- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

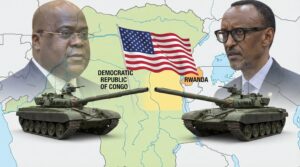

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Author: Caroline Muriuki

Airtel Uganda and KCB Bank Uganda announced a partnership to introduce a variety of mobile loans and savings solutions in Uganda. From the partnership, its customers will earn interest on savings of five percent per annum on regular savings and 9 percent per annum on fixed deposits. The automated digital products include Regular Savings, Instant Unsecured Mobile Loans and Fixed Deposit Savings Accounts that will allow its customers to borrow mobile loans from as low as UGX300 (KSH 9.15). Airtel Money Agents will be able to get unsecured loans at UGX300 interest only while KCB and Airtel customers can earn…

Equity Group Holdings has recorded huge profits of $80.6 million after-tax in its first quarter of 2021 amidst the impacts of the pandemic on economies. In its latest financial report, for the first quarter that ended on March 31, 2021, Equity group profits increased by 64 percent after-tax to $80.6 million compared to $49.1 million recorded in 2020, which shows recovery in the financial sector. Equity group holdings total income grew by 29 percent to $236.3 million in the same period while staff costs, loss loan provisions and other operating expenses increased to $127.9 million from $117.7 million. During the…

Chinese lending to Africa has declined drastically after nearly two decades of bilateral lending which has led to the development of infrastructure in the region. Chinese lending to the public sector in Africa was $28 billion in 2016 according to research from the China Africa Research Initiative. In 2018 it also declined to $9.9 billion and sunk further to billion in 2019. (Valium) The decline is due to changes in the Chinese economy, Chinese investment losses and the uncertainty of the Chinese trade with the United States. The fact that Chinese lending has been receiving negative criticism as the cause…

Remittance to Kenya increased by 10 percent to $3,095 million in 2020 from $2,796 million in 2019 while in Uganda they dropped to $1.1 billion in 2020 from $1.4 billion in 2019. According to the Central Bank of Kenya (CBK), the increase accounted for three percent of the country’s Gross Domestic Product (GDP). The remittance was projected to decrease in 2020 due to the pandemic. (Clonazepam) Financial innovations such as mobile money which have opened more convenient transactions highly contributed to the increase in remittance flow to Kenya. With the restriction measures which were put in place to curb the…

Airlines are expected to make big losses in 2020 with the challenges being experienced in containing new coronavirus variants and slower vaccination in some African countries according to the International Air Transport Association (IATA). According to IATA, airlines are expected to post-tax losses of 47.7 billion in 2021 from the initial projection of $38 billion in December. “Financial performance will be worse and more varied this year than we expected in our December forecast, because of difficulties in controlling the virus variants and slower vaccination in some regions,” said IATA. The aviation sector is expecting $81 billion in cash burn…

Ethio- telecom launched a service called ‘Telebirr’ as it seeks to boost growth by offering cashless transactions in Ethiopia. Telebirr will allow ethio-telecom’s customers to send, store and receive money using their phones. The mobile money service aims to extend mobile services to areas that have been financially excluded. With just 19 commercial banks which serve a population of 115 million, Telebirr will bridge the financial gap to those who do not have access to banks in Ethiopia. The CEO of Ethio telecom, Frehiwot Tamiru said that within its first year of operations, the telecom plans to recruit 21 million…

Airtel records a massive rise in profit of $1.03 billion in Q1 2021 due to an increase in data and mobile money subscribers between January and March 2021. In its latest financial report for Q1 2021, Airtel saw a significant rise in revenue by 21.7 per cent from Q1 of 2020 which recorded $899 million in revenue. However, due to constant currency change, the revenue growth is at 15.4 per cent. In Q1 2021, Airtel recorded a $215 million increase in profit before tax from $97 million recorded in Q1 2020 despite recording a 6.9 growth in its total subscribers.…

MTN Rwandacell has listed its shares becoming the first telecom company to list on the Rwanda Stock Exchange (RSE). The listing will see 100 per cent of MTN Rwandancell listed on the market but only 20 per cent of the shares previously owned by Crystal Telecoms’ (CTL) will be floated to the public. The telecom listed its shares by introduction making shareholders of Crystal Telecoms’ (CTL) direct shareholders in MTN Rwanda. Crystal telecom was established following a share transfer of 20 per cent of shares held in MTN Rwanda from Crystal Ventures to Crystal Telecom in 2015. Listing by introduction…

Remittance flows to the Middle East and North Africa (MENA) region increased by 2.3 per cent to record about $5.6 billion in 2020 according to a report by World Bank. The press release from World Bank noted that strong remittance flows to Morocco and Egypt strongly contributed to the growth. In 2020, flows to Morocco rose to 6.5 per cent while flows to Egypt rose by 11 percent to record a high of nearly $20 billion. Tunisia also recorded an increase of 2.5 per cent. According to the statement, other economies in the region experienced losses in the same period…

The International Monetary Fund (IMF) which has so far lent about $491.5 million to Uganda said that it is a misconception to assume that Uganda’s debt is unsustainable. Uganda’s public debt levels are within a manageable threshold in the long term, noted Izabela Karpowicz the IMF Resident Representative for Uganda. “We used to rate Uganda at low risk and now it will be moving to medium risk and this is due to Covid-19. It is not correct to say the debt is not sustainable over the medium and long term.” Ms Karpowicz said on the sidelines of a policy dialogue…