Trending

- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

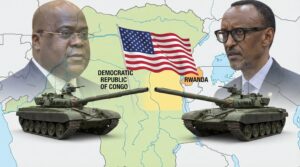

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions