- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

- AIM Congress 2024: Catalysing global investments with awards

- Kenya’s economic resurgence in 2024

- The most stressful cities to live in 2024 exposed

- Tech ventures can now apply for the Africa Tech Summit London Investment Showcase

Regional Markets

- East Africa’s economic growth is projected to grow at 5.3 and 5.8 per cent in 2024 and 2025-26, respectively.

- The World Bank projects African economies to grow by 3.4 per cent in 2024.

- However, faster and more equitable growth is needed to reduce poverty.

East Africa’s economic growth to lead the continent

Economies in East Africa are expected to spearhead growth in Sub-Saharan Africa this year amid increased private consumption and declining inflation, which are supporting an economic rebound in the region.

The World Bank’s latest Africa’s Pulse report indicates the East African Community is projected to grow at the fastest pace at 5.3 and 5.8 per cent in 2024 and 2025–2026, respectively, thanks to robust growth in the Democratic Republic of Congo, Kenya, Rwanda, and Uganda.

This is higher than the compounded growth for Sub-Sahara Africa, which, albeit rebounding from a low of 2.6 per cent in 2023, is …

- Kenya is keen on extending its pipeline to Malaba (Kenya-Uganda border), with Uganda expected to construct a link line to Kampala.

- According to the Shippers Council of Eastern Africa (SCEA), Mombasa used to command up to 70% of transit business, but this has decreased to 60 per cent.

- Uganda imports an average of 2.5 billion litres of petroleum annually, valued at about $2 billion, with KPC handling at least 90 per cent of the volumes.

Kenya is courting Uganda in a fresh bid to retain and possibly increase petroleum exports amid increased competition from neighbouring Tanzania. In recent months, East Africa’s economic powerhouse has come under pressure from Tanzania, which is eyeing to tap more transit markets for imports and exports into the hinterland through the Dar es Salaam Port.

In the latest developments, Tanzania has offered to license Uganda National Oil Company (UNOC) to import petroleum products through Dar …

- Kenya’s equity market has received an upgrade on its classification by the FTSE Russel Index from “Restricted’ to “Pass” on the repatriation of capital and income.

- This development partly indicates that Kenya is now a maturing market, characterised by increased transparency, liquidity, and a growing investor confidence.

- Across Africa, data shows that an estimated $700 million was reported held in 11 African countries, with Nigeria accounting for the lion’s share.

FTSE Russell, a global provider of analytics, benchmarks and data services, has endorsed the Nairobi Securities Exchange Plc (NSE), ushering a new era in Kenya’s financial services industry. The NSE has announced that as of March 2024, the Nairobi bourse has been reclassified by the FTSE Russell Governance Board, moving from a “restricted” to a “pass” status.

This pivotal change is not just a mark of progress, but a move to underscore the resilience and strategic navigation of the Kenyan …

- Rwanda and Kenya who have already started trading through the agreement.

- Mid-February, Tanzania also said it was ready to trade under the agreement.

- The implementation of AfCFTA is projected to increase intra-African trade significantly, especially in manufacturing.

Uganda has expressed readiness to join Kenya, Tanzania and Rwanda in trading under the African Continental Free Trade Area (AfCFTA) as the continent slowly embraces the pact.

The implementation of AfCFTA is projected to increase intra-African trade significantly, especially in manufacturing.

The share of intra-Africa exports to total global exports is expected to increase in Tanzania by 28 per cent, Uganda by 29 per cent, Rwanda by 33 per cent and Kenya by 43 per cent.

“As Ugandan private sector, we are ready to trade under the AfCFTA Guided Trade Initiative and follow our counterparts from Rwanda and Kenya who have already started trading through the agreement,” East African Business Council (EABC) Vice …

Currently, Africa is over-exposed to the impact of the US Dollar. Thus, African nations must either act individually or together to mitigate these effects. Dollar strength bursts are cyclical. Therefore, there should be enough time to implement efforts before the next one occurs. African governments have recognized the harm done in the previous year and should work round the clock to find a lasting solution.…

- The change in patterns of trade triggered by these two major events is now forcing the MNCs to go back to the drawing board.

- MNCs need to reconfigure their trade routes. They have to re-lobby for assured capital and they have to broker new destinations for their goods.

- With the changing global trade polarities, the MNCs are rethinking China, and eyeing future giants like Africa.

The much acclaimed African Continental Free Trade Area (AfCFTA) that came into being last year may just have saved Africa from a new world trade order.

Thanks to the global pandemic and then the Russia-Ukraine war, the plate tectonic of global trade is shifting. The resulting divergence and convergence are squeezing and pulling in different directions.

Multinational Companies (MNCs) have, for the last three decades or more, controlled trade. These international corporations have enjoyed the fruits of globalization more than any other business entity.

They …

The two south American nations are exploring methods to increase bilateral commerce and wean themselves off the mighty US currency. Its announcement has been widely criticized since they are not a natural fit for a single currency. This is due to one country’s relative economic prosperity and the other’s economic upheaval. This experience between Brazil and Argentina is instructive and illustrative for African nations with comparable aspirations to develop a single currency.

- Brazil and Argentina announced early last month that they would create a joint currency to increase trade and political relations.

- Similarly Africa has expressed the same ambitions at different times. The advent of AfCFTA gives further impetus to the concept that Brazil and Argentina has reignited.

- Brazil and Argentina first came up with the idea of a joint currency in the 1980s but it never took off because economic fundamentals.

- The joint currency experiment by Brazil and Argentina

- TransCentury Plc’s right issue is set to be reopened following approval from the Capital Markets Authority (CMA) after the initial issue failed to hit a 50 per cent threshold.

- Unfortunately, the rights issue performed below expectations, and as a result, CMA has invoked its powers under Section 14 of the Public Offers and Listings Regulations to allow TransCentury to reopen the issue.

- The rights’ issue will be open from March 20 -30 this year with additional information provided in the secondary prospectus to be issued by March 17 as the firm seeks shareholders’ approval to enable the conversion of shareholder loans to ordinary shares as a mode of payment for rights.

TransCentury Plc’s right issue is set to be reopened following approval from the Capital Markets Authority (CMA) after the initial issue failed to hit a 50 per cent threshold.

TC shareholders had until January 23, 2023 to take …

- AGOA has been a cornerstone of the U.S trade policy in Sub-Saharan Africa since the year 2000.

- The non-reciprocal trade preference programme that provides duty-free access to the U.S market.

- A range of manufactured goods and processed mineral products account for the bulk of exports.

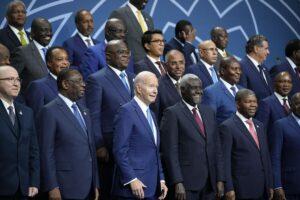

African countries are pulling together to lobby the U.S Congress to approve the renewal of the Africa Growth and Opportunity Act (AGOA) this year.

Kenya and South Africa are leading the push to have a 10-year extension on the pact that allows a select number of African countries to export finished products to the US.

AGOA has been a cornerstone of the U.S trade policy in Sub-Saharan Africa since the year 2000.

The non-reciprocal trade preference programme that provides duty-free access to the U.S market, for about 40 eligible African countries, is set to expire in 2025.

Initially, it was intended to last 15 years …