- Who got the money and who didn’t in Africa’s 2025 race for foreign direct investments?

- AI’s Dual Capacity and a Strategic Opportunity for African Peace and Security

- How African economies dealt with the 2025 debt maturity wall

- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

Browsing: premium

Much of the talk at the moment, and nearly always, is where we should invest in a world of recession, low-interest rates, unpredictable markets and a challenging socio-political climate. As open borders in East Africa close, open, close and re-open again and as Kenya prepares for yet another Covid-19 lock-down our own region is particularly challenging.

I am a member of several international investment groups and so I am fortunate to hear the views, perspectives and experiences of many clever and visionary investors around the world. I have written here before about ESG investing – Environmental, Social Impact and Governance – the “do’s” of impact invest but I haven’t written about the “Don’ts”. And it strikes me that we should be talking just as much, perhaps even more, about where not to invest at the moment and in the future.

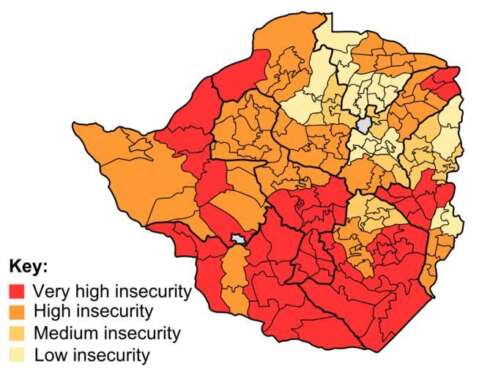

Zimbabwe’s food security levels are quite low, but there is a promise of a better outcome from the previously anticipated situation. This is mainly because the country has received above-average levels of rainfall during the current rain season. There is hope that the expected bumper harvest will help bring resolution to the challenges of food insecurity.

However, there is still a need for food aid due to the deficit emanating from the two previous consecutive poor rainfall seasons experienced in most districts of Zimbabwe. The droughts resulted in poor harvests, which caused inadequate household food stock from personal production.

Africa has experienced marginalisation and social exclusion since gaining independence from its colonisers. Among the policies developed during the colonisation era was the exclusion of Africans from any level of government, or if they were allowed to join, they joined without authority. This kind of racial discrimination is still being experienced in global workspaces to date. Africa has remained stagnant and regressed in terms of foreign trade, investment, per capita income, and other economic growth measures to date due to the effects of colonisation.

Poor governance and corruption, amongst other factors, have continued to repress Africa’s growth; however, more governments are taking the initiative to improve policies that promote education and health outcomes for their people, thereby reducing social exclusion and marginalisation.

March 8th marked the celebrations of International Women’s day under the theme ‘choose to challenge’. As women across the world choose to challenge societal norms and the traditional disregard of women, African women are steering the growth of the continent as pivotal players.

A commonly shared African proverb says, ‘when you educate a boy, you train a man; if you educate a girl, you train a village.’ This proverb simply highlights the impact women have on the community when given a chance and a voice. In the economic history of the African community, women were sidelined and viewed as lesser than their male counterparts.

The AfCFTA gives Africa an opportunity to confront its trade and economic development challenges such as market fragmentation, small-scale national economies, a narrow export base, caused by shallow manufacturing capacity, and underdeveloped industrial regional value chains.

AfCFTA is one of the tools for making a fundamental structural transformation for Africa’s economy and placing it on the path of long-term industrial development. AfCFTA will also strengthen the continent’s bargaining position when engaging in trade negotiations with economic powers such as China and the European Union. This implies that trade will become more favourable for African products, and now when Africa partners with the likes of China and other countries, focus should be on capital supply as well as industrialisation.

Over the years, various climatic disasters have occurred, notably the recent Cyclone Idai that hit the continent’s south-eastern part. Various more catastrophic weather events continue to affect the continent socially and economically. Kenya, which relies on its agricultural sector’s performance, has evidenced a sustained and growing divergence between farm production and consumption. Notable air masses like the El Nino and La Nina have had substantial negative impacts on coastal countries such as Kenya due to rising sea levels caused by changing oceanic climatic conditions.

Kenya has been forecasted to face another severe dry spell this year as a result of La Nina. La Nina, an air mass typical of cold weather, which is not ideal for rainfall, has been hitting the east coastal country nearly every five years. In 2016, 2.7 million people were affected by a hunger crisis, and the majority of them displaced. A notable concern in such events is the government’s limited financial ability for relief aid. Much of the burden has been borne by humanitarian organizations that continue to offer substantial assistance both for disaster relief and Africa’s economic development.

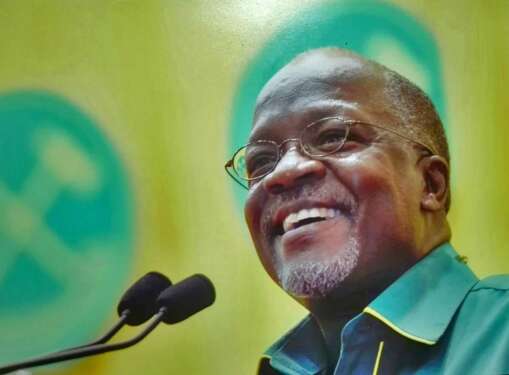

The late Magufuli is celebrated and mourned across the East African Community which has also joined hands with Tanzania to remember his legacy—which extended from his fight against corruption and the misuse of public resources to his diplomatic relations, forged across the landscape through several regional communities—where on numerous occasions he had declared that ‘we are unified as one’.

Magufuli was a stern advocate of hard work for economic excellence. His voice on this matter was as strong as his willpower. Throughout his unfinished tenure, he had demonstrated how Tanzania can transform its natural wealth and utilize domestic tax collections to fuel development projects.

The Grassroots Business Fund (GBF), a global impact organization that utilizes the power of blended capital to invest in traditionally under-financed businesses, has announced the spin-off of its Latin America team into a new fully-fledged unit operating as Andes Impact Partners – AIP with its headquarters in Lima, Peru and is planning on expanding its African operations from Nairobi.

AIP launched APF-I in November 2020 with an initial focus on Peru and Colombia and a possibility to expand to other markets in the region. The fund targets inclusive businesses which incorporate underserved, vulnerable or low-income communities in their supply chains, helping to improve incomes and the quality of life of these communities. Target businesses must be committed to gender equity and to promoting equal opportunities.

Enjoying some of the world’s highest annual economic growth rates, and by the measure of the amount of infrastructures works, the East African Community (EAC) is one of the world’s fastest-growing regional trade blocs.

East Africa is undertaking some of the world’s grandest infrastructure works yet, ranging from fast-speed electric train railways and single cable bridges to imposing dams and oil and gas pipelines as well as multinational road networks.

It is just as well because trade on the continent is growing exponentially and is bound to grow even faster with the signing of the continent-wide free trade pact.

Tourism was Tanzania’s leading source of forex—this according to data from the Ministry of Natural Resources and Tourism—but that was only true before the global Covid-19 pandemic hit.

Statistics from the ministry show that the country earned an impressive USD2.5B from the tourism sector in 2019. That was the highest it would rake in before Covid-19 befell the world in 2020. To date, the future looks grim.

The effect of the global pandemic on Tanzania’s economy in general has been devastating. Consider the fact that earnings from the travel subsector have plummeted by more than half its pre-pandemic earnings.