- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Opinion

- Artificial intelligence in Africa can potentially propel the fintech industry into a new era of financial inclusion.

- AI tools can analyse data from client discussions, producing legal documents in simple language and at a fraction of what it would typically take to draft a contract.

- Banks, for example, can make their services more affordable to their customers by rolling out AI-powered chatbots to handle routine queries while sparing them from having to travel to a bank branch.

It’s difficult to imagine a time before the widespread adoption of mobile technology in Africa – particularly where financial services are concerned. For millions of unbanked people, transactions were limited to cash, postal services or even the barter system.

Now, in much the same way as mobile payments completely disrupted the status quo, AI has the potential to propel the fintech industry into a new era of financial inclusion. And perhaps most exciting …

- One of the most important ways a fintech can listen to its customers is to gauge how they engage with its products.

- Having a deep understanding of customer needs results in innovative solutions.

All around the world businesses are pulling out the stops to achieve growth in what can best be described as challenging economic conditions. Africa is no exception. The continent has long been recognised for its immense potential, and as such businesses across sectors are investing heavily into the continent.

Advancements in technology make serving the unbanked and underserved populations in Africa more viable than ever before. However, that does not mean growth comes easily. It is a hyper competitive and complex environment where genuinely understanding your customer is key to growth.

Even with this textbook understanding, there is a strong urge to take the “build it and they will come” approach because we can get caught up …

- Namibia is fortunate to benefit from the experiences of other oil- and gas-producing states.

- The country’s oil and gas sector is still looking forward to reaching the production phase, but S&P Global analysts don’t anticipate Namibia’s first oil production will come until 2029.

- Further, the country’s first gas-to-power project is scheduled to begin in 2027.

Namibia’s energy sector is still looking forward to reaching the production phase — S&P Global analysts don’t anticipate Namibia’s first oil to come until 2029, and the country’s first gas-to-power project is scheduled to begin in 2027.

Ohio State Team Jersey

ohio state jersey

Ohio State Team Jersey

asu jersey

ohio state jersey

Iowa State Football Uniforms

detroit lions jersey

micah parsons jersey

micah parsons jersey

Iowa State Football Uniforms

fsu football jersey

OSU Jerseys

custom football jerseys

asu jersey

Before Namibia achieves these hotly anticipated milestones, Namibian lawmakers can implement thoughtful, …

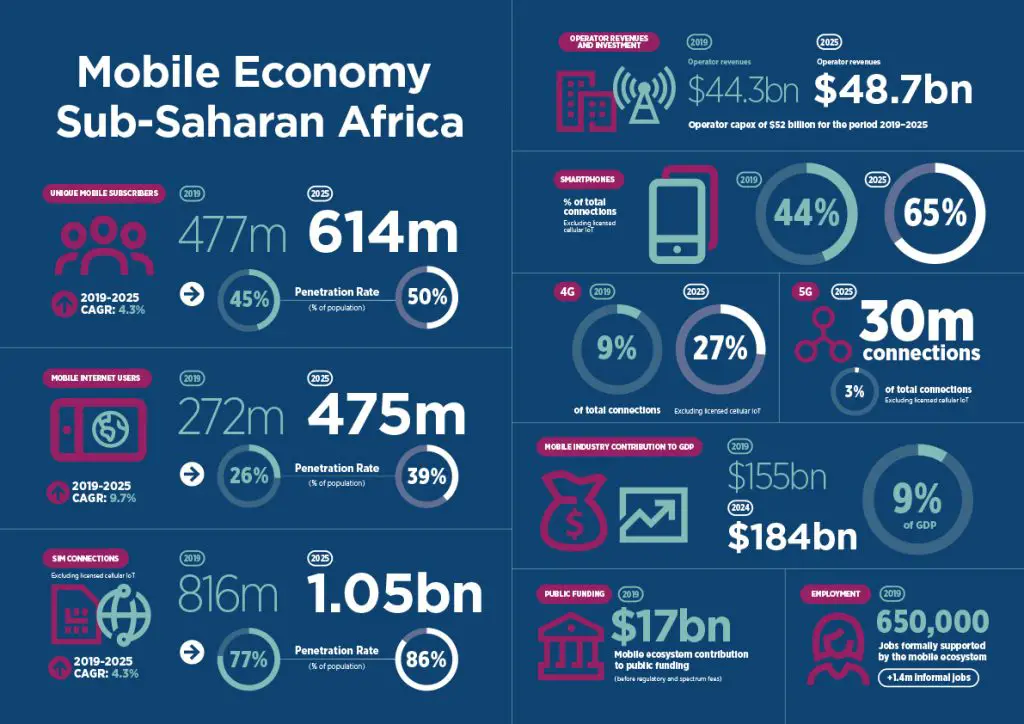

On the 1st of October 2020, the Global System Mobile Association (GSMA) released their “Mobile Economy Sub-Saharan Africa” report which forecasted the mobile economy in Africa into 2025.[1] A positive outlook to start the month of October and the last quarter of 2020.

The highlight of this forecast is that by 2025, even with 1.05 billion sim connections and 614 million unique mobile subscribers and smartphone adoption reaching 65% of the total population, only 39% of Africans would be experiencing their mobile web on those smartphones. This seems to suggest that even though there would be exponential smartphone growth over the period the cost of connectivity may be a showstopper. That’s not necessarily the case because there’s more happening than meets the eye.

The Mobile Network Operators (MNOs) are going to spend collectively about $52 billion on infrastructure between now and 2025 and this would grow their revenues …

On Oct. 1, 1960, everything seemed possible for Nigeria: After nearly 80 years of colonialism under Great Britain, it was finally an independent nation.

During the newly independent nation’s earliest days, there was every reason for Nigerians to envision a bright future for themselves and their country, one in which Nigeria’s vast oil and gas reserves would deliver widespread prosperity. One of stability and growth.

Tragically, Nigeria’s story moved in a different direction. Yes, there was a brief period of economic growth, but that was followed by multiple coups, civil war, military rule, corruption, and poverty. Instead of helping everyday Nigerians, the country’s oil wealth went to an elite few in power while leaving communities, particularly those in the Niger Delta, to deal with environmental degradation and dwindling means of supporting themselves. Instead of using its oil revenue to strengthen other sectors and diversify the economy, Nigeria has made oil

Business success is perceived differently today. Buzzwords like maximization, venture-backed, growth hacking, and well-conceived exit strategies (like IPOs or acquisitions) define entrepreneurial success in the current age. In a mad rush to show high quarter-on-quarter growth rates, corporate leaders have forgotten that the true value of a business is how long it stays relevant in the market and instead focus solely on transient growth spurts even if they cost profits.

Any business, no matter how big its initial success, needs to take a long-term approach if it’s to avoid being one of history’s almost-rans. This applies to every aspect of the business, including, people, products, and customers.

Invest in People

When you are a new company working on developing deep tech, discovering talent and retaining them is a challenge. Try to create and slowly nurture a pool of capable workers who will gain domain expertise over time. At Zoho, in …

In 2020, remote working finally became normal everywhere. Analysts and thought leaders had predicted that this would happen “soon” for the past 25 years, but it took a global crisis for it to materialize.

Since March, people in many professions have gotten increasingly used to working from outside their offices.

Before the pandemic hit, many employers were loath to give their staff that flexibility, especially for extended periods of time. With Covid-19, that changed overnight. Even the most diehard bosses have now given in and allowed people to work from home or remotely.

One key realization, captured in many memes, was: “Wow! all those meetings could actually have been emails!”.

Online meetings had already become generally accepted as a more efficient alternative to most in-person meetings. Many of us had even come to cherish the online format, as they tend to be shorter and more to the point than those …

“Flatten the curve.” Do you remember that phrase? It was on everyone’s lips back in the spring, when the novel coronavirus (COVID-19) pandemic began rampaging across the world in earnest.

At the time, the idea was that the best way to combat the germ known as SARS CoV-2 was to go home and stay there long enough for hospitals, clinics, and other medical facilities to build up the capacity needed to handle the expected flood of new patients. Most of us expected that this departure from routine would be a temporary thing. We hoped it wouldn’t last long — that we’d be able to return to our normal routines after a brief disruption, with confidence that all necessary safeguards were in place.

Of course, it didn’t turn out that way. We spent far more time than we expected sheltering in place, unable to visit friends and family, attend school, or …

On 9th September 2020, US-based blockchain investor, Digital Currency Group (DCG) bought Naspers-backed South African cryptocurrency exchange Luno[1] and Transactions Capital, which took a $109M position in WeBuyCars also from South Africa.[2] According to Bloomberg, WorldRemit acquired Soundwave for $500M on 25th August 2020.[3]

In late July, Network International, a Dubai-headquartered enabler of commerce bought Africa’s leading online commerce platform, DPO Group, for $288M.[4] But it all started in January when Circles Gas acquired KopaGas’ proprietary technology for $25M.[5] These are signs of the times – the EXITS are finally here. But it been a long time coming since 1999 when Mark Shuttleworth had the first exit of selling Thawte to Verisign for $575M.[6] Since then, there have been spates of private equity or “financial exits”, like Visa’s acquisition of Fundamo for $110M,[7] and others that have not being disclosed. The …