- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Banking

- Kenyan Banks Hit by fresh $1.2 Billion Bad Loans in 2023 according to a new report by the Central Bank of Kenya

- The regulator says it is concerned by the sharp rise in bad loans and is working closely with lenders to mitigate the crisis.

- Kenyan banks hit by fresh $1.2 billion bad loans as global interest rates remained high throughout the year.

The high cost of living due to weak currency and shakeups in the global supply chain saw banks suffer an additional $1.2 billion (Sh150 billion) in bad loans in 2023, pushing the total to $4.98 billion (Sh651.8 billion).

The Banking Supervision Report by the Central Bank released Thursday shows the deterioration in banks’ asset quality was the highest in the past five years and almost 30 per cent compared to the previous year. The gross non-performing loans for 2022 were $3.85billion (Sh503.2 billion).

Non-performing loans were concentrated …

- Central Bank of Kenya says active mobile subscriptions hit 66.8 million by December 2023 compared to 65.7 million a year earlier.

- Increasing usage of mobile money saw the banking industry in Kenya experience a drop in the value of banking transactions via bank agents to $10.5 billion.

- Kenya is a trailblazer in the adoption and usage of mobile money across Africa.

A steady rise in the use of cashless transactions as well as the opening of 8,555 new mobile money agent shops in Kenya drove the value of mobile money transactions up by 13.8 percent to record KSh788.35 billion or $6 billion in 2023.

Kenya has been a trailblazer in the adoption and usage of mobile money across Africa since the launch of pioneer cash transfer platform M-PESA by Safaricom PLC in 2007.

“Amidst the increasing adoption of technology and the widespread use of mobile phones in daily life, coupled …

- Kenya’s bilateral loans data show that the Asian giant is still a major lender to Kenya mainly for the development of roads rails and port infrastructure.

- The country’s debt as of March 2024 comprised of $80.9 billion (Sh10.4trillion) comprising $40.5 billion (Sh5.2 trillion) domestic and same amount in external loans.

- In the past three months the strong shilling has come in handy in helping the state reduce its debt.

Kenya owes China $7.2 billion (Sh920.52 billion) in loans making it the leading lender by country rankings, even as President William Ruto looks west for more financing and trade cooperation.

Official data shows the Asian giant is still a major lender to Kenya mainly for the development of roads rails and port infrastructure.

It is the second biggest majorl lender after the World Bank, whose credit line to Kenya is currently at an estimated $14 billion (Sh1.8 trillion)

The country’s debt …

- President Ruto calls for reforms in the IMF to address emerging global challenges and seeks flexible lending instruments, equitable special drawing rights, and debt financing plans.

- He also advocates for governance reforms to better represent the Global South’s economic and demographic contributions.

- These changes are crucial for maintaining the IMF’s relevance and effectiveness in fostering stability and sustainable development.

In a rapidly evolving global economy, the International Monetary Fund (IMF) finds itself at a critical moment as President William Ruto of Kenya articulates in the latest issue of the IMF’s Finance and Development Magazine. With over eight decades of history, the IMF’s journey from supporting the gold standard to promoting flexible exchange rates and development financing mirrors the dynamic changes in the global financial architecture.

President Ruto says that the IMF has to adapt once again, highlighting four key areas for reform: lending instruments, special drawing rights (SDRs), addressing …

- Financial markets provide liquidity essential for bolstering economic growth and stability.

While well-regulated financial systems are essential for macroeconomic stability - Good financial markets are critical in channeling resources into productive investment and fostering growth.

- Strengthening judicial systems and enforcing regulations are thus central to deepening financial systems. Protecting creditors‘ and borrowers‘ rights, enforcing contracts, and establishing transparent information-sharing mechanisms are also prerequisites for financial deepening.

Financial markets play a vital role in enhancing the smooth operation of economies by allocating resources and creating liquidity for businesses and entrepreneurs. The markets make it easy for investors and traders to trade their holdings. They additionally create security products that provide returns for investors/lenders and make these funds available to those needing extra financing.

Stock market, bond market, forex, commodities, and the real estate market, just to name a few, are examples of commodities in financial markets. Moreover, they can be divided into …

- The National Bank of Rwanda has reported a surge in bank borrowers attributable to intensified awareness campaigns, and the introduction of innovative products.

- The regulator reports a 40 per cent surge in the number of depositors in commercial banks.

- However, borrowers in microfinance institutions (MFIs) and Saccos experienced a 15 per cent decline.

Rwanda’s financial services industry witnessed a remarkable uptick in the number of individuals accessing loans from commercial banks, with a 39 per cent rise recorded over 12 months ending on June 30, 2023. This surge was underpinned by proactive measures instituted by the central bank to enhance financial inclusivity in an economy historically dominated by informal and traditional savings mechanisms.

Data released by the National Bank of Rwanda (NBR) reveals a substantial growth in bank borrowers, escalating from 683,851 in June 2022 to 949,778 in June 2023. In contrast, the number of borrowers in microfinance institutions (MFIs) …

- The funding is designated for the construction of a bridge spanning the River Nile in northwest Uganda and the enhancement of roads stretching over 105 kilometers.

- Uganda has encountered obstacles in accessing financial support from international institutions like the World Bank, primarily due to policy differences.

- The loan holds the potential to stimulate job creation, foster entrepreneurship, and spur innovation

Uganda has finalized an agreement with the Saudi Islamic Development Bank (IDB), securing a $295 million loan to bolster infrastructure development, particularly road construction projects across the country. This landmark agreement, signed by Uganda’s Finance Minister, Matia Kasaija, and IDB President Muhammad Al Jassar in Riyadh, underscores Uganda’s strategic shift towards diversifying its sources of external funding amidst ongoing negotiations with traditional lenders such as the World Bank.

The financing agreement, which was formalized during Minister Kasaija’s attendance at the 2024 Islamic Development Bank Group Annual Meetings in Riyadh, marks …

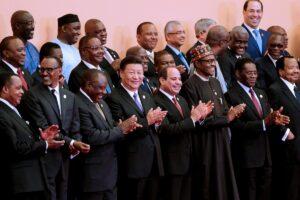

- 19 African Heads of State seek to triple IDA’s financing capacity to $279 billion by 2030.

- IDA remains [Africa’s] most dependable source of capital, with every dollar of donor financing enabling an additional $3.5 in capital market leverage to amplify development impacts: President Ruto

- We are united by a shared vision for the future of Africa—a continent rich in diversity, culture, and potential, thanks to its young people and natural resources: The World Bank Group President Ajay Banga.

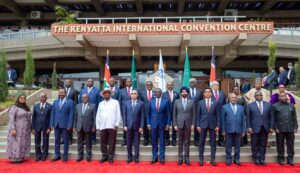

In a historic gathering of 19 African Heads of State and government in Nairobi, Kenya’s President William Ruto has ramped up calls for increased concessional financing from the World Bank’s International Development Association (IDA).

The rallying call, which was made during the International Development Association (IDA21) for Africa Heads of State Summit held at the Kenyatta International Convention Centre (KICC) in Nairobi, reverberated with urgency and determination.

President Ruto’s plea sought …

- AfDB asks policymakers to put in place an orderly and predictable way of dealing with Africa’s $824Bn debt pile.

- According to AfDB, Africa’s ballooning external debt reached $824 billion in 2021.

- AfDB president says there is urgent need for increased concessional financing, particularly for low-income countries.

Africa’s immense economic potential is being undermined by non-transparent resource-backed loans that complicate debt resolution and compromise countries’ future growth, African Development Bank (AfDB) President Dr Akinwumi Adesina has said.

Adesina at the Semafor Africa Summit taking place on the sidelines of the International Monetary Fund and World Bank 2024 Spring Meetings, highlighted the challenges posed by Africa’s ballooning external debt, which reached $824 billion in 2021, with countries dedicating 65 per cent of their GDP to servicing these obligations.

He said the continent would pay $74 billion in debt service payments this year alone, a sharp increase from $17 billion in 2010. “I …