- In 2025, wars, coups take the shine off Africa’s next investment frontier destination appeal

- Who got the money and who didn’t in Africa’s 2025 race for foreign direct investments?

- AI’s Dual Capacity and a Strategic Opportunity for African Peace and Security

- How African economies dealt with the 2025 debt maturity wall

- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

Author: Martin Mwita

Martin Mwita is a business reporter based in Kenya. He covers equities, capital markets, trade and the East African Cooperation markets.

Tala, the leading consumer lending app in emerging markets, has disbursed loans to over 2.5 million customers globally, in the wake of continued global expansion of financial technology. READ:Kenyan fintech companies brace for sectors’ revolution This was revealed on Monday during the celebrations to mark the company’s five year anniversary in Kenya. When Tala, formerly Mkopo Rahisi, was launched in Kenya in 2014 becoming the first in the world to offer unsecured mobile loans direct to consumers. Since then, Tala has expanded credit access across Kenya by using alternative data to instantly underwrite and disburse credit to people who have…

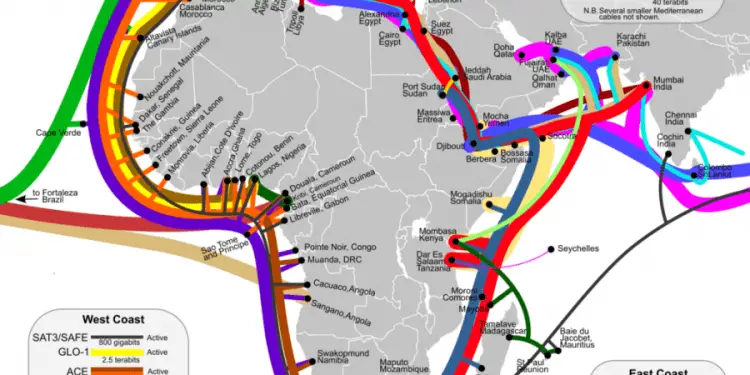

Pan-African telecoms enabler SEACOM has further extend its corporate market offering into the East African region, under its Seacom Business brand, by providing its industry-leading Internet connectivity and cloud services directly to corporate customers in Uganda. SEACOM has been a leading data connectivity provider in Uganda enabling access though the service provider segment. READ ALSO:SEACOM and Microsoft to boost connectivity in Kenya It is now bolstering its presence in Kampala by expanding its enterprise reach and will now be able to provide corporate organisations in Uganda with reliable data connectivity and cloud services. SEACOM will provide a corporate-grade consistent service quality by leveraging…

ATZ Law Chambers, the Africa Legal Network (ALN) member firm in Tanzania has rebranded to A&K Tanzania, in its quest to expand its services in the country and the region. Anjarwalla & Khanna (A&K) Tanzania has taken over the practice of ATZ Law Chambers in the new move. The firm’s core leadership team will now include Partner, Geofrey Dimoso and Director, Shemane Amin who joined in April and February respectively. “Driven by the firm’s vision to complement its robust local practice with the capability to service clients regionally and in recognition of the value that our clients have gained as…

Bolt, the leading European on-demand transportation platform has launched ‘Bolt for Business’, a plan that allows companies to manage and pay for all corporate trips from one central location. On the new Bolt for Business portal, account managers can set up company-wide rules and control when and who can use business trips, making it simple to budget for and get a clear overview of the company’s transportation expenses. The platform also enables the corporate to set and customise the spending allowances and the number of trips employees can take. It is also possible to require employees to report the purpose of…

Trading at the Nairobi Securities Exchange (NSE) more than doubled this week compared to the previous week, as the market recorded increased investor activities. Week on week turnover rose Ksh3.7 billion (US$36.3 million) on 102 million shares traded against 51.8 million shares valued at Ksh1.3 billion (US$12.8 million) transacted the previous week. During the week’s trading which closed on Friday, the NSE 20 share index was up 6.32 points to stand at 2706.78. All Share Index (NASI) shed 0.35 points to settle at 150.12 while the NSE 25 Share index lost 11.08 points to settle at 3637.98. Banking Sector The…

The Kenya Bureau of Standards (KEBS) has initiated Kenya Quality Award (KQA), a scheme aimed at promoting and entrenching a quality culture amongst Micro, Small and Medium Enterprises (MSMEs) in Kenya. This comes in the wake of increased efforts to improve the quality of local products to meet international standards, which will help Kenyans manufacturers and producers increase Kenyan exports to foreign markets. The move is also as a strategy to prepare local businesses to tap into the Africa Continental Free Trade Area which is slowly taking shape. READ:What Africa stand to gain from ACFTA Designed to recognize MSMEs striving to…

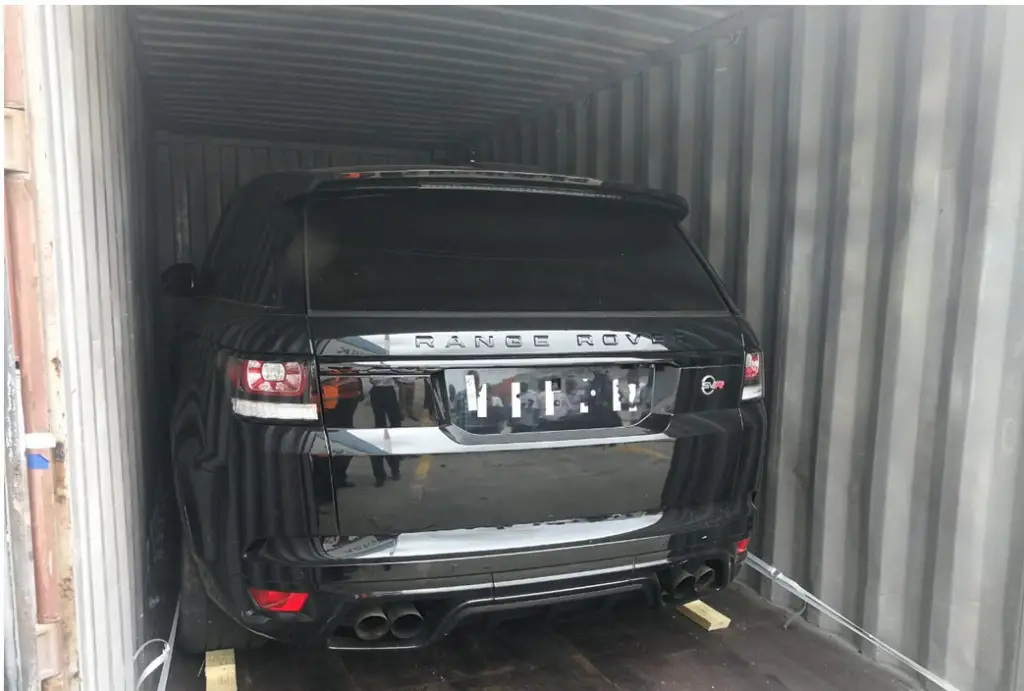

Kenyan authorities have unearthed an international car smuggling racket targeting the East Africa region, one in many that have been busted in recent times. On May 9, 2019, Customs officers in Mombasa received intelligence to the effect that two 20-foot containers on board a ship sailing to the Port of Mombasa was suspected to be stolen motor vehicles from the United Kingdom. The containers arrived at the Port of Mombasa on May 11, 2019 aboard MV. MSC Positano from Oman and had not been declared. Authorities subjected the two containers to x-ray cargo scanning where the images revealed the presence of…

Six months after hosting the first global conference on ‘Sustainable Blue Economy’, Kenya is keen to invest in international shipping, as it remains focused on tapping its maritime resources for economic growth. The government has set-off a number of initiatives that could see the country reap big from the maritime industry, which drives 92 per cent of its international trade. Policies, institutional changes, incentives and funding are being put in place to optimize gains in the sector, which has the potential to contribute up to Ksh500 billion (US$4.9 billion) to the GDP annually. READ:Kenya’s Maritime Transport Policy takes shape Shipping industry …

Barclays Bank (Kenya) has registered a flat growth in profit for the first quarter of 2019 as ongoing rebranding to Absa continues to impact its balance sheet. The Nairobi Securities Exchange (NSE) listed lender has reported a Ksh1.89 billion (US$18.7million) net profit for the period under review, a marginal 0.5 per cent growth compared to Ksh1.88billion (US$18.6million) posted in a similar period last year. READ:Barclays Bank Q1 profit up 8% despite squeeze on loan book This is despite gains on interest earnings and reduced expenses during the quarter. Quarterly results published through the NSE shows total interest income edged up…

KCB Group shareholders have approved the proposal to acquire 100 per cent of the issued ordinary shares of National Bank of Kenya Limited (NBK) via share swap. This approval follows the offer made by KCB Group on April 18, 2019 to acquire the shares of struggling NBK by way of a share swap of 10 ordinary shares of NBK for every one ordinary share of KCB. The transaction is subject to regulatory and NBK shareholders approvals. The acquisition is part of KCB’s ongoing strategy to explore opportunities for new growth while investing in and maximizing the returns from its existing…