One of the most important ways a fintech can listen to its customers is to gauge how they engage with its products. Having a deep understanding of customer needs results in innovative solutions. All around the world businesses are pulling out the stops to achieve…

Level of remote desktop protocol abuse unprecedented since launch of report in 2020. External remote services were the number-one way…

Remittance inflows for March grew to $407.8 million up from $385.9 million in February, with the US maintaining its lead…

Africa’s agritech potential is immense. Agriculture can help solve various issues, including food security, poverty reduction, and economic transformation. However, technology is needed to revolutionise agriculture and solve farming and agricultural challenges.

East Africa’s economic growth is projected to grow at 5.3 and 5.8 per cent in 2024 and 2025-26, respectively. The…

Remittance inflows for March grew to $407.8 million up from $385.9 million…

Featured

International arrivals increased from 1.48 million in 2022 to 1.95 million as…

Industry & Trade

One of the most important ways a fintech can listen to its…

Countries

A total of 77 people, including 22 Chinese and a Cameroonian, all suspects in an elaborate cybercrime ring in Zambia targeting thousands of people…

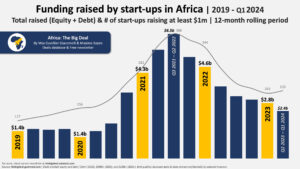

Following a slow recovery from the debilitating impact of COVID-19, Africa’s economic…

Kenya’s business conditions weakened slightly in March despite easing inflation. Kenyan firms…

Three decades later, the Rwanda genocide elicits several unanswered questions about the…

Regional Markets

East Africa’s economic growth is projected to grow at 5.3 and 5.8 per cent in 2024 and 2025-26, respectively. The…

Tech & Innovation

Level of remote desktop protocol abuse unprecedented since launch of report in 2020. External remote services were the number-one way attackers initially breached networks. Remote Desktop…

Editor's Picks

International arrivals increased from 1.48 million in 2022 to 1.95 million as…

Africa

In 2024, diversification of your crypto portfolio remains a fundamental principle for…

Industry & trade

DRC Joins the Organisation of Southern Cooperation after depositing the Instrument of…

Money Deals

A key component of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively.…

Investing

In 2024, diversification of your crypto portfolio remains a fundamental principle for…