- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

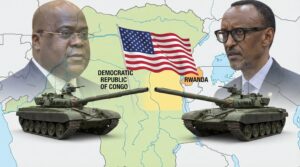

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Browsing: technology

In a recent announcement during the US-Africa Business Roundtable in the United States, Kenya’s President William Ruto revealed that Safaricom, a leading telecommunications company, is establishing a strategic partnership with Apple Inc. The Safaricom-Apple partnership will integrate the widely-used mobile money platform, M-Pesa, with Apple’s ecosystem. This integration will expand M-Pesa’s mobile financial services globally.

President William Ruto announced the deal after he toured Silicon Valley in San Francisco Bay, United States, on 16 September. The Kenyan leader is fast gaining popularity across Africa and globally. He has led from the front in marketing Kenya as a conducive ground for foreign business to thrive.

Currently, financial inclusion is a target that all African countries must achieve. Boosting Africa’s financial inclusion will have a positive impact on economic growth and the prosperity of society. Through financial inclusion, everyone has access to a variety of quality, effective, and efficient financial services. Increasing public accessibility to financial service products will further reduce the level of economic and social inequality which in turn will improve the welfare of the community.

One of the efforts to achieve this financial inclusion target is through technology in the form of digital finance. When financial products and services use internet technology, it makes it easier for people to directly access various kinds of payments, shopping, savings, and investments, including loan and credit facilities. Among these digital financial elements, the payment facility is the service that is experiencing the fastest development and contributes greatly to the achievement of Africa’s financial inclusion targets.

The United Nations Conference on Trade and Development (UNCTAD) recently published the Economic Development for Africa 2023 Report. The document, titled “The Potential of Africa to Capture Technology-Intensive Global Supply Chains,” looks at Africa’s capacity to become a prominent player in global supply chains for “high-technology” industries, which include automobiles, mobile phones, green energy, and healthcare.

However, integrating cryptocurrencies with conventional financial systems becomes increasingly essential as they become more commonplace. This presents several obstacles to overcome before cryptocurrencies can realise their full potential. For instance, traditional institutions may be hesitant to work with cryptocurrencies due to concerns about money laundering and other illicit activities. Moreover, the technical difficulty of integrating cryptocurrencies with existing banking systems can prove intimidating.

An infusion of new investments and regulatory transformations is shaping financial interactions and digital payments in Africa. Africa’s digital payments…

Governments can play a crucial role in enhancing agricultural productivity in Africa for economic growth. Individual nations can accomplish this by establishing policy environments to promote agricultural investment, including providing tax incentives and subsidies to producers. Governments can also prioritize agricultural development in their national budgets by allocating a more significant proportion of their resources to the sector.

An efficient crypto mining industry can generate more job opportunities in Africa as the demand for miners, blockchain specialists, and technology specialists increases, . This encourages nations to enhance their energy and technological capacities to support crypto operations. These enhancements can considerably benefit other industries and the economy as a whole.

African nations must embrace the chance to become a crypto mining hub. This can aid in the digital economy’s growth, citizens’ financial standing, and the infrastructure for energy production. Consequently, African governments can invest in cryptocurrencies to acquire alternative funding sources for developing renewable and alternative energy sources.

Digital technologies have enabled farmers to obtain crucial information on soil quality for nutrient levels, water levels, pests, and disease…

Liquid Cloud, Microsoft Collaborate to Deploy Hybrid Cloud Infrastructure in Africa Combining linear TV via satellite and on-demand services via…

Integrating AI in farming machines will definitely help in optimizing operations. Investments in mechanization enable farmers to expand the range of their activities and diversify their livelihoods in ways that can reduce their vulnerability to climate change.

The availability of appropriate machinery to carry out sustainable crop management practices increases productivity per unit of land. It also increases efficiency in the various production and processing operations and in agricultural inputs’ production, extraction and transport. Artificial Intelligence methods support agriculture decision-making systems, help optimise storage and transport processes, and make it possible to predict the costs incurred depending on the chosen direction of management.

Tractor-operated tillage is the single most energy-consuming operation in crop production. Operating a plough is the main reason many farmers require high horsepower and diesel-fueled tractors. Conservation agriculture is flexible enough to accommodate the socio-economic resources of smallholder farmers as well as large-scale farming operations.