- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

- From banking to supply chains, here’s how blockchain is powering lives across Africa

- Modern railways system sparks fresh drive in Tanzania’s economic ambitions

Author: Martin Mwita

Martin Mwita is a business reporter based in Kenya. He covers equities, capital markets, trade and the East African Cooperation markets.

When the African Union announced Agenda 2063 in 2015, it was touted as Africa’s most ambitious road map yet. It pledged a prosperous, democratic and peaceful continent, under the guiding spirit of “The Africa We Want,” as part of the Pan-African vision. The vision was bold. The continent would, by 2063, be linked together by high speed rail, trade freely with each other as a single market, and power Africa’s cities from renewable energy from mega-projects such as the Grand Inga Dam. But a decade later this dream is facing its sternest test, war. From Sudan’s civil war to the…

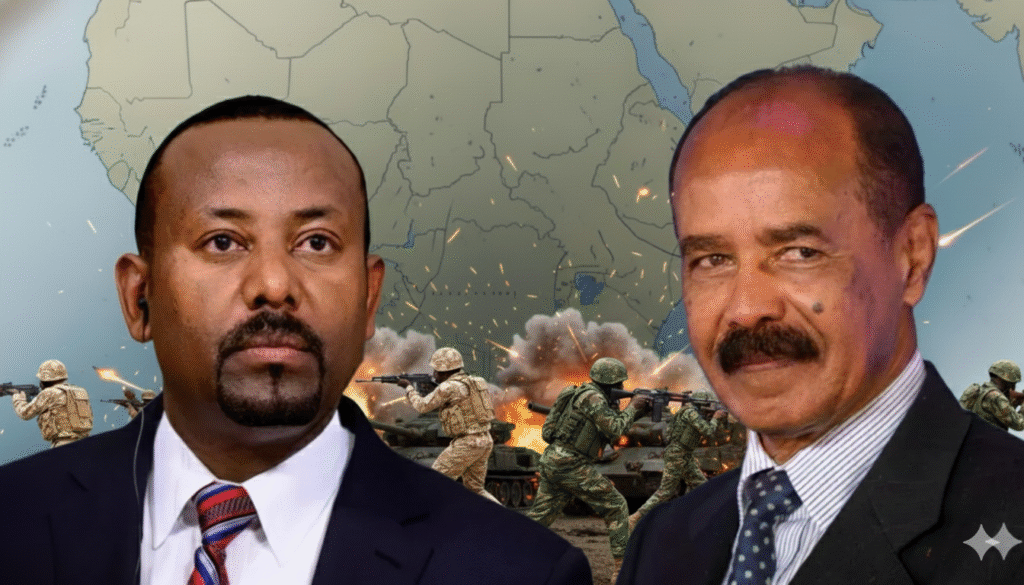

Resilience, revolution and rivalry have long marked the Horn of Africa, a region that is home to more than 160 million people. At the center of this tension is one of the continent’s longest and most tortured standoffs: Ethiopia vs. Eritrea. This border war, a product of colonial lines and further stoked by ideology, nationalism and geopolitics, still influences not only the respective fates of Addis Ababa and Asmara but also the distribution of power in the Red Sea corridor. By 2025, as undercurrents of tension bubble up again, the world is reminded that the rupture is not yet healed.…

When the United States rolled out a June 27, 2025 Washington ceremony to display a breakthrough between both the Democratic Republic of the Congo and Rwanda, it was easy on the ears and broad in scope: Pull back troops. Cut ties with proxy militias. Chill the front lines in the mineral-rich east. Unlock investment and rebuild lives. For a moment, it seemed that DR Congo Peace could be within reach. Now, just four months later, that promise has crumbled in the face of realities on the battlefield and with missing enforcement tools and against the cold calculus of a war…

In Kenya, off-grid solar power is a game changer in rural parts of the country where main electricity transmission lines are yet to reach. Across rural homes, locals are tapping sun energy provide clean drinking water without the high costs of diesel pumps that often worsen air pollution. Solar power is also being used in clinics, improving medical care, including providing services during the day and emergency treatment at night. Kenya has made significant progress in driving the adoption of solar power as part of a broad strategy to enhance the country’s switch to green energy. The East African country…

Last year, the mining sector suffered 6.5% contraction, attributable to a dip in production of titanium and soda ash minerals. Overall, Kenya’s total earnings from minerals dropped by 4.3% to $261.7 million in 2023. A further dip could be in the offing as Base Titanium, which accounts for 65% of total mineral exports, is set to cease mining operations December. The challenges gripping Kenya’s mining sector are set to worsen this December when Base Titanium, arguably the biggest miner in the country closes shop following the depletion of minerals at its focus area, Kwale County. Base Titanium’s closure is expected…

In this article, we will explore the top-rated replica Breitling watches that offer an authentic look, precision, and exclusivity. Here you can find various series of fake watches, best assurance, and fast delivery. The largest & most trusted name to buy ultimate Rolex replica watches. Best selection, Free shipping, paypal payment only at Replica Valley online store. EABL recorded strong topline and operating profit growth in a challenging market. Net sales totaled $958.3 million, up from $846.3 million in the FY ended June 2023, as the brewer defied tough macroeconomic conditions and evolving microeconomic factors. Profit after tax dropped to $84.2 million, down from…

Growth attributed to increase in Foreign Direct Investment (FDI), which increased by 11.6 per cent from $8.2 billion at the end of 2020, to $9.2 billion. The stock of Other Investment (OI) liabilities increased from $4.9 billion in 2020 to $6.2 billion in 2022. Similarly, Portfolio Investment (PI) rose from $253.4 million to $266.4 million in 2022. The OI liabilities accounted for 39.2 per cent of total foreign liabilities in 2022, and were mainly in the form of loans, and currency and deposits. Kenya’s foreign liabilities Europe and Africa account for the biggest share of Kenya’s foreign liabilities mainly Foreign…

In the first three months of this year, Asia remained the leading source of Kenya’s imports accounting for goods worth $3.4 billion, as the country’s import bill closed the quarter at $5.4 billion. Kenyan traders and government imported goods worth $990.2 million from China, data by the Kenya National Bureau of Statistics (KNBS) shows, making it the biggest import source by country. Unlike his predecessors, President Ruto is seen to lean more towards the West as he seeks financing and trade cooperation. Kenya’s imports from Asian countries including China China and India remained the top exporters to Kenya in the…

Business confidence slips to lowest since February Input prices rise mildly after back-to-back declines Steepest drops in activity and new work for seven months Kenya’s business activity dips amid tax revolt Kenya’s business activities fell sharply in June amid reports of widespread economic challenges and a negative impact on sales from protests and policy uncertainty, the Standard Bank’s Purchasing Managers’ Index (PMI) for June indicates. New business intakes dropped at the fastest rate since November last year, leading to a drop in business confidence and weaker job creation. Although Kenyan firms also saw a renewed increase in their input costs…

The transaction marks the successful outcome of BII and I&M’s equity partnership for over 7 years as AfricInvest takes over. The institution said that the sale to a like-minded investor is one of the most significant transactions in East Africa in recent years and represents a vote of confidence in the region’s financial services sector. It is listed on the Nairobi Securities Exchange, and the Rwandan subsidiary I&M Bank Rwanda PLC is listed on the Rwanda Stock Exchange. British International Investment (‘BII’) British International Investment (‘BII’), the UK’s development finance institution and impact investor, has sold its 10.1 per cent…