- South Africa Budget Disappoints Investors as Deficit Widens

- Kenya drops to 6th place in Africa trade barometer

- Tanzania’s bold move to boost cashew nut exports by 2027

- Chinese cities dominate global list of places occupied by billionaires

- Sudan tops up as Africa aims for $25 billion development fund

- Opportunities for youth: Tech firms Gebeya and NVIDIA to train 50,000 developers in Africa

- Shelter Afrique taps green bonds to raise funds for affordable housing in West Africa

- New digital wallet suite for Africa as Network joins forces with Ant

Author: Evelyn Shumba

Evelyn is a finance and business content writer with a passion for business news in Africa. Her expertise is in analyzing African equities and telling the truth when it comes to doing business on the continent!

The recent IMF’s World Economic Output 2020 revealed a new world order. According to the report, the US economy at $20.8 trillion trails the Chinese economy at $24.2 trillion. These statistics are based on purchasing power parity, a measure of the power of a currency to buy the same goods and services within its own shores.

This implies that you can buy more with a dollar in China than you would in the US. By this metric, China's economy

Public funds are seldom enough to fund developmental projects which is why many Africa countries have turned to debt. Albeit the challenge with accumulating mounds of debt is the equal mounds of repayment obligation with the added inconvenience of interest accrual.

The fluctuations in commodity prices which African countries rely on have not helped the situation. Data from the IMF indicates that 20 of the 54 countries in Africa are already in or headed towards distress.

With the rising number of countries going towards the red zone, it is certainly a nerve-wracking fact for Africa.

COVID-19’s Impact on African Debt

The arrival of coronavirus on the continent caused much alarm; rightfully so, given the devastation on health and the economy around the wealth. The transmittal effect of world economic standstill, recession, and local lockdowns heavily damped economic activity.

One of the major risk factors that the heavily indebted African countries

South African Credit rating agencies, Moody’s and Fitch, have both downgraded South Africa’s credit rating. The country’s credit rating further plummeted into junk territory making debt issuance both difficult and expensive

Moody’s dropped the credit rating two steps below investment grade to Ba2 from the previous Ba1 level.

”The downgrade reflects the impact of the pandemic shock, both directly on the debt burden and indirectly by intensifying the country’s economic challenges and the social obstacles to reforms.

South Africa’s capacity to mitigate the shock over the medium term is lower than that of many sovereigns given significant fiscal, economic and social constraints and rising borrowing costs.” Moody rating action report

Additionally, Fitch stepped down the countries rating to a BB minus which is three positions below investment grade.

The ratings apply to both local and foreign borrowing.

Another credit rating agency S&P maintained South Africa’s rating which is currently …

Africa’s Cashless Payment Revolution, According to World Bank data, more than two-thirds of Africa’s population has no access to the formal banking system. This is largely the direct result of challenges such as underdevelopment, financial illiteracy as well as a predominantly rural based population.

These factors among others have led to a situation where banking is both inaccessible and overly expensive for the bulk of the population. Further, African economies are driven by an informally oriented economic climate; as a result, banking for many is not an option.

This situation has prompted innovative approaches to avail financial services. Among the disruptions in financial services, there has been a rise of fintech to cater for payments outside of the banking system. Some of these include mobile money payment solutions and online payment/receipt platforms.

Fintech Start Ups Attracting Investment

This sector has become one of Africa’s fastest-growing in the digital …

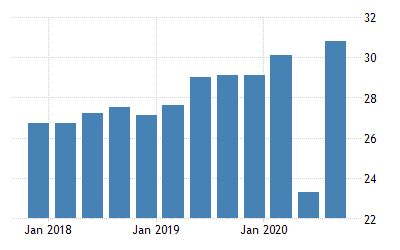

South Africa’s unemployment soars have risen to levels last seen in 2008. According to the country’s National Statistics Agency, 30.8% of South Africans are now unemployed. This figure is the highest the country has experienced since 2008.

The statistics are mainly caused by the effects of COVID-19 on the economy. The southern African country, one of the most industrialized in Africa, was among the first to record a case of COVID-19 on the continent. It is also one of the most heavily affected countries in Africa.

In response to the pandemic

the government instituted a raft of measures to flatten the infection curve. The covid response involved a total lockdown which halted economic activity, affecting revenue for the industry and other productive sectors of the economy. (https://rpdrlatino.com)

The lockdown hit businesses severely, prompting restructuring which has seen many employees losing their …

A South African tech-based company FinChatBot has secured a funding round worth $1.6 million to drive expansion beyond South Africa. The fintech company is a provider of customer service AI bot technology in the financial services industry. Its bespoke technology connects with different operating systems and third-party systems allowing financial services firms smooth interaction with their customers. Their AI-based chat system operates independently of human interaction.

The company’s mission of guiding the customer experience will be supported by three funding partners. The participants in the funding round are:

- Compass Venture Capital, an early-stage focused investor that is based in Mauritius. It looks for strong propositions set to disrupt traditional ways.

- South African, Kalon Venture Capital which focuses on tech-based solution providers mostly in South Africa. It promotes investments in top companies with disruptive technologies

- Saviu Ventures an African-focused investment holding company from France which invests in established startups in both

In what could easily be mistaken as a scene from the TV series Knight Rider, an autonomous bot delivery vehicle took to the streets of London. In its maiden journey, it delivered medical supplies for a Hounslow care home.

The vehicle named Kar-go is a brainchild of Zimbabwean serial entrepreneur Pasi William Sachiti. It uses artificial intelligence to learn from natural events, including the terrain, allowing it to use this learned knowledge in new situations.

The bot also has a specialized delivery management system and is capable of delivering parcels completely autonomously.

To fulfill safety regulations, Kar- go moves around with a driver who can step in, in case of an emergency.

The car can deliver in any terrain whether rural or urban and can navigate both smooth and dirt roads.

The bot was built by Academy Robotics, a startup founded by Mr. Sachiti. The vehicle works through an app …

The South African government last week announced a resumption in international visitors to the country amid a COVID- 19 infection reality.

Earlier this year, South Africa, like many other countries, shut itself out from the world to control the spread of COVID within its borders. It immediately implemented local lockdowns which have been gradually lifted in different phases.

Authorities had initially indicated that international borders were billed to be opened in February 2021. The country has, however, given the green light to international visitors in order to stimulate a faltering tourism sector.

Initially, borders were opened on October 1 but excluded visitors from many countries that were classified as high risk.

Last week, the government updated its travel restrictions alert, opening up entry to all countries.

The opening up of borders is aimed at arousing the tourism sector in South Africa which contributes significantly to GDP. It has been …

COVID-19 Vaccine On African Soil

South African Aspen Pharmacare, a wholly-owned subsidiary of Aspen Holdings, has entered into an arrangement with Janssen Pharmaceutical, an arm of Johnson & Johnson, for the commercial reproduction of candidate COVID vaccine Ad26.COV2-S.

Aspen Pharmacare will do the formulation, filling as well as secondary packaging of the vaccine. After which it will be supplied to Johnson & Johnson.

COVID-19 Vaccine

The fine print of the agreement, including the terms of manufacturing, is yet to be concluded. Further, the technology transfer required to complete the successful implementation of the deal has not yet been finalized.

The manufacturing will be done at one of Aspen Pharmacare’s sterile facilities, which has the capacity to produce 300 million doses per annum, located in Port Elizabeth, South Africa.

Currency, the proposed vaccine is undergoing clinical trials.

To date, Aspen has poured in over $3 million of investment to prepare the …

Education Business

Exeo capital, an African alternative investment firm, has acquired the Pearson Institute of Higher Education. The acquisition, a joint initiative between EXEO Capital and Stellenbosch Graduate Institution, is set to widen availability and access to higher education in Africa, particularly South Africa.

Person Institute Of Higher Education operates across 12 separate campuses in South Africa covering over 7000 students.

The institute of higher learning was formed through the union of CTI Education Group and Midrand Graduate Institution in 2010. The institution offers academic and career-oriented learning programs.

The investment aims to scale the operation of Pearson Institute within South Africa as well as expand into the pan African market.

The demand for higher education remains high given the rising population and increasing middle class in Africa. The investment firm projects that the business of education in Africa is anticipated to quadruple in the next ten years. They are …