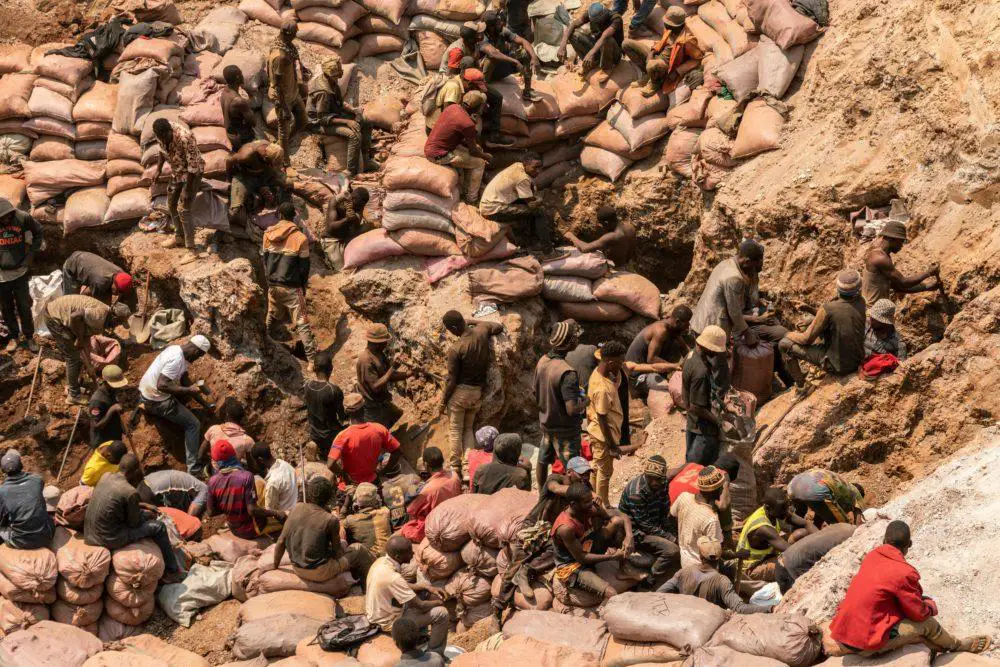

- Cobalt mining is linked to severe human rights violations; with an estimated 25,000 children engaged in cobalt mining, there is a need to reform artisanal mines to address these challenges.

- The metal’s surging demand, driven by its essential role in powering mobile phones and electric vehicles, is encountering obstacles due to the country’s poorly regulated artisanal mines.

- The cobalt market is undergoing a significant transformation, characterized by an abundant supply and decreased demand.

Cobalt mining in the Democratic Republic of Congo (DRC) remains crucial in meeting global demand due to its usage in electric vehicle batteries and electronic devices.

However, the industry is marred by grave human rights abuses, including unsafe working conditions and child labour. Efforts must be made to reform mining practices and address the challenges associated with informal or artisanal mining sites.

The cobalt market is also experiencing a remarkable shift as Congo solidifies its position as the leading producer, accounting for 72 per cent of global cobalt production, according to Darton Commodities. The metal’s surging demand, driven by its essential role in powering mobile phones and electric vehicles, is encountering obstacles due to the country’s poorly regulated artisanal mines.

The Scale of the Problem

Approximately 80 per cent of the world’s cobalt reserves are located in the DRC, making it a vital source for global cobalt supply. However, cobalt mining is linked to severe human rights violations, with an estimated 25,000 children engaged in cobalt mining. The cobalt supply chain intertwines formal mechanized mines with artisanal mines, making it challenging to separate the two sources.

Industry Responsibility

Major industry players, such as Glencore, which supplies cobalt to companies like Tesla, acknowledge the risks associated with artisanal mining and support initiatives to address child labour and mine safety. However, some companies attempt to distance themselves from the challenges of the informal mining sector. Companies and automakers need to recognize their direct responsibility as beneficiaries of cobalt profits.

Recommendations for Reform

Two recent publications provide insights into potential solutions. Siddharth Kara’s book, “Cobalt Red,” sheds light on the dire conditions of artisanal cobalt mining and emphasizes the need for reform. Dorothée Baumann Pauly’s white paper, “Cobalt Mining in the Democratic Republic of Congo: Addressing Root Causes of Human Rights Abuses,” offers practical recommendations for mining companies, governments, and corporate buyers:

Acknowledging Responsibility

Corporate buyers must accept their share of responsibility for addressing challenges in the informal mining sector and work toward developing enforceable safety and labour standards. No company can claim complete insulation from artisanal mining operations.

Formalization of Artisanal Sites

The only way to improve mine safety and limit child labour is to formalize artisanal mining sites. This involves implementing safety protocols, hiring guards, distributing protective equipment, and excluding children from work areas. Successful pilot projects have demonstrated the positive impact of formalization, such as improved safety conditions and increased incomes for miners.

Involvement of Local Actors

Local mining cooperatives and the DRC government should actively participate in these reforms. Governments in countries where major cobalt buyers are based, including Germany, the U.S., Japan, and South Korea, should support the DRC and mining companies in enforcing strong human rights standards.

The Path Forward

The proposed agenda provides a practical roadmap for promoting human rights and ethical cobalt sourcing. Global mining companies, battery manufacturers, and governments must embrace these recommendations and collaborate in addressing the challenges of cobalt mining in DRC. By doing so, they can contribute to a more sustainable and responsible cobalt supply chain while ensuring the welfare of artisanal miners who are integral to the industry.

Shifting Demand Dynamics

A mere year ago, a global scarcity of cobalt threatened to impede the energy transition. Insufficient extraction rates and Congo’s prevalence of instability, corruption, and child labour created concerns. However, the landscape has dramatically transformed since then. The price of cobalt, which more than doubled from summer 2021 to spring 2022, peaking at US$82,000 per tonne, has now plummeted to US$35,000, nearing historic lows.

Reduced Demand and Increasing Supply

One contributing factor to the price decline is a decrease in demand. In battery packs, most cobalt is used for smartphones, tablets, and laptops. The heightened demand for these devices, particularly during the COVID-19 pandemic, has since subsided as people spend less time engrossed in screens.

As consumer electronics demand decreased, so did the need for cobalt. Even the surge in electric vehicles has not offset this decline, as manufacturers have actively sought ways to reduce reliance on this previously costly metal.

Simultaneously, the cobalt supply is experiencing rapid growth. Industry expert Susan Zou from Rystad Energy predicts a 38 per cent increase in Congolese production this year, reaching 180,000 tonnes. Particularly noteworthy is the surge in Indonesian exports, projected to reach 18,000 tonnes this year from virtually nonexistent levels a few years ago. The market could soon face an overabundance of cobalt.

While low prices typically lead to mine closures in other markets, cobalt presents a unique scenario. The price has already fallen below the break-even point for many miners.

Despite this, major industry players like Glencore and China Moly have indicated that they will maintain or even increase output. Large firms can tolerate low prices because cobalt is a by-product of copper and nickel extraction, which remain in high demand.

Moreover, global electric vehicle manufacturers are actively seeking nickel supplies from Indonesia, initiating projects yielding cobalt. For instance, China Moly’s colossal Congo mine will produce three times more copper than cobalt.

Future Outlook

While prices may experience a slight increase this year as speculators seize opportunities, a long-term dampener looms beyond 2025. As the initial wave of electric vehicle batteries, with an average lifespan of up to eight years, begin to be recycled, the demand for new cobalt supply will diminish. Irrespective of the pace of the energy transition, cobalt is unlikely to serve as a significant growth inhibitor.

The cobalt market is undergoing a significant transformation, characterized by an abundant supply and decreased demand. Congo’s dominance in production and the challenges posed by artisanal mines necessitate a cautious approach by stakeholders in the battery materials sector.

As prices plummet, major industry players demonstrate resilience, given cobalt’s association with valuable metals like copper and nickel. Recycling electric vehicle batteries will further impact the demand for fresh cobalt supply. The evolving dynamics of the cobalt market demand strategic navigation and adaptation within the battery materials industry.

Read: Plundering the Congo: The impoverishing gold trade