- Abu Dhabi radiates optimism as over 300 startups join AIM Congress 2024

- TLcom Capital Raises $154 million in Funding to Boost Its African Growth

- Africa’s $824Bn debt, resource-backed opaque loans slowing growth — AfDB

- LB Investment brings $1.2 trillion portfolio display to AIM Congress spotlight

- AmCham Summit kicks off, setting course for robust future of US-East Africa trade ties

- Why the UN is raising the red flag on the UK-Rwanda asylum treaty

- Portugal’s Galp Energia projects 10 billion barrels in Namibia’s new oil find

- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

Browsing: Africa

Approximately 10% of Tanzania’s landmass is covered by freshwater.

This essentially means that nearly 4,868,424 million hectares of wetlands can generate billions of dollars in revenue earnings for the country if harnessed correctly. When looking at this in the greater context of East Africa, Tanzania is the leading country with the largest freshwater reserves, an economic advantage over its neighbors.

The Great Lakes region of East Africa, that encompasses Kenya, Uganda, Tanzania as the main countries, are currently undergoing dynamic changes with respect to various water demands occurring across the region.

Still, Tanzania remains to reap significant rewards. The Food and Agriculture Organization (FAO) place Tanzania to be an owner of 96. 27 km3 of renewable water resources per year, which corresponds to 2,266 m3 per person and year, despite being unevenly distributed over time and space, still these numbers give way more financial leeway to Tanzania’s economic …

Hong Kong is targeting investment and trade deals in Kenya in renewed effort to deepen its relations with the East Africa’s economic power house.

The Hong Kong Trade Development Council (HKTDC) this week led a delegation to Nairobi and Mombasa, eying investments in the Kenyan market.

It is keen to tap on investments under the government Public Private Partnership (PPP) initiatives, in a close collaboration with the Kenya National Chamber of Commerce and Industry (KNCCI).

The delegation which included ten leading companies held talks with the Kenyan business community and government in Nairobi and Mombasa, with KNCCI playing host during the six days visit that commenced on Monday.

Hong Kong companies are eying investments in Export Processing Zones (EPZ), export market, Special Economic Zones, logistics, real estate and trade.

READ ALSO:What Kenyatta secured at China Belt and Road Summit

Speaking during a Nairobi forum, KNCCI President Richard Ngatia encouraged …

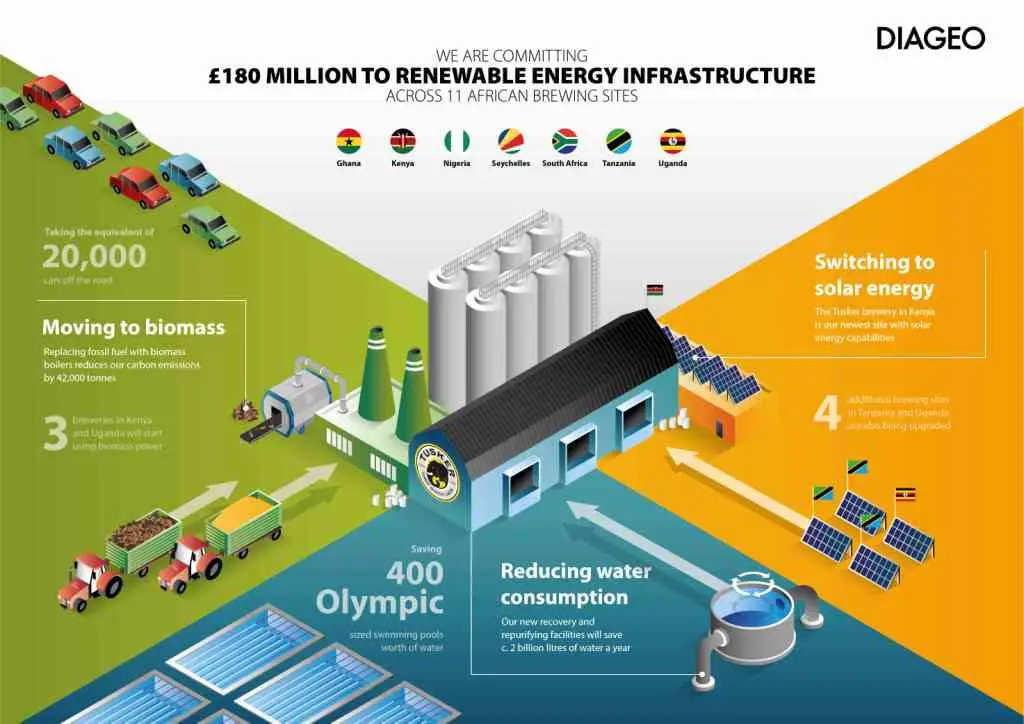

Diageo has committed to invest £180 million (US$217million) in renewable energy resources across its African sites, the British multinational alcoholic beverages company has announced.

According to the world’s second largest distiller, the move is to ensure its breweries are the most carbon and water efficient.

This commitment represents Diageo’s largest environmental investment in a decade confirming its commitment to reducing its carbon footprint and addressing climate change.

READ ALSO:How KBL’s water savings are quenching communities’ thirst

The investment will touch 11 of Diageo’s African brewing sites where it will deliver new solar energy, biomass power and water recovery initiatives.

It is also targeting to bring new infrastructure designed to improve the long-term sustainability of Diageo’s African supply chain in seven countries.

“We believe this is one of the biggest single investments in addressing climate change issues across multiple sub Saharan markets. It demonstrates the strength of our commitment to …

Leading electronic financial services company NilePay PLC has partnered with Zain South Sudan to launch the first licensed mobile money service in South Sudan.

Dubbed ‘NilePay Mobile Money’, the service is expected to deepen financial inclusion in the country.

The partnership is geared towards eliminating significant barriers that have hindered consumers in the country from taking full advantage of global eCommerce.

“NilePay Mobile Service’s partnership with Zain South Sudan is part of the company’s long-term strategy to enable eCommerce and digitize financial services across the country,” said Darius Mobe, Director, NilePay Mobile Money.

Most people in South Sudan’s capital have been relying on unlicensed mobile operators to transfer money through platforms created by MTN Uganda and Kenya’s M-PESA.

“We are excited to have partnered with NilePay PLC to bring the mobile wallet services to the South Sudan market, which makes it more convenient and secure for users to withdraw …

Kenya’s Equity Bank has been named Africa’s Best Digital Bank for 2019 at the Euromoney Awards for Excellence, validating its role in delivering simple, fast, convenient and affordable banking products and services to customers.

Equity has been recognised for being a bank that shows true leadership in its digital offerings, both in corporate and retail banking, and uses technology to benefit both clients and the efficiency of the institution, placing digital at the heart of its business.

Digitisation has seen 93 per cent of loans disbursed by the bank, being accessed through the mobile channels, while 97 per cent of all cash-based transactions are happening outside Equity Bank branches, with mobile and agency channels taking the lion’s share.

READ ALSO:Fintech drives Equity Bank’s diaspora remittances to Ksh100Bn

Digitisation of the customer journey has eased customer experience leading to growth of digital payment transactions by 94 per cent in the …

Economic diplomacy can conquer poverty and create more jobs in Africa, President Uhuru Kenyatta has said.

The Kenyan President has since called on those in positions of power to provide quality leadership by getting actively involved in economic diplomacy that delivers opportunities for growth and transformation.

President Kenyatta spoke at Avani Victoria Falls Resort in the tourist town of Livingstone in Zambia, when he addressed the inaugural National Economic Summit (NES) at the invitation of President Dr Edgar Lungu.

READ ALSO:Why it’s too expensive for Africa trading internationally

Economic diplomacy is an engine that developing countries are employing to drive faster economic development especially in Africa.

It is becoming a major theme of the external relations of virtually all countries. Economic Diplomacy promotes a country’s foreign and financial relations in support of its foreign policy.

Current trends include increasing collaboration between state and non-official agencies, and increased importance given …

Due to lower levels of technology adoption and the smaller manufacturing base, automation is not likely to displace many workers in the coming years in Africa. …

Business coach and trainer, TriciaBiz has launched an online business school, Business Lab Africa with the aim of helping entrepreneurs in Africa succeed in business. The school, which offers a new approach to learning, is subscription-based and is geared towards providing quality content at a price MSMEs can afford.

According to its management, not only is BLA easily accessible via mobile or web, it also offers knowledge that is practical, qualitative and locally relevant.

Courses on the BLA curriculum, are taught by business experts from around the world covering a wide range of business subject areas including Marketing, Sales, Global Expansion, Business Structure and Processes, Business Models and more.

Speaking on the operations of the platform, Lead Trainer of the school, Tricia Ikponmwonba said that BLA’s faculty consists of trainers with deep business knowledge having consulted and trained for several Fortune 100 companies and taught a combined pool of over

Kenya’s Insurance sector is set to face disruption following the launch of a new InsurTech ecosystem seeking to create new solutions to the ailing insurance sector.

READ:Why Kenya’s insurance sector is “rotten”

Over 60 InsurTech start-ups pitched to investors at the inaugural two day Africa 3.0 conference held in Nairobi, as they seek to partner in increasing insurance penetration in the region.

The Conference which was organised Market Minds in partnership with Evolution East Africa and the UK Department for International Trade also saw over 150 start-ups from Africa participate.

Market Minds Founder, Sebastian De Zulueta, says a number of deals are expected to be signed with over 30 venture capitalists keen to tap into the opportunities in the insurance market in Kenya and Africa at large.

READ ALSO:Sanlam Kenya reveals secret weapon for 2019

“East Africa’s mobile penetration gives great opportunities for disruptions in the insurance sector. …

Pan-African financier that exclusively supports the development of the housing and real estate sector in Africa, Shelter Afrique, has urge governments to establish a housing microfinance fund to improve access to housing finance by those in the lower end of the market.

Speaking at the Affordable Housing Investment Summit in Nairobi recently, Shelter Afrique’s Chief Executive Officer Andrew Chimphondah said most policies had an exclusive urban focus, and non-consideration of the low-income groups and the rural areas.

According to Shelter Afrique, establishment of such a fund would make it easier to facilitate efficient and inclusive housing market systems and make affordable housing a reality across Africa.

Currently, 90 per cent of Africans cannot afford to buy a house or qualify for a mortgage.

READ ALSO:AfDB to inject more millions to support affordable housing in Africa

“Access to adequate housing for low-income earners is a critical development issue globally and …