- Libya joins Afreximbank and lines up mega projects to advance intra-African trade

- How Africa’s critical minerals is vital engine of regional growth and integration

- Strength in struggle: A Ugandan mpox survivor’s tale

- AFIS 2024: Here’s how we can grow Africa’s unicorns and gazelles

- African Energy 2024: Surging investment, waves of change

- AIM Congress 2025: Competition opens doors for Africa’s top tech innovators

- Zimbabwe rolls out $24M project to reduce use of mercury in gold mines

- Zambia secures $184M IMF support as economic growth set to decline to 1.2 per cent

Opinion

- To vastly increase the number of gazelles—and by extension, the likelihood of unicorns—stakeholders must work together to overcome existing barriers.

- Under ideal circumstances, gazelles—fast-growing companies essential for economic growth and employment—can mature into unicorns.

- To get unicorns, however, the key lies in cultivating gazelles first. Across Africa, there is a clear need to focus on the imperatives that can drive this transformation.

Gazelles. Camels. Elephants. In the language of venture capital, we have a full menagerie to describe a startup’s growth progression. However, in the past decade, the ultimate aspiration remains the unicorn: privately held companies valued at over $1 billion.

Globally, there are approximately 1,200 unicorns across various industries, and while Africa’s list is smaller, it is growing. As of February 2023, the seven identified African unicorns predominantly operate in the fintech and digital sectors, addressing payment challenges across the continent.

For many startups in Africa, achieving unicorn status …

- Majority of 2024’s capex was driven by established producers like Angola and Nigeria.

- Senegal is an example of how operator-friendly policies, political stability, and vast reserves can attract foreign investment.

- Africa holds nearly 18 trillion cubic meters of natural gas reserves, which will prove essential for a just energy transition.

I’ve said for years that African energy is a vital investment. Backers clearly agree — to the tune of $47 billion. That’s how much capital expenditure (capex) 2024 saw in African oil and gas, showing a 23 per cent increase from last year. Better yet, we expect growth to continue through the end of the decade.

This capex activity is a welcome sign that energy majors are deepening their long-term interests in Africa. And as our 2025 State of African Energy report details, their momentum has created unique opportunities for local communities, indigenous companies, and national oil companies (NOCs) from …

- Transition finance is funding dedicated to decarbonizing hard-to-abate and emissions-intensive sectors, such as steel and cement manufacturing.

- Companies in these sectors must prepare for an orderly transition, as failure to act will bring immense risk in a decarbonizing world economy.

- Nurturing a thriving transition finance market is critical to mitigating systemic economic and financial risks.

The transition finance market provides a unique opportunity for Africa to leapfrog to low-carbon technologies and business models, which will address climate risks and enhance the continent’s global competitiveness.

Though lacking a universal definition, transition finance refers to funding dedicated to decarbonizing hard-to-abate and emissions-intensive sectors, such as steel and cement manufacturing.

It is key to overcoming financial barriers to sustainability in the industries essential for economic development yet major contributors to greenhouse gas emissions. Companies in these sectors must prepare for an orderly transition, as failure to act will bring immense risk in a …

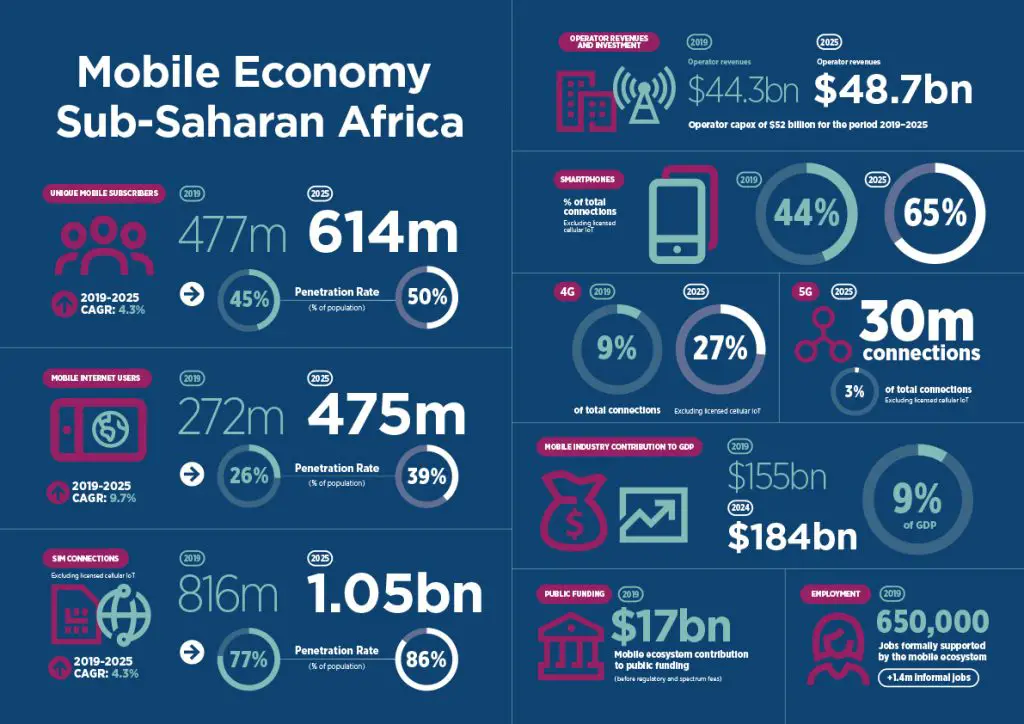

On the 1st of October 2020, the Global System Mobile Association (GSMA) released their “Mobile Economy Sub-Saharan Africa” report which forecasted the mobile economy in Africa into 2025.[1] A positive outlook to start the month of October and the last quarter of 2020.

The highlight of this forecast is that by 2025, even with 1.05 billion sim connections and 614 million unique mobile subscribers and smartphone adoption reaching 65% of the total population, only 39% of Africans would be experiencing their mobile web on those smartphones. This seems to suggest that even though there would be exponential smartphone growth over the period the cost of connectivity may be a showstopper. That’s not necessarily the case because there’s more happening than meets the eye.

The Mobile Network Operators (MNOs) are going to spend collectively about $52 billion on infrastructure between now and 2025 and this would grow their revenues …

On Oct. 1, 1960, everything seemed possible for Nigeria: After nearly 80 years of colonialism under Great Britain, it was finally an independent nation.

During the newly independent nation’s earliest days, there was every reason for Nigerians to envision a bright future for themselves and their country, one in which Nigeria’s vast oil and gas reserves would deliver widespread prosperity. One of stability and growth.

Tragically, Nigeria’s story moved in a different direction. Yes, there was a brief period of economic growth, but that was followed by multiple coups, civil war, military rule, corruption, and poverty. Instead of helping everyday Nigerians, the country’s oil wealth went to an elite few in power while leaving communities, particularly those in the Niger Delta, to deal with environmental degradation and dwindling means of supporting themselves. Instead of using its oil revenue to strengthen other sectors and diversify the economy, Nigeria has made oil

Business success is perceived differently today. Buzzwords like maximization, venture-backed, growth hacking, and well-conceived exit strategies (like IPOs or acquisitions) define entrepreneurial success in the current age. In a mad rush to show high quarter-on-quarter growth rates, corporate leaders have forgotten that the true value of a business is how long it stays relevant in the market and instead focus solely on transient growth spurts even if they cost profits.

Any business, no matter how big its initial success, needs to take a long-term approach if it’s to avoid being one of history’s almost-rans. This applies to every aspect of the business, including, people, products, and customers.

Invest in People

When you are a new company working on developing deep tech, discovering talent and retaining them is a challenge. Try to create and slowly nurture a pool of capable workers who will gain domain expertise over time. At Zoho, in …

In 2020, remote working finally became normal everywhere. Analysts and thought leaders had predicted that this would happen “soon” for the past 25 years, but it took a global crisis for it to materialize.

Since March, people in many professions have gotten increasingly used to working from outside their offices.

Before the pandemic hit, many employers were loath to give their staff that flexibility, especially for extended periods of time. With Covid-19, that changed overnight. Even the most diehard bosses have now given in and allowed people to work from home or remotely.

One key realization, captured in many memes, was: “Wow! all those meetings could actually have been emails!”.

Online meetings had already become generally accepted as a more efficient alternative to most in-person meetings. Many of us had even come to cherish the online format, as they tend to be shorter and more to the point than those …

“Flatten the curve.” Do you remember that phrase? It was on everyone’s lips back in the spring, when the novel coronavirus (COVID-19) pandemic began rampaging across the world in earnest.

At the time, the idea was that the best way to combat the germ known as SARS CoV-2 was to go home and stay there long enough for hospitals, clinics, and other medical facilities to build up the capacity needed to handle the expected flood of new patients. Most of us expected that this departure from routine would be a temporary thing. We hoped it wouldn’t last long — that we’d be able to return to our normal routines after a brief disruption, with confidence that all necessary safeguards were in place.

Of course, it didn’t turn out that way. We spent far more time than we expected sheltering in place, unable to visit friends and family, attend school, or …

On 9th September 2020, US-based blockchain investor, Digital Currency Group (DCG) bought Naspers-backed South African cryptocurrency exchange Luno[1] and Transactions Capital, which took a $109M position in WeBuyCars also from South Africa.[2] According to Bloomberg, WorldRemit acquired Soundwave for $500M on 25th August 2020.[3]

In late July, Network International, a Dubai-headquartered enabler of commerce bought Africa’s leading online commerce platform, DPO Group, for $288M.[4] But it all started in January when Circles Gas acquired KopaGas’ proprietary technology for $25M.[5] These are signs of the times – the EXITS are finally here. But it been a long time coming since 1999 when Mark Shuttleworth had the first exit of selling Thawte to Verisign for $575M.[6] Since then, there have been spates of private equity or “financial exits”, like Visa’s acquisition of Fundamo for $110M,[7] and others that have not being disclosed. The …