The increasing food prices have majorly occasioned the rise in consumer expenditure. In the review period, 50 per cent of the Kenyans polled indicated static income levels over the last year 53 per cent of Kenyans polled allocated less than 10 per cent of their…

Kenya Ports Authority handled 37,576 metric tons of cargo in 2023, according to its Managing Director. The KPA MD revealed…

One of the most important ways a fintech can listen to its customers is to gauge how they engage with…

Level of remote desktop protocol abuse unprecedented since launch of report in 2020. External remote services were the number-one way…

Remittance inflows for March grew to $407.8 million up from $385.9 million in February, with the US maintaining its lead…

Remittance inflows for March grew to $407.8 million up from $385.9 million…

Featured

International arrivals increased from 1.48 million in 2022 to 1.95 million as…

Industry & Trade

One of the most important ways a fintech can listen to its…

Countries

The increasing food prices have majorly occasioned the rise in consumer expenditure. In the review period, 50 per cent of the Kenyans polled indicated…

A total of 77 people, including 22 Chinese and a Cameroonian, all…

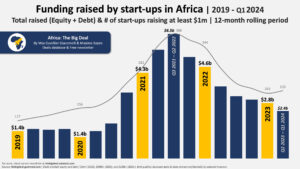

Following a slow recovery from the debilitating impact of COVID-19, Africa’s economic…

Kenya’s business conditions weakened slightly in March despite easing inflation. Kenyan firms…

Regional Markets

East Africa’s economic growth is projected to grow at 5.3 and 5.8 per cent in 2024 and 2025-26, respectively. The…

Tech & Innovation

Level of remote desktop protocol abuse unprecedented since launch of report in 2020. External remote services were the number-one way attackers initially breached networks. Remote Desktop…

Editor's Picks

International arrivals increased from 1.48 million in 2022 to 1.95 million as…

Africa

In 2024, diversification of your crypto portfolio remains a fundamental principle for…

Industry & trade

Kenya Ports Authority handled 37,576 metric tons of cargo in 2023, according…

Money Deals

A key component of successful cryptocurrency investment is utilizing cryptocurrency exchanges effectively.…

Investing

In 2024, diversification of your crypto portfolio remains a fundamental principle for…