- African Energy 2024: Surging investment, waves of change

- AIM Congress 2025: Competition opens doors for Africa’s top tech innovators

- Zimbabwe rolls out $24M project to reduce use of mercury in gold mines

- Zambia secures $184M IMF support as economic growth set to decline to 1.2 per cent

- Equity enters alliance with ODDO BHF to spur Europe-Africa investments

- Air Tanzania hits turbulence: Can the airline fly back to EU skies?

- Ghana’s President Elect John Mahama Outlines His Economic Blueprint

- AfDB backs “green shares” funding model with $30M AFC equity boost

Browsing: Mobile money

Pyypl uses advanced Artificial Intelligence (AI) and Machine Learning (ML) for regulatory compliance, Anti Money Laundering (AML), and Counter-Terrorism Financing (CTF).

The platform also conducts real-time Politically Exposed Persons (PEP) and sanctions (both country and individual) screening against the latest and historical UNSC, USDT, FATF, OFAC, and EUCFSF records, as well as all local databases.

Fintech startups in Africa have continued to gain a lot of attention from investors who have been pouring billions of dollars to support the industry. …

Safaricom has a network of partners whose collaboration allows subscribers to send and receive money from more than 200 countries and territories.

The launching of the M-Pesa supper app has also enabled its users to operate mobile money transfer easily and securely making it rise faster in the African continent.

For instance, access to financial services and products in Kenya grew by an astonishing 56 per cent between 2006-2019 due to the availability of the mobile money services . M-Pesa has been credited with lifting at least two per cent of Kenyan households out of extreme poverty.…

Airtel Network Kenya, the second biggest telecommunications network, saw shareholder loans from its holding firm, Bharti Airtel Kenya BV, rise by 12.01 per cent from sh46.6 million in 2020 to sh52.2 million in the year ending December 2020.

The causes of the financial losses have been additional lending, forex losses as the shilling depreciate, and postponement in paying interests.

Capitalization interest due to being paid stands at Sh1.34 billion, which has disrupted cash flow in the firm.

Airtel Kenya said that the issued shareholder funds, revenue generated from its operations, and borrowing from external lenders had kept the company afloat.…

- Mobile money is growing fast in East Africa

- Despite of the pandemic, still mobile money regulators enabled its performance

- Financial technologies are changing the way unbanked populations access finance services

Mobile money is still king in Africa and will be so for long. With more than 548 million (up 12 per cent) registered accounts attached to a 27.4 billion transaction volume worth $490 billion, Africa stands to draw billions from mobile money and transform its economies significantly (GSMA 2021).

Thanks to financial technology (fintech) which has accelerated financial inclusion in sub-Saharan Africa, now more than ever, the unbanked population in rural areas of Africa can access financial services seamlessly, even during the coronavirus pandemic’s harsh times.

Today fintech technologies are challenging traditional financial services, particularly banks in Africa. This has forced banks to adapt to the new game brought by fintech aggregators, including fusing their services to mobile services and

The government amended the Electronic and Postal Communication Act (CAP) last month by imposing a levy of between US$0.0043 (10Tsh) and US$4 on mobile money transactions, depending on the amount sent and withdrawn.

One of the key factors that led to the expansion of mobile money in Africa and Tanzania, in this case, was the increased interoperability, product expansion—which brought financial inclusion to enable nearly everyone with decent income-earning schedules to own a mobile wallet account.…

Airtel Uganda and KCB Bank Uganda announced a partnership to introduce a variety of mobile loans and savings solutions in Uganda.

From the partnership, its customers will earn interest on savings of five percent per annum on regular savings and 9 percent per annum on fixed deposits.

The automated digital products include Regular Savings, Instant Unsecured Mobile Loans and Fixed Deposit Savings Accounts that will allow its customers to borrow mobile loans from as low as UGX300 (KSH 9.15). Airtel Money Agents will be able to get unsecured loans at UGX300 interest only while KCB and Airtel customers can earn up to 9 percent interest on mobile savings.

The partnership is set to revolutionize savings in Uganda by providing the best interest rate in the market.

“Most of our customers are unbanked with limited or no access to financial products especially saving deposits. By offering competitive interest rates in an …

Ethio- telecom launched a service called ‘Telebirr’ as it seeks to boost growth by offering cashless transactions in Ethiopia.

Telebirr will allow ethio-telecom’s customers to send, store and receive money using their phones. The mobile money service aims to extend mobile services to areas that have been financially excluded.

With just 19 commercial banks which serve a population of 115 million, Telebirr will bridge the financial gap to those who do not have access to banks in Ethiopia.

The CEO of Ethio telecom, Frehiwot Tamiru said that within its first year of operations, the telecom plans to recruit 21 million users and 33 million in five years. She added that by the end of the five years, Ethiopia’s annual economic output of about 40 to 50 percent will be transacted on the platform.

The telecom has 1600 agents onboard already and will increase to more than 15,000 within 12 …

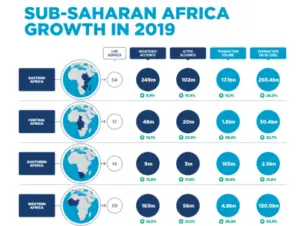

East Africa is a global leader of mobile money with the highest penetration of mobile money in the world according to a report by the African Union in collaboration with the Organisation for Economic Corporation and Development.

The joint report is titled; Africa’s Development Dynamics’ authored by the African Union (AU) in collaboration with the Organisation for Economic Corporation and Development.

Mobile money services are provided by telecommunication companies and supported by a network of licensed agents that allows registered users to deposit and withdraw cash in a virtual wallet.

According to data from the report, for every 1,000 adults, the East Africa region has 1,106 registered mobile money accounts compared to 600 for the whole of Africa, 533 and 245 for Asia, Latin America and the Caribbean respectively.

The penetration is higher in the region with most adults subscribers owning one or more mobile money accounts.

According …

Banks continue to fill the impact of mobile money as it eats into their asset quality and profits despite partnering with telecoms.

According to a 2020 banking sector analysis report by Summit Consulting, increase in mobile money deposits has a negative connection to banks’ return on equity defined as the ability of a firm to generate profits from its shareholder’s investments in the company.

“High volume of mobile money transactions discourages customers from depositing with banks due to convenience,” the report read in part.

Accessibility and convenience of the telecom hosted platform have been boosted by the increase in the number of mobile money agents making it more attractive to the 27.9 million subscribers.

Deposits of mobile money accounted for 37.7 per cent of the slump on return on equity and deny banks of adequate deposits for investment, as most banks get money from customer deposits, which they lend out …

MTN Uganda recorded a 9.1 per cent increase in net profit to about $120.47 million for the first six months of 2020, according to the company’s latest interim results.

According to the report, the strong performance of mobile money, data and digital income attributed to the performance.

MTN Uganda overall revenues grew by 7.6 per cent to about $244.97 million in the six months while data incomes saw a 30 per cent growth from about $34.84 million to about $45.45million.

The company’s mobile money which has been another cash source grew by 6.5 per cent to about $58.25 million as its active mobile money subscribers hit 7.4 million an increase from 7.3 million.

Meanwhile, its Voice revenues grew from about $124.67 million to about $128. 2 million as the company reported a 10 per cent growth in subscriber base to 13.2 million, up from 13 million last year.

The number …