The government expects private sector to contribute 60% of the development

International property developers are angling themselves to tap into the housing projects in Kenya’s Big Four Agenda, a boost to President Uhuru Kenyatta’s ambition to deliver 500,000 units by 2022.

This came out at the sixth East Africa Property Investment Summit (EAPI) held in Nairobi this week, where the government called on the private sector to support the projects, assuring them of offtake.

An offtake assurance or agreement is a commitment between a producer and a buyer to purchase or sell portions of the producer’s future production.

“We want to assure the developers that whatever they build, we will buy,” Charles Hinga, Kenya’s Principal Secretary -State Department of Housing and Urban Development.

He spoke during the event which saw Nairobi host some of the largest international and regional developers and financial investors such as USA’s Echostone housing, South Africa’s International Housing Solutions, UK’s CDC, USA’S OPIC, World Bank’s IFC and REIT Groups from across Africa.

The forum attracted over 1,000 delegates and 240 leading real estate development and investment companies, with representation from all member countries of the East African Community (EAC).

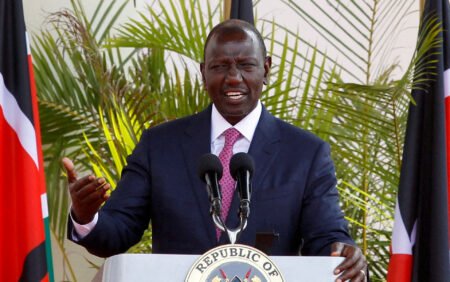

Under his plan, President Kenyatta, through is administration has promised Kenyans affordable and decent houses, universal health care, food security and a revamp of the manufacturing sector to increase its contribution to the GDP to 20 per cent by 2022, from the current 9.2 per cent.

Government housing plan

The government has lined up a number of incentives to attract developers and investors. They include availing land for housing projects, zero rating of construction material, Value Added Tax (VAT) refunds on imported machinery among other tax rebates.

The State also plans to adopt modern building technology which is cheaper and faster to put up a house.

It is considering 14 modern technologies including the 3D printing, where a house can be constructed with US$4000 (Ksh402,880), with a completion timeline of 48 hours (two days).

To guarantee offtake, the State is setting up a pooled fund that will see formally employed Kenyans contribute 1.5 per cent of their gross salary towards the fund..

Employers will also contribute a similar percentage of the employees’ basic salary with total contribution capped at Ksh5, 000 (US$ 49.58).

Individuals earning a basic salary of Ksh166, 000 (US$1,646) and above will part with up to Ksh2, 500 (US$24.79) for the fund.

According to PS Hinga, the government estimates to collect between Ksh6 billion (US$59.5 million) and Ksh18 billion (US$178.5 million) monthly. Kenya Revenue Authority (KRA) is expected to effect the tax anytime soon.

The funds will be used to support individuals purchase homes. Where developers have failed to sale a unit, the government has promised to move in and buy the houses.

“Of course is it going to be a slow start as information gets out there but we are good to go,” Hinga said.

The government has set up an online platform dubbed “Boma Yangu” which is Swahili for “My Home” to support the home ownership programme.

Under the programme, Kenyans are required to register on the platform which will guide allocation of homes in the affordable housing scheme. At least 200,000 individuals have registered on the programme, the government has confirmed.

During his last week State of The Nation address, President Kenyatta said those who have registered on the ‘Boma Yangu’ platform will be given first priority in allocation of houses.

“We are now on track to deliver affordable housing to Kenyans. This life changing programme is being undertaken in partnership with County Governments and the Private Sector,” President Kenyatta told the nation.

Additionally, the Affordable Housing Programme is expected to create opportunities for the local industry.

“We have ring-fenced the supply of certain components, such as doors and windows, for exclusive delivery by Micro, Small and Medium size enterprises.This will not only put money in the pockets of our local artisans, but also supports formalization of the industry,” Kenyatta said.

Mortgage

To further support Kenyans acquire homes; the government is setting up the Kenya Mortgage Refinance Company (KMRC).

KMRC will refinance Primary Mortgage Lenders (PMLs) such as commercial banks, microfinance banks and Saccos, using funds from the capital markets, to provide affordable mortgages to eligible members of the public.

21 private entities have already come on board in the programme where they control (private sector) 80 per cent of the company, with government taking the remaining 20 per cent shareholding.

“This is a single purpose institution that is coming in to provide primary funding for lending institutions,” said Johnstone Oltetia, Interim CEO-Kenya Mortgage Refinance Company, noting the financing will be “long-term” as opposed to short-term mortgage products offered by other lending institutions.

KMRC is currently counting on concessional funding from the government, with other funds expected from the World Bank and the African Development Bank (AfDB). It plans to issue bonds in future to raise capital to firm up its operations.

“We will be going to the capital markets to raise funds for re-financing housing projects,” Oltetia said.

Investor readiness

A section of developers including architects have expressed interest in the programme, even as they call on the government to fulfill its promise on incentives and meet its offtake obligation.

“It is about time that we had that conversation about affordability of houses. It is time that our citizens lived in dignity. I think the government has done a lot of home work in terms of putting it together on the way to crack it and we will support the initiative,” said Emma Miloyo, the Architectural Association of Kenya President.

The National Cooperation Housing Union (NACHU) has also expressed confidence on uptake of the projects by the private sector.

“Investors are ready. They are just waiting on the government to sort out the procurement processes,” said Stanley Ndungu, NACHU Finance Manager.

If implemented properly, the affordable housing programme will bridge the housing deficit in Kenya which currently stands at two (2) million and continues to grow at a rate of about 200,000 units a year, with the market offering a paltry 50,000 units annually.

There is a proliferation of informal settlements in urban areas with 67 per cent of the urban population living in slums in overcrowded homes, typically with only one room and no adequate ventilation, drainage and other important facilities.

ALSO READ:Kenya lures Private Equity, Venture Capital entities to fund Big 4