Cairo, Egypt, holds third place after Athens and Manilla, Philippines. India stands out, with three cities being included in the world’s top 10 most stressed cities. Los Angeles, US, holds the ninth place with the highest obesity rate on the list. Experts conducted a study to…

Ventures interested in applying for the Investment Showcase can submit applications here by 2nd May. To qualify, the ventures must…

Survey shows 60% of journalists interviewed indicate that their newsroom lacks an AI use case policy. However, 20% of journalists…

Exclusive pre-congress workshop launched to elevate startups for the global stage This year’s startup competition has attracted entrants from 53…

The increasing food prices have majorly occasioned the rise in consumer expenditure. In the review period, 50 per cent of…

Remittance inflows for March grew to $407.8 million up from $385.9 million…

Featured

International arrivals increased from 1.48 million in 2022 to 1.95 million as…

Industry & Trade

One of the most important ways a fintech can listen to its…

Countries

Cairo, Egypt, holds third place after Athens and Manilla, Philippines. India stands out, with three cities being included in the world’s top 10 most stressed…

The increasing food prices have majorly occasioned the rise in consumer expenditure. …

A total of 77 people, including 22 Chinese and a Cameroonian, all…

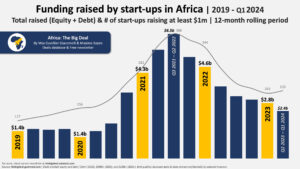

Following a slow recovery from the debilitating impact of COVID-19, Africa’s economic…

Regional Markets

East Africa’s economic growth is projected to grow at 5.3 and 5.8 per cent in 2024 and 2025-26, respectively. The…

Tech & Innovation

Ventures interested in applying for the Investment Showcase can submit applications here by 2nd May. To qualify, the ventures must be African, have at least one…

Editor's Picks

International arrivals increased from 1.48 million in 2022 to 1.95 million as…

Africa

Exclusive pre-congress workshop launched to elevate startups for the global stage This…

Industry & trade

Kenya Ports Authority handled 37,576 metric tons of cargo in 2023, according…

Money Deals

A key component of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively.…

Investing

In 2024, diversification of your crypto portfolio remains a fundamental principle for…