- Wärtsilä Energy offers tips on how Africa can navigate energy transition and grid reliability

- Powering Africa: Africa’s Path to Universal Electricity Access

- Global investment trends at AIM Congress 2024: a spotlight on the keynote speakers

- South Africa’s deepening investment ties in South Sudan oil industry

- Agribusiness could drive Africa’s economic prosperity

- Dawood Al Shezawi: Why AIM Congress 2024 is the epicenter of global economic and cultural dialogues

- d.light’s 600,000 cookstoves project verified as top source of quality carbon credits

- Artificial intelligence (AI) could create a turning point for financial inclusion in Africa

Browsing: Kenya Revenue Authority

- The government of Kenya is deploying measures to protect local industries from the onslaught of cheap imports.

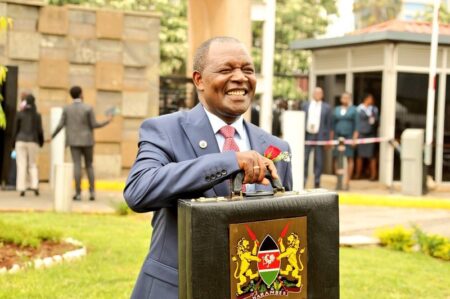

- Kenya’s $26.4 billion FY2023/24 budget is an increase from $23.6 billion plan for the fiscal year ending June 30.

- The country is, however, facing high inflation, ballooning debt, and a high rate of joblessness.

President William Ruto’s first $26.4 billion budget for the FY2023/24 starting July 1st seeks to boost job creation, power growth of industries, and reduce borrowing.

Kenya’s $26.4 billion FY2023/24 budget is an increase from the $23.6 billion plan for the fiscal year ending June 30. East Africa’s economic powerhouse, Kenya, continues to struggle with growing inflation, skyrocketing debt, and a high unemployment rate.

Job creation targets Kenya’s youth

The lack of enough jobs is disproportionately affecting the country’s young people. The economy is also struggling from the impact of external shocks. For instance, Kenya is hurting from the Russia-Ukraine …

In the first six months of the year, Kenya’s food imports had increased to sh103.34 billion. The figures collected by the Kenya Revenue Authority (KRA) showed that the food imports were sh12.35 billion more than the amount spent in the same period in 2020.

According to data from the national treasury, import expenditure increased by 29 per cent in the third quarter of 2021. China is the most significant contributor of Kenyan imports accounting for 31.6 per cent of the total bill from the Asian continent.

This is the fastest growth in the food import bill since a 60 per cent jump recorded in 2016 when the bill stood at sh82.83 billion. The exponential increase has been linked to the growing popularity of digital trading, allowing retailers and consumers to order and ship food and other commodities directly.…

Digital initiatives intending to streamline tax procedures instituted by the Kenya Revenue Authority (KRA) in 2019 have opened up the door for bad actors to stop the legal transfers of properties held in collateral.

KRA reintroduced in 2014 a 5% tax on the gains achieved when selling land, building or investment shares. It further enhanced the payment of this tax through its online portal i-Tax under the watchful eye of KRA agents to allow or deny exemptions. This, however, has brought chaos and a loophole for unscrupulous players to cheat the system.

Prior to this online system change, buyers and sellers both had the option to pay relevant capital gains tax to KRA, but now the new system restricts the payment of capital gains tax to sellers only.

This means that any individual or business who has a property, including land, buildings, or any appreciating asset that would be subject …

Kountable, a global trade and technology platform, has formed strategic partnerships with customs agencies in both Rwanda and Kenya.

This provides Kountable with a dedicated group of customs experts to assist in the timely processing and payment for imported goods in the region in addition to providing last-mile logistics so that goods can remain insured in that final stretch of the trade.

“The more parties we have who validate and participate in a transaction,” said Kountable CEO Chris Hale, “the more trust and transparency we bring to the network. We have gone through an extensive process to select these partners based on their professionalism and strength of their experience.”

Selected by an in-depth interview process and the recommendations of the Rwanda Revenue Authority’s (RRA’s) Risk Management Office and the Kenya Revenue Authority (KRA’s) Commissioner, Customs and Excise Services Department, these custom agencies are certified, vetted and found to be …

Kenya’s tax collector Kenya Revenue Authority has been looking for avenues for raising the tax as the countries look for a more sustainable way of meeting its development budget, and with a debt that seems to be spiraling out of control.

Media reports emerging from Kenya have indicated that the taxman in conjunction with The Communication Commission of Kenya (CA) are looking at media streaming sites like Netflix and YouTube as well as other apps operating in Kenya.

Further, the taxman is looking at ways of collecting revenue from every app downloaded, similar to a legislative clause currently available in Cameroon which allows for Telcos to pay a certain percentage for every app downloaded.

According to KRA, provision of online platforms for use by third parties is a taxable supply under the Value Added Tax Act of 2013. This means that this will attract the standard 16% levy.

“If you …