- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Banking

- Kenyan Banks Hit by fresh $1.2 Billion Bad Loans in 2023 according to a new report by the Central Bank of Kenya

- The regulator says it is concerned by the sharp rise in bad loans and is working closely with lenders to mitigate the crisis.

- Kenyan banks hit by fresh $1.2 billion bad loans as global interest rates remained high throughout the year.

The high cost of living due to weak currency and shakeups in the global supply chain saw banks suffer an additional $1.2 billion (Sh150 billion) in bad loans in 2023, pushing the total to $4.98 billion (Sh651.8 billion).

The Banking Supervision Report by the Central Bank released Thursday shows the deterioration in banks’ asset quality was the highest in the past five years and almost 30 per cent compared to the previous year. The gross non-performing loans for 2022 were $3.85billion (Sh503.2 billion).

Non-performing loans were concentrated …

- Central Bank of Kenya says active mobile subscriptions hit 66.8 million by December 2023 compared to 65.7 million a year earlier.

- Increasing usage of mobile money saw the banking industry in Kenya experience a drop in the value of banking transactions via bank agents to $10.5 billion.

- Kenya is a trailblazer in the adoption and usage of mobile money across Africa.

A steady rise in the use of cashless transactions as well as the opening of 8,555 new mobile money agent shops in Kenya drove the value of mobile money transactions up by 13.8 percent to record KSh788.35 billion or $6 billion in 2023.

Kenya has been a trailblazer in the adoption and usage of mobile money across Africa since the launch of pioneer cash transfer platform M-PESA by Safaricom PLC in 2007.

“Amidst the increasing adoption of technology and the widespread use of mobile phones in daily life, coupled …

- Kenya’s bilateral loans data show that the Asian giant is still a major lender to Kenya mainly for the development of roads rails and port infrastructure.

- The country’s debt as of March 2024 comprised of $80.9 billion (Sh10.4trillion) comprising $40.5 billion (Sh5.2 trillion) domestic and same amount in external loans.

- In the past three months the strong shilling has come in handy in helping the state reduce its debt.

Kenya owes China $7.2 billion (Sh920.52 billion) in loans making it the leading lender by country rankings, even as President William Ruto looks west for more financing and trade cooperation.

Official data shows the Asian giant is still a major lender to Kenya mainly for the development of roads rails and port infrastructure.

It is the second biggest majorl lender after the World Bank, whose credit line to Kenya is currently at an estimated $14 billion (Sh1.8 trillion)

The country’s debt …

asu football jersey

asu football jersey

Ohio State Team Jersey

custom football jerseys

49ers jersey

College Football Jerseys

johnny manziel jersey

Florida state seminars jerseys

asu football jersey

Florida State Seminars jerseys

fsu football jersey

ohio state jersey

ohio state jersey

College Football Jerseys

- The BRICS-owned New Development Bank (NDB) was established in 2015 by Brazil, Russia, India, China, and South Africa.

- The multilateral lender plans to disburse about $5 billion in loans this year.

- The bank has an initial verified capital of $100 billion and a subscribed capital of $50 billion.

Emerging economies could give the superpowers a run in the lending sector with the the BRICS alliance planning to disburse about $5 billion in loans this year. This was announced by the bloc’s New Development Bank (NDB) Vice President Zhou Qiangwu on Tuesday, March 26.

As China, one of Africa’s closest trade partners, experiences …

- Ecobank’s new appointments have combined the commercial and the consumer businesses under the leadership of Anup Suri.

- Martin Miruka joins Ecobank as the Group Executive for Transformation, Enablement, and Customer Experience.

- Abena Osei-Poku was appointed as the Regional Executive for Anglophone West Africa.

Pan-African lender Ecobank has appointed key senior executives to bolster its leadership team and spearhead the implementing its new Growth, Transformation, and Returns (GTR) strategy.

Ecobank’s new appointments are crucial when the lender aims to solidify its position as a preferred bank and a pioneer in providing responsive, innovative, and cost-effective financial solutions across Africa.

The latest appointments have seen Abena Osei-Poku appointed as the Regional Executive for Anglophone West Africa and will also serve as the Managing Director of Ecobank Ghana.

With a wealth of experience in the financial sector, Osei-Poku brings strategic insights and leadership skills that will be instrumental in driving growth and fostering …

- East Africa’s banking giant KCB Group reports heightened operational expenses, which surged to $627 million in 2023, up from $447.9 million in 2022.

- The costs are associated with the consolidation of its subsidiary in the Democratic Republic of Congo, Trust Merchant Bank (TMB),

- Additional expenditures were related to a voluntary retirement scheme as well as litigation fees.

KCB Group, one of East Africa’s banking giants, has reported a net profit decline to $282 million for the year ending December 2023, from $307 million in 2022.

The bank has attributed this decline to increased operational costs and higher provisions for bad loans as primary reasons for the downturn in profitability.

In a period marked by economic challenges and strategic expansions, KCB Group faced heightened operational expenses, which surged to $627 million in 2023, up from $447.9 million in 2022.

DRC-based Trust Merchant Bank consolidation costs

This increase was largely due to …

- In Kenya, the level of bank clients running two bank accounts stood at 53% in 2023 compared to 48.2% in the 2022 survey.

- Industry survey ranks Cooperative Bank as the best overall lender in customer experience in the country followed by regional giant NCBA.

- The results show that the respondents had an overwhelmingly positive view of their banks.

The competition within Kenya’s banking sector is driving an increasing number of customers to diversify their relationships, opting to hold accounts with multiple institutions, a practice commonly referred to as multi-banking, in order to tap into a range of benefits.

In a 2023 survey, the Kenya Bankers Association (KBA) says 53 per cent of bank customers maintain more than one bank, in a trend that highlights a growing desire for customized convenience in services and products among bank customers.

Growth of multi-banking in Kenya

According to the Banking Industry Customer Satisfaction Survey…

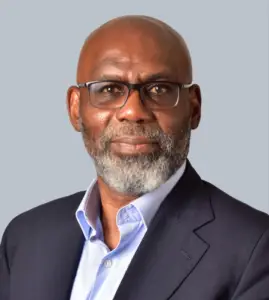

- Emuwa brings to Africa Finance Corporation a wealth of experience over three decades.

- He has been a part of AFC’s Board since 2015, previously serving as the Board Risk and Investment Committee Chairman.

- AFC, with its partners, is the biggest investor in renewable energy in Africa

Africa Finance Corporation (AFC), the continent’s leading instrumental infrastructure solutions provider, has appointed Emeka Emuwa as Chairman of its Board of Directors.

Emuwa brings a wealth of experience spread over three decades, leading and transforming banking institutions across Africa.

After completing a 25-year career with Citibank, where he left as the Country Officer and Managing Director of Citibank in Nigeria, he went on to serve as the Group Managing Director and Chief Executive Officer of Union Bank of Nigeria.

In this role, he led the bank’s transformation. He worked successfully with the new shareholders to transform and restore one of …

- Non-performing loans in Kenya surged to a 16-year high of 15 per cent in August 2023.

- The Kenya Bankers Association had called for further monetary policy tightening by the CBK, terming it a cure to elevated non-performing loans.

- According to the CBK data, forex pressure cut lending to the private sector to 8.3 per cent during the review period.

The banking sector regulator has said that Kenya’s private sector players resorted to alternative funding sources to avoid the high lending rates, leading to a drop in non-performing loans during the holiday season.

The continued surge in bank interest rates has hit individuals and businesses hard on the back of the Central Bank of Kenya’s (CBK) elevated benchmark interest rate. This has happened thrice since Governor Kamau Thugge took office, citing the need to support the country’s struggling shilling.

On Tuesday this week, the Central Bank of Kenya increased the benchmark …