- AI’s Dual Capacity and a Strategic Opportunity for African Peace and Security

- How African economies dealt with the 2025 debt maturity wall

- Africa’s Green Economy Summit 2026 readies pipeline of investment-ready green ventures

- East Africa banks on youth-led innovation to transform food systems sector

- The Washington Accords and Rwanda DRC Peace Deal

- Binance Junior, a crypto savings account targeting children and teens debuts in Africa

- African Union Agenda 2063 and the Conflicts Threatening “The Africa We Want”

- New HIV prevention drug is out — can ravaged African nations afford to miss it?

Author: Martin Mwita

Martin Mwita is a business reporter based in Kenya. He covers equities, capital markets, trade and the East African Cooperation markets.

Equity Group Holdings was the day’s main feature with 2.3 million shares traded The week’s trading at the Nairobi Securities Exchange (NSE) opened on a modest pace marked by low volumes and value of shares. The bourse opened the week with a total of seven million shares valued at Ksh219 million (US$2.2 million) against 9.3 million shares valued at Ksh249 million (US$2.5 million) posted on Friday. The NSE 20 share Index, which tracks blue chip companies, was down 15.38 points to stand at 2899.41. All Share Index (NASI) shed 0.58 points to settle at 157.33. Equally, the NSE 25 Share…

2018 profits dropped to US$6.1 million from US$18.8 million in 2017 Cement manufacturers-Bamburi Cement has expressed concerns over the Uganda-Rwanda border row, warning it could derail its earnings. This comes amid a drop in net profit for the year 2018, reported at Ksh614 million (US$6.1 million) down from Ksh1.9 billion (US$18.8 million) in 2017. “The difficulties experienced in the Uganda-Rwanda border have significantly impacted exports to Rwanda from Uganda and the Group hopes this matter is resolved expeditiously,” the company said in its financial statement signed by Chairman John Simba and Group Managing Director Seddiq Hassani. The Nairobi Securities Exchange…

The government expects private sector to contribute 60% of the development International property developers are angling themselves to tap into the housing projects in Kenya’s Big Four Agenda, a boost to President Uhuru Kenyatta’s ambition to deliver 500,000 units by 2022. This came out at the sixth East Africa Property Investment Summit (EAPI) held in Nairobi this week, where the government called on the private sector to support the projects, assuring them of offtake. An offtake assurance or agreement is a commitment between a producer and a buyer to purchase or sell portions of the producer’s future production. “We want to assure…

Diaspora transaction volumes rose to Ksh107 billion in 2018 Equity Bank’s Fintech innovation and digitization has powered rapid growth of Diaspora banking boosting the total revenue income by 38 per cent. Diaspora transaction volumes grew by 196 per cent to Ksh107 billion (US$1.06 billion) while the commissions recorded a 169 per cent rise from Ksh279 million (US$2.76 million) in 2017 to Ksh751 million (US$7.43 million) after the same period last year. The results came in the backdrop of a unique business model and strategy that creates resilience while managing headwinds of interest rate capping and challenging macroeconomic and business environment.…

Private capital remains an important driver of investment activity in much of Africa Office yields remained largely stable in most African markets over the past two years, anchored by patient domestic capital as local investors assume a longer-term perspective, a new analysis by Knight Frank shows. The analysis, published in a new Knight Frank report dubbed Africa Horizons, shows that of the 35 office markets covered, yield remained stable in 16 locations in the two years to 2018 and rose in six, while 13 markets recorded declines. Africa Horizons provides a unique guide to real estate investment opportunities on the…

Money Market Funds remain the largest Unit Trust Fund Unit trust fund investments in Kenya recorded a 4.3 per cent growth in 2018, latest industry data shows, as investors moved to deepen the capital markets and provide alternative funding for businesses. During the year, Total Assets Under Management (“AUM”) held by Unit Trust Fund Managers grew to Ksh58.0 billion (US$574.8 million) up from Ksh55.6 billion (US$551 million) recorded in 2017. This came as the money market funds continued to be the most popular product with the AUM held by Money Market Funds, having grown by 8.9 per cent to Ksh48.5…

Coverage of retirement schemes in Kenya remains below 50% Majority of Kenyans securing their old age by saving under retirement schemes are still exposed to tough times during sunset years, a survey has revealed. The study by pension fund administrator Zamara Group has revealed that though pension’s legislation in the country has improved the governance and operations of the retirement funds, it has done little to improve the coverage and adequacy of retirement benefits to individuals. Coverage of retirement schemes in Kenya has remained relatively low with less than 50 per cent of the formal sector covered and coverage of…

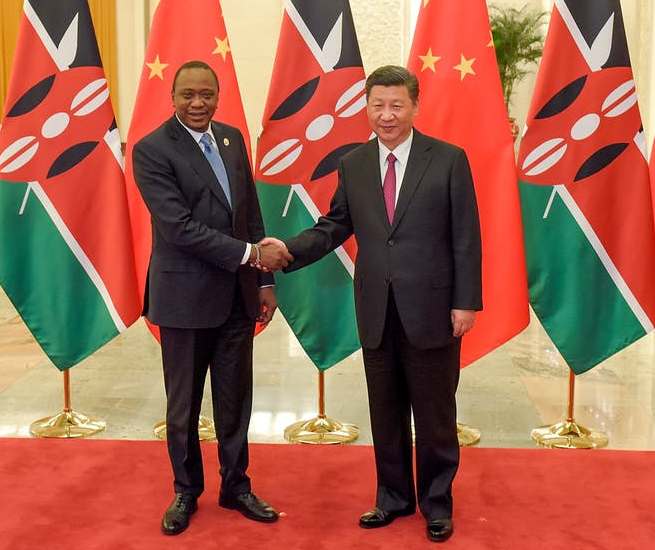

Loans from China hit a high of US$6.2 billion last year The Chinese government has dismissed claims that it’s continued heavy lending to Kenya in the financing of mega infrastructure projects is a ‘ debt trap’, even as loans from Beijing hit a high of ShUS$6.2 billion(Sh625.9 billion) in December last year. This is up from US$5.3 billion (Sh535 billion) a year earlier with a lion share going towards the construction of the multi-billion Standard Gauge Railway (SGR). “We are not putting Kenya into a debt trap. China-Africa corporation cannot put Africa into a trap but booming economic growth,” China’s…

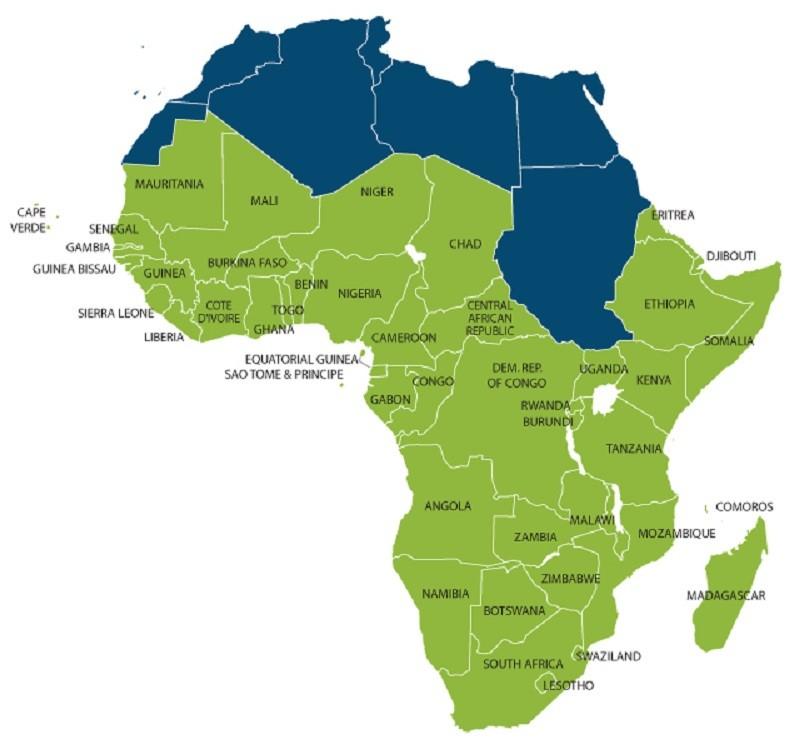

Three years past the crisis period, economies are still performing poorly The growth story in Sub-Saharan Africa in the past few years has been one of faltering recovery from the worst economic crisis of the past two decades. This remains the case according to the World Bank’s April 2019, 19th edition of Africa’s Pulse, which estimates GDP growth in 2018 at a lower-than-expected 2.3 per cent, with a forecast to 2.8 per cent in 2019. “Three years past the crisis period, we should be seeing a more widespread pickup in growth; instead we have downgraded our estimates again for 2018,”…

Mobile subscription in the country grew 6.2 per cent in the second quarter of 2018 A proliferation of mobile applications on popular online stores is exposing Kenyans to increased cyber attacks and fraud, a latest sector statistics report by the Communications Authority of Kenya (CA) has revealed. This comes in the wake of a fast growing mobile subscription in the country which grew 6.2 per cent in the second quarter of 2018(October-December). According to CA’s sector statistics report for the financial year 2018-2019, mobile subscriptions in Q2 grew to 49.5 million up from 46.6 million in the first quarter(July-September). Data…