- Palm oil production continues to grow each year, driven by increasing global demand.

- The main producing countries are Indonesia, Malaysia, Thailand, and Colombia.

- In addition, the production of palm oil is also increasing in other countries, such as Nigeria, Brazil, and Ecuador.

The demand for palm oil is on the rise, and Africa is positioned to benefit from it. Palm oil production has been steadily increasing in recent years, with African countries such as Nigeria, Ghana and Ivory Coast leading the way. However, there are still many challenges that need to be addressed if Africa wants to close the gap between its current production levels and global demand for palm oil.

One of the challenges lies in infrastructure development within African countries. Adequate roads must be built so that farmers can transport their produce easily across borders. Access to finance needs to be fast-tracked so that farmers can invest more in their operations without having too much financial risk involved. Additionally, improved agricultural practices should also be encouraged; this includes using fertilizer appropriately as well as adopting sustainable farming methods like agroforestry or permaculture which could help increase yields while reducing environmental damage caused by traditional monocrop plantations used extensively throughout Asia Pacific regions today.

What is palm oil?

Palm oil is an edible vegetable oil derived from the fruit of the oil palms, primarily the African oil palm Elaeis guineensis. It is widely used in the food industry as a cooking oil, shortening, and margarine, and is also used to make a variety of other products, including soaps, detergents, and biofuels. It is also an ingredient in many processed foods, such as baked goods, confectioneries, and snack foods, and is used as a lubricant in certain industrial processes. In recent years, palm oil has become increasingly popular in the cosmetics industry as it is an effective emollient and skin moisturizer. Additionally, palm oil is often used as a biofuel, as it is an efficient and sustainable source of energy.

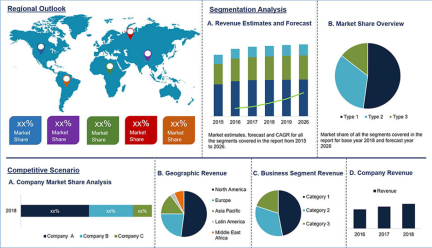

The global palm oil market is anticipated to reach US$ 147.59 billion by 2026 according to a new study published by Polaris Market Research.

Palm oil production in Africa has a long history that dates back to the 17th century, when Portuguese and Dutch traders began trading in palm oil in the region. The palm oil industry in Africa continued to expand throughout the 19th and 20th centuries, and by the early 2000s, the region had become one of the world’s leading producers of palm oil.

According to the Food and Agriculture Organization of the United Nations, Africa is currently the second-largest producer of palm oil, with Nigeria, Cote d’Ivoire, and Cameroon accounting for the majority of production. In 2020, Africa produced a total of 5.9 million metric tons of palm oil, which is an increase of 7.4 per cent from the previous year. Indonesia is the world’s largest producer of palm oil, with a total production of 44.4 million metric tons in 2020.

Read: Unlocking Potential of Nigeria’s Yam

However, Indonesia is set to export less of the commodity overseas as it tightens a policy requiring companies to keep more production at home. The government cut the amount producers can export to six times the domestic sales requirement, down from eight times, according to Budi Santoso, director general of foreign trade at the country’s trade ministry.

The change took effect from January 1. Exporters will be allowed to ship six times their domestic sales volume, less than the current ratio of eight times, according to a new regulation reviewed by the Reuters news agency and confirmed by an industry official.

“To secure domestic supply, especially for the first quarter of 2023,” said Septian Hario Setio, a senior official at the Coordinating Ministry for Maritime and Investment Affairs.

Seto said the ratio will be evaluated periodically by considering the domestic situation, including cooking oil availability and prices. Indonesia early last year introduced export measures on palm oil products amid concerns about cooking oil prices spiralling out of control.

A brief ban on exports of the edible oil from Indonesia shook markets and exacerbated existing global supply concerns, but it also led to ballooning domestic inventory. Indonesia currently imposes a so-called domestic market obligation (DMO) requiring businesses to sell a portion of output locally in return for export permits.

These policy changes and the rising demand will see key Africa countries take advantage of rising global demand for palm oil but steps need to be taken to improve the output. Such measures would not only help close any existing gaps between current output levels versus what’s required but also ensure long term sustainability both economically and environmentally speaking going forward.