- Africa’s new dawn: the rising role of digital and AI in agriculture

- Can Dangote Refinery Transform Africa Energy Ambition

- Gallup Survey: 80 per cent of Kenyan Workers Are Disengaged and Seek New Opportunities

- Madagascar Man Freed from 5KG Tumor After 15-Year Struggle

- How women in Africa are perceived and treated

- Sugar consumption in Kenya to Increase to 1.23 Million Tonnes

- Can Somalia and Turkey Oil deal Bring Change in Somaliland

- Remittances to Kenya dropped to $371.6 million in June, marking a six month low

Africa

- Madagascar man freed from 5KG tumor after the four-hour surgery, his family, including his wife, daughter, and sister, were all waiting for him outside

- By age 53, Fidisoa struggled to do the high level of manual labor required from his livelihood

- He said that the benign tumor, a soft lobular fibroma which weighed 5 kilograms, was now gone for good

A father of three can sleep comfortably on his back for the first time in 15 years after having a massive tumor – weighing 11lbs (5kgs) – removed by surgical charity Mercy Ships.

Malagasy builder and rice farmer Fidisoa was 38 when what appeared to be a tiny pimple on his back started to grow, first into a lump and then into the size of a fist. It continued to grow until Fidisoa looked as if he carried a backpack underneath his shirt.

By age 53, Fidisoa struggled to …

- Only about 50% of women in Kenya and 52% in Uganda feel that they are treated with respect and dignity.

- In Zimbabwe, 60% of women feel that they are treated with respect and dignity. This is a sharp drop from an estimated 71% of women who reported being treated with respect in 2013.

- The percentage of people in South Africa who feel this way was even worse at 27% among men and 28% among women.

In Africa’s most advanced economy South Africa, the percentage of people in South Africa who felt this way was even worse at 27 percent among men and 28 percent among women.

The push for equality across Africa appears far from yielding good results with a new report showing that the perceptions that women are treated with respect and dignity have dropped sharply in recent years in Kenya, Uganda South Africa, and Zimbabwe.

According to Gallup …

- Africa posts sharp decline in support for democracy despite 66 Per cent of the continent preferring democracy over any other system.

- Opposition to military rule has also weakened by 11 points, notably in Mali and Burkina Faso.

- Satisfaction with democracy has notably decreased in prominent democracies like Botswana (-40 points), Mauritius (-40 points), and South Africa (-35 points).

Over the past decade, popular support for democracy has declined sharply in several African countries, and opposition to military rule has weakened a new survey by Afrobarometer has shown.

Afrobarometer’s inaugural flagship report shows that satisfaction with the way democracy works has continued to decline despite that Africans remaining strongly committed to democracy, its norms, and institutions.

The survey covering the period between 2021 and 2023, covers 39 countries, providing data on African experiences and evaluations of democracy, governance, and quality of life.

The findings, based on 53,444 face-to-face interviews, show that …

- Each dollar invested in contraceptive services saves up to $31 in other social services

- Healthier women can pursue careers and contribute to national development

- Policymakers need to think about the connections between women’s health and national development

Women’s economists consider women’s health a key determining factor in national development; women’s health refers to the range of health experiences that affect women uniquely, differently, or disproportionately to men.

“The women’s health gap is the disease burden associated with inequities between women and men in intervention efficacy, care delivery, and data,” explains authors of a recent report by the World Economic Forum.

The McKinsey Health Institute authors the report. It shows that ‘closing the women’s health gap globally could result in better overall health, fewer early deaths, and a boost in the economy.’

“Comparatively, more than half of the women’s health burden reflects conditions that affect women disproportionately or differently, with …

- Highly potent opioids, nitazenes, a drug up to 100 times more potent than heroin, were found in 83% of drug samples in Sierra Leone and 55% in Guinea-Bissau.

- This discovery marks a dangerous escalation in the African drug crisis.

- Nitazenes has been linked to overdose deaths in Western countries and parts of Asia.

The persistent menace of drug and substance abuse is set to worsen with new revelations that for the first time, traces of highly potent opioids, known as nitazenes, have been found among hard drug users in Africa. This discovery was made by the Global Initiative Against Transnational Organized Crime, a non-profit organization, through an extensive report released this week.

Nitazenes, synthetic opioids notorious for their potency, have previously been linked to overdose deaths in Western countries and parts of Asia. Their newfound presence in Africa marks a dangerous escalation in the continent’s drug crisis.

The

…-

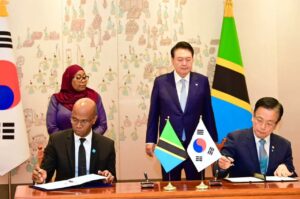

- Tanzania, Korea ink USD 2.5bn trade pact, cooperation MoU

- Tanzania President Samia completes 6-day Korean visit

- Tanzania earmarks five regions for the ‘Smart City’ project

Tanzania-Korea relations

Tanzania-Korea relations are growing, with the latter securing a $2.5 billion soft loan from the Economic Development Cooperation Fund (EDCF).

The loan comes on the heels of Tanzania’s President Samia Suluhu Hassan’s state visit to the Republic of Korea.

The Tanzania-Korea loan was subject to criticism surrounding its terms. Still, the government of Tanzania has refuted claims that the loan has a security guarantee clause that may have forced the government to ‘mortgage’ some of the country’s resources.

Chief Government Spokesman Mr. Mobhare Matinyi was forced to elaborate on the loan terms following the ongoing social media buzz about what the spokesperson described as ‘misinformation.’

“The government has not mortgaged anything or any property because this loan does not have any conditions that …

- The number of Africans living in urban areas is expected to increase to around 50 per cent by 2030.

- In the dynamic journey towards progress, the concept of “Smart Cities” emerges as a beacon of hope, transforming urban spaces into intelligent, efficient, and sustainable hubs.

- technology can help improve transportation systems. Mobile apps can inform people about real-time traffic updates, schedule public transportation, and facilitate carpooling or ride-sharing services.

Urbanisation in Africa is a force that has become irresistible, the number of Africans living in urban areas is expected to increase to around 50 per cent by 2030. The continent’s urbanisation rate, rated the highest in the world, can result in economic growth, transformation, and poverty reduction. Similarly, it can lead to increased inequality, urban poverty, and the growth of slums. Therefore, the laws, policies, and actions needed to reap positive results from Africa’s urbanisation are critical in the …

- Key findings reveal a significant gender gap in digital technology use, with young African women often pressured to abandon social media

- The “Youth in Digital Africa” report calls for government investment in infrastructure and skills development

- Young African Women also face higher rates of online harassment and bullying

Societal norms and bullying have seen young African women lag in adopting digital technologies, a new survey has revealed. The report titled Youth in Digital Africa: Our connections. Our choices. Our future. has been released by Caribou Digital in partnership with the Mastercard Foundation.

The report compiles personal narratives from young people across Africa, providing insights into how digital technology influences their lives and offering recommendations to maximise its benefits.

The study identifies five key themes: access, skills, jobs, voice, and choice, highlighting the intertwined nature of digitalisation in their experiences.

Caribou Digital conducted a six-month study across seven African countries …

- The transformative potential of the Heaven on Earth Program utilizes self-reprogramming techniques to achieve inner peace, happiness, and financial abundance through mental and spiritual practices.

- Supported by scientific research and universal wisdom, the program emphasizes brain synchronization, meditation, and manifesting desires to foster mental clarity, emotional stability, and overall well-being.

- By integrating these holistic practices, individuals can reprogram their minds to create a state of ‘heaven on earth,’ enhancing their happiness, wealth, and life performance.

Is it possible for individuals to achieve a state akin to heaven on Earth through the Heaven on Earth Program? This question lies at the heart of a profound exploration into the transformative potential of self-reprogramming to elevate happiness and wealth. In this article, we delve into compelling research findings to deepen comprehension and endeavour to provide insights into this intriguing inquiry.

The concept of the “Guide to Heaven on Earth Living,” as posited …