- Agriculture employs a great percentage of the Tanzanian labour force

- AVCA assists in developing an understanding of how value chain actors/participants deal with powers

- The purpose of agricultural value chain analysis (AVCA) is to increase the efficiency, productivity and competitiveness of an agricultural sub-sector or industry

Agriculture seems to be the backbone of the economy for most developing countries including Tanzania.

The agro-sector employs a great percentage of the Tanzanian labour force; meanwhile almost 80% of those engaging in this sector conduct dual agriculture (cultivating and livestock keeping).

Provision of finance to the agro-sector was previously ignored by most financial institutions despite the current struggle for stimulating finance to agro-sector.

Read: Top reasons why agriculture players in Africa should use Artificial Intelligence

The breakthrough for the struggle would be realised if the agricultural value chain were to be properly mapped out to provide a clearer path to profitability.

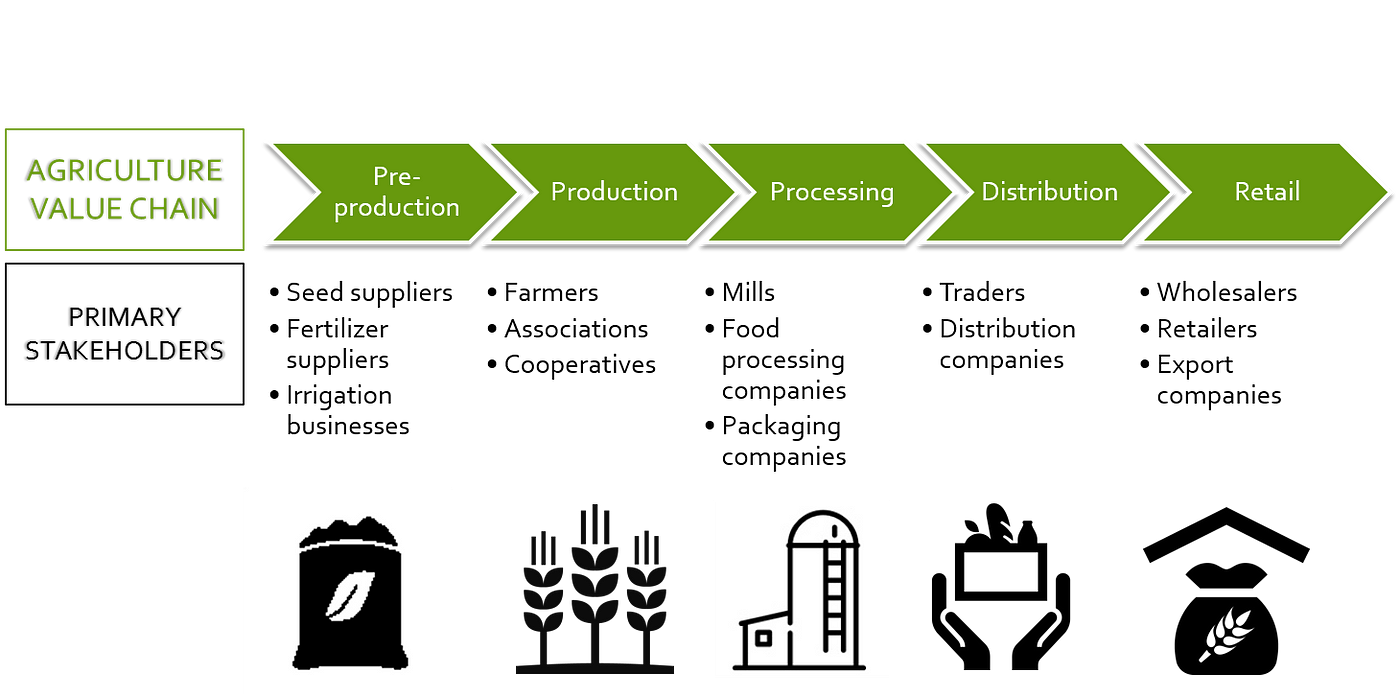

Agriculture value chain analysis, also commonly referred to as mapping the agriculture value chain, is the assessment of the value chain participants and factors influencing the performance of the agricultural commodity industry and evaluating the relationships between these participants to identify the main constraints.

The purpose of agricultural value chain analysis (AVCA) is to increase the efficiency, productivity and competitiveness of an agricultural sub-sector or industry and develop solutions for how the identified constraints can be overcome.

AVCA assists in developing an understanding of how value chain actors/participants deal with powers and who governs or influences the chain.

Step One: End Market Analysis

End market refers to where the final transaction takes place in a value chain. This is where the end-user is located. The end-user is the individual or organization for whom the product or service has been created and is not expected to resell that product or service.

Mapping the agriculture value or agriculture value chain analysis starts with the end-market analysis and involves looking at: market size and growth rates, market segmentation, consumer behaviour, supplier requirements, competitive position (benchmarking), network relationships, and so on.

It takes into consideration the process of globalization since it has both the competitive threats in domestic markets (imports) and the opportunities in overseas markets (exports).

Step Two: Business Enabling Environment (BEE) Analysis

The business enabling environment includes norms and customs, laws, regulations, policies, international trade agreements and public infrastructure that either facilitate or hinder the movement of a product or service along its value chain. BEE analysis involves:

- Examining conventions, treaties, agreements and market standards that shape the global business enabling environment. Trade agreements such as the Lomé Convention or AGOA can open opportunities for firms

- At the national and local level, analysis of the BEE is best done according to the size of the operators since there may be constraints and opportunities distinctly facing micro-and small enterprises, small and medium enterprises and large firms. At this level, the business enabling environment encompasses policies, administrative procedures, enacted regulations and the state of public infrastructure.

- Understanding unwritten rules of society is essential in order to develop an understanding of the value chain actor’s behaviour and how they will behave in response to value chain interventions. The unwritten rules of the society include social norms, business culture and local expectations and they can be powerful aspects of the BEE.

Read: First agriculture technology and innovation centre launched in Kenya

Step Three: Vertical Linkages Analysis

Vertical linkages refer to vertical inter-firm relationships that exist between factors that influence the competitiveness of the value chain. Vertical linkages facilitate the smooth transmission of information from end markets to small producers and meet market demand.

Effective vertical linkages are generally characterized by mutually beneficial relationships, knowledge transfer between firms, quality standards, embedded services and financial flows.

During the vertical linkage analysis look at the governance mechanisms and transaction costs between successive value chain actors. Examine how information flows and capacity-building within the value chain are stimulated (e.g., through embedded services).

Step Four: Horizontal linkages analysis

Horizontal linkages are longer-term cooperative arrangements among firms that involve interdependence, trust and resource pooling in order to jointly accomplish common goals. Horizontal linkages can be both formal and informal.

They help reduce transaction costs, create economies of scale, and contribute to the increased efficiency and competitiveness of an industry in addition to lowering the cost of inputs and services (including financial services). Inter-firm horizontal linkages can contribute to shared skills and resources and enhance product quality through common production standards.

Such linkages also facilitate collective learning and risk-sharing while increasing the potential for upgrading and innovation. Small-scale producer groups have strong potential to increase their bargaining power in the marketplace, while processors, suppliers and traders may also form their own groups to strengthen their position within industries.

Step Five: Supporting Markets Analysis

Supporting markets are firms offering products and services in support of a range of business functions to actors throughout a value chain. The supporting-market products and services can be divided into three main categories:

- Financial services—e.g., lending, leasing, capital investing, factoring.

- Cross-cutting services—e.g., business consulting, tax and accounting services, legal advice, market information and communication, advertising, waste management.

- Sector-specific services—e.g., irrigation equipment, veterinary services, handicraft design services.

Supporting market analysis involves establishing the availability of financial services such as lending, leasing, capital investing, factoring, cross-cutting services, such as business management consulting, transportation and communications, sector-specific services, such as specialized equipment manufacturers; and financial services.

Step Six: Value chain dynamics analysis

At this stage examine the dynamics that affect how the value chain structure changes over time. The primary factors driving or blocking the dynamics of the value chain include changes in market demand technology, available service, profitability and risk, large-firm behaviour, input supply, barriers to entry and policy. These value chain structural changes spread through a number of dynamic elements including:

- Upgrading through investment by individual firms.

- Value chain governance.

- Power exercised by firms in their relationships with each other.

- Inter-firm cooperation and competition.

- The transfer of information and learning between firms.

Read: Adopting tech to increase agriculture mechanisation in Africa

The author, Simon G. Musiba, is a Tanzanian Banker