- Russia and Tanzania unite to double trade, boost Africa market access

- History as Janngo Capital seals Africa’s largest gender-equal $78M tech VC fund

- South Africa Budget Disappoints Investors as Deficit Widens

- Kenya drops to 6th place in Africa trade barometer

- Tanzania’s bold move to boost cashew nut exports by 2027

- Chinese cities dominate global list of places occupied by billionaires

- Sudan tops up as Africa aims for $25 billion development fund

- Opportunities for youth: Tech firms Gebeya and NVIDIA to train 50,000 developers in Africa

Browsing: Africa

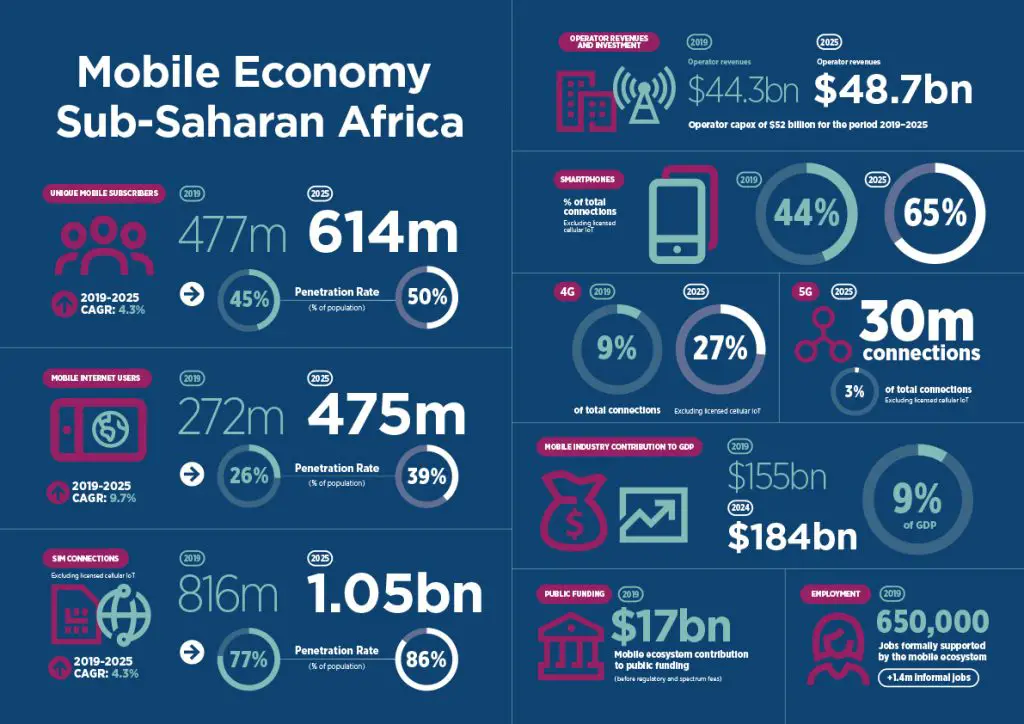

On the 1st of October 2020, the Global System Mobile Association (GSMA) released their “Mobile Economy Sub-Saharan Africa” report which forecasted the mobile economy in Africa into 2025.[1] A positive outlook to start the month of October and the last quarter of 2020.

The highlight of this forecast is that by 2025, even with 1.05 billion sim connections and 614 million unique mobile subscribers and smartphone adoption reaching 65% of the total population, only 39% of Africans would be experiencing their mobile web on those smartphones. This seems to suggest that even though there would be exponential smartphone growth over the period the cost of connectivity may be a showstopper. That’s not necessarily the case because there’s more happening than meets the eye.

The Mobile Network Operators (MNOs) are going to spend collectively about $52 billion on infrastructure between now and 2025 and this would grow their revenues …

illicit capital flows

Curbing illicit capital flows could almost cut in half the annual financing gap of $200 billion that the continent faces to achieve the Sustainable Development Goals according to UNCTAD’s Economic Development in Africa Report 2020.

The report titled “Tackling illicit financial flows for sustainable development in Africa,” notes that every single year an estimated $88.6 billion, equivalent to 3.7 per cent of Africa’s GDP, leaves the continent as illicit capital flight.

According to the report, Illicit financial flows (IFFs) are movements of money and assets across borders which are illegal in source, transfer or use. The outflows include illicit capital flight, tax and commercial practices like mis-invoicing of trade shipments and criminal activities such as illegal markets, corruption or theft.

As per the average for 2013 to 2015, the outflows are nearly as much as the combined total annual inflows of official development assistance, valued at $48 …

The World Business Angels Investment Forum announced the African Development Bank as its newest Board Member.

The bank will represent Africa’s early-stage equity markets, angel investors, entrepreneurship and startup ecosystems, small and medium enterprises and high-growth businesses and private equity funds.

The African Development Bank Director of Industrial and Trade Development, Abdu Mukhtar will occupy the bank’s board seat.

“We are delighted to have the African Development Bank Group as a global board member of the World Business Angels Investment Forum. I am confident that by including AfDB, WBAF will be able to provide a wide range of opportunities for start-ups, scaleups and high growth businesses in Africa—ones that will open the doors for economic development. By working together across borders, with a common vision, and with these smart dynamics in mind, we are well placed to bring about positive change in Africa and the global economy.” Said Baybars Altuntas, …

Africa is big! Africa is growing and is projected to be more populous than it is now. Estimates indicate that nearly 2.8 billion people will inhabit Africa by 2060, according to the World Bank.

The high population could impact African countries depending on each respective country's reaction toward overpopulation and urbanization.

A crucial factor in this is land. To be more specific, urbanization of African economic hotspots ought to be analyzed effectively, because Africa is not open to the world as it supposed to be.

Not only that, but African cities are changing fast, and Africa requires a robust approach which is close to fool-proof to push the region towards sustainable development.

In this case, the Organization for Economic Co-operation and Development (OECD) report on Africa’s Urbanisation Dynamics 2020 enlightens the perspective quite vividly.

Kenya had more urban dwellers than the entire

It is nature that is going to save us, yes, nature.

The rich arable lands of Tanzania, the recycling business potential in Nigeria and Kenya, and the sustainable-architectural business models in Rwanda and South Africa are few angles that the World Economic Forum (WEF) finds to be vital in channeling better economic solutions and resilience.

This thinking-approach emanates from the second report (of three), The Future of Nature and Business by the WEF which provides practical insights necessary to steer economies around the world towards a nature-positive economy.

It is safe to say the Coronavirus (COVID-19) pandemic has given rise to a lot of ideas towards rethinking and developing sustainable economy approaches.

As job losses and economic uncertainty hurt economies and livelihoods, nature-centred economic approaches seem to carry the necessary incentives to accommodate the global community’s needs.

“As governments and businesses look to stimulate growth, a new

VUCA (Volatility, Uncertainty, Complexity and Ambiguity) in Sub-Saharan Africa presents challenges to doing business that are distinct and unique to each market in the region. Such issues as political and economic risk which affect business decisions and hamper business growth in some climes, language barriers and cultural distinctions which affect communication and understanding in trade and currency value disparities all create opportunities for solutions through strategic government relations.

Also Read:Coveting larger markets: Ethiopia’s bid to join WTO

Forbes®, in defining the meaning of the acronym, explains that ‘Volatility’ refers to rate of change at a market or global scale. The more volatile the market is, the higher its chances of change. ‘Uncertainty’ deals with the level of confidence with which the future can be predicted. Where the market situation is uncertain, there is greater difficulty to predict and anticipate a market shift. ‘Complexity’, which refers

Africa’s labour pool is uniquely made up of various sections, the most dominant one being the informal sector—encompassing the most human capital, catering for most young-population livelihoods and it is highly un-attended—in terms of proper management and regulations by governments across the region and there is substantial evidence to back this claim.

According to a 2018 publication by the World Bank Understanding the informal economy in African cities: Recent evidence from Greater Kampala, the informal sector accounts for huge employment in African cities, marking 86 per cent of total employment in sub-Saharan Africa according to the International Labor Organization estimates (ILO).

“With a pervasive informal sector, city governments have been struggling with how best to respond. On the one hand, a large informal sector often adds to city congestion, through informal vending and transport services, and does not contribute to city revenue,”

Nature hurts economies, and if such economies are not well equipped to handle the aftermath of flooding, famine, water scarcity, or food insecurity—the more shocking realities are bound to come.

Climate change is real and it hurts African economies, and the region is being slapped with a heavy price to pay, amid its struggle to mark sustainable development.

According to a 2018 report by The Conversation, in the same year—almost 10,000 homes were wiped off the ground by floods, displacing nearly 2 million people in Africa up to September 2018.

In East Africa, Tanzania losses nearly $2 billion in damage from floods according to a report published by Nature Climate Change in 2017.

As the least emitter of greenhouse gases, Africa stands to lose a lot in this battle, with climate action funding coming in short and countries such as the United States of America and China tiptoe on taking …

African businesses are shifting towards new technologies in response to the ongoing pandemic, according to a new report published by the United Nations Economic Commission for Africa (UNECA).

The UNECA and the International Economics Consulting Ltd jointly published the report which is the second comprehensive survey on the COVID-19 pandemic and its economic impact across Africa, according to UNECA.

The online survey was conducted from June 16 to July 20 to provide insights into the effects of the pandemic on economic activity for businesses across the region. The survey mainly identified challenges encountered by African businesses as well as their responses to mitigate the adverse impact of the pandemic.

According to the report from the survey among the top three challenges faced by African countries during the pandemic are reduced opportunities to meet new customers drop in demand for products and services, as well as lack of cash flow.

“Companies …

Across the continent to West Africa where we find one of Africa’s largest economies, Nigeria. Here we find another railway deal gone bad, the $500 million Lagos – Ibadan railway.

In a similar manner to Kenya’s SGR debacle with China, which resulted in Kenya sinking heavily into debt that it simply cannot afford to pay and restructure, Nigeria is now finding a similar fate.

According to the country’s Director General for Nigeria’s Debt Management Office (DMO) Patience Oniha, when making a deal with China, ‘…the Chinese determine the cost of projects, give us loans tied to the projects and the projects must be executed by Chinese firms alone.’

It is alleged that not only does China force importation of even the smallest of laborers but also all the equipment and guess where they are imported from? Yes, China.

It is further argued that by so doing, China is using these …