energy funding models, financing mechanisms, and regulatory and policy reforms to facilitate the growth of green and sustainable infrastructure.

To foster sustainable development in Africa, the United States Trade and Development Agency (USTDA) is joining forces with the African Development Bank Group to host the US-Africa Green and Sustainable Financing Workshop.

Set to go down in Abidjan, Côte d’Ivoire, on March 19–20, 2024, this event is poised to bring to the forefront the pressing need for green and sustainable infrastructure projects across the continent.

The workshop, a convergence of industry leaders, explores innovative financing models that can support Africa’s journey towards a resilient and sustainable future.…

- Equity Group has reported a 36% growth in its after-tax profit to hit KSh 24.4 billion, principally driven by the growth of loans to customers

- The Kenyan-based regional lender also attributed the performance to its recovery and resilience strategy

- Equity Group CEO James Mwangi said the loan growth was targeted to supporting their clients to recover and rebuild after the Covid-19 business disruptions

Equity Group has reported a 36 per cent growth in its after-tax profit to hit KSh 24.4 billion.

The performance was principally driven by a 29 per cent growth in interest income to KSh 55 billion, up from KSh 42.8 billion as a result of the growth of loans to customers by 29 per cent to KSh 650.6 billion, up from KSh 504.8 billion.

The Kenyan-based regional lender also attributed the performance to its recovery and resilience strategy.

Equity Group CEO James Mwangi said the loan growth …

- Kenya’s next government will be required to work on new strategies to reduce the country’s over-reliance on debt

- The country’s debt stock stood at KSh 8.6 trillion as of May 2022, equivalent to 69.1 per cent of the GDP and 19.1 per cent points above the IMF recommended threshold of 50 per cent for developing nations

- The incoming government could bridge the deficit gap by instituting austerity measures, reducing amounts extended to recurrent expenditure and focusing on developments

Kenya’s next government will be required to work on new strategies to reduce the country’s over-reliance on debt.

According to analysts from Cytonn Investments, the country’s debt stock stood at KSh 8.6 trillion as of May 2022, equivalent to 69.1 per cent of the GDP and 19.1 per cent points above the IMF recommended threshold of 50 per cent for developing nations.

According to the analysts, Kenya’s new president will need to …

- EA Limited, an African infrastructure investment company based in Nairobi, Kenya, has announced plans to develop an affordable housing project worth USD 250 million in the Democratic Republic of Congo (DRC)

- The project targets the Office Conglais De Controle (OCC) staff (a quality assurance body) and will consist of 5,000 units to be constructed over a period of five years, starting in 2022

- EA limited will be the Engineering, Procurement and Construction (EPC) contractor as per the signed Memorandum of Understanding (MOU) with Symbion Architect

EA Limited, a subsidiary of TransCentury PLC, an African infrastructure investment company based in Nairobi, Kenya, has announced plans to develop an affordable housing project worth USD 250 million (KSh 29.8 billion) in the Democratic Republic of Congo (DRC).

According to EA Limited, the project targets the Office Conglais De Controle (OCC) staff (a quality assurance body).

It will consist of 5,000 units to be …

- Central Bank of Kenya data shows that Kenya’s banking sector assets grew by double-digits in 2021, owing to growth in the purchase of government securities

- The Kenya Financial Sector Stability Report shows that loans and advances (net) as a share of net assets declined to 48.5 per cent in 2021 from 49.2 per cent in 2020

- Investment in government securities grew at a faster pace compared to growth in loans and advances between 2021 and 2020

A new report by the Central Bank of Kenya shows that Kenya’s banking sector assets grew by double-digits in 2021 because of the increased purchase of government securities.

According to the Kenya Financial Sector Stability Report, loans and advances (net) as a share of net assets declined to 48.5 per cent in 2021 from 49.2 per cent in 2020. At the same time, government securities holding increased to 30.5 per cent in December 2021 …

- Stanbic Holdings Plc has announced a profit of KSh 4.8 billion for the half year ended 30 June 2022, representing a 37 per cent increase from last year’s performance

- The performance is attributable to strong business momentum, and judicious execution of its digital transformation strategy as the Group continues to support its customers in their growth journeys

- Stanbic Bank CEO Charles Mudiwa said the performance reflects resilience amidst a tough operating environment characterised by uncertainties around elections and risks posed by the Russia-Ukraine conflict

Stanbic Holdings Plc has announced a profit of KSh 4.8 billion for the half year ended 30 June 2022, representing a 37 per cent increase from last year’s performance.

According to the Kenyan lender, the performance is attributable to strong business momentum, and judicious execution of its digital transformation strategy as the Group continues to support its customers in their growth journeys.

Stanbic Bank CEO Charles …

- KEMSA said it had invested more than KSh 30 million to facilitate efficient service provision from the Kisumu regional supply chain centre

- KEMSA is executing a three-pronged transformation strategy (KEMSA2.0) geared at enhancing its customers’ experience

- The county has accessed health supplies from KEMSA worth more than KSh 122million in the last financial year, comprising TB drugs, Antiretroviral therapies, HIV test kits and antimalarials

The Kenya Medical Supplies Authority (KEMSA) said it had invested more than KSh 30 million to facilitate efficient service provision from the Kisumu regional supply chain centre.

On August 19, 2022, the CEO of KEMSA Terry Ramadhani said the Authority is executing a three-pronged transformation strategy (KEMSA2.0) geared at enhancing its customers’ experience by providing quality, assured, efficient supply chain solutions for health commodities. She spoke when she hosted Homa Bay County Governor-Elect Gladys Wanga in her office.

What is KEMSA’s strategy?

As part of the …