- Jubilee Holdings Limited’s shareholders have approved a final dividend of KSh 13.0 per share

- The payout follows the exceptional results posted in 2021, where the gross profit hit KSh 8.4 billion, after increasing by 66% from the KSh 5.1 billion reported in 2020

- The performance was despite the increase of medical and life claims relating to COVID-19 cases, which was partly driven by the gain on the sale of controlling interests in the general businesses in Kenya and Uganda

Jubilee Holdings Limited’s shareholders have approved a final dividend of KSh 13.0 per share, bringing the total dividend payout to KSh 14.0 (including a special dividend of KSh 5.0).

The payout follows the exceptional results posted in 2021, where the gross profit hit KSh 8.4 billion, after increasing by 66% from the KSh 5.1 billion reported in 2020.

According to the regional insurer, the performance was despite the increase of medical and life claims relating to COVID-19 cases, which was partly driven by the gain on the sale of controlling interests in the general businesses in Kenya and Uganda, transactions that were completed last year. The company retains a 34 per cent interest in both companies.

During the review period, Jubilee’s Gross Written Premium reached KSh 38.8 billion, an increase of KSh 825 million. The growth, despite the loss of the general insurance business in Kenya and Uganda, was driven by the good performance in the health and life insurance business, which grew by KSh 1.4 billion and KSj 1.2 billion, respectively.

The group’s total assets increased by KSh 9 billion to KSh 155 billion from KSh 146 billion in 2020, the largest in the industry.

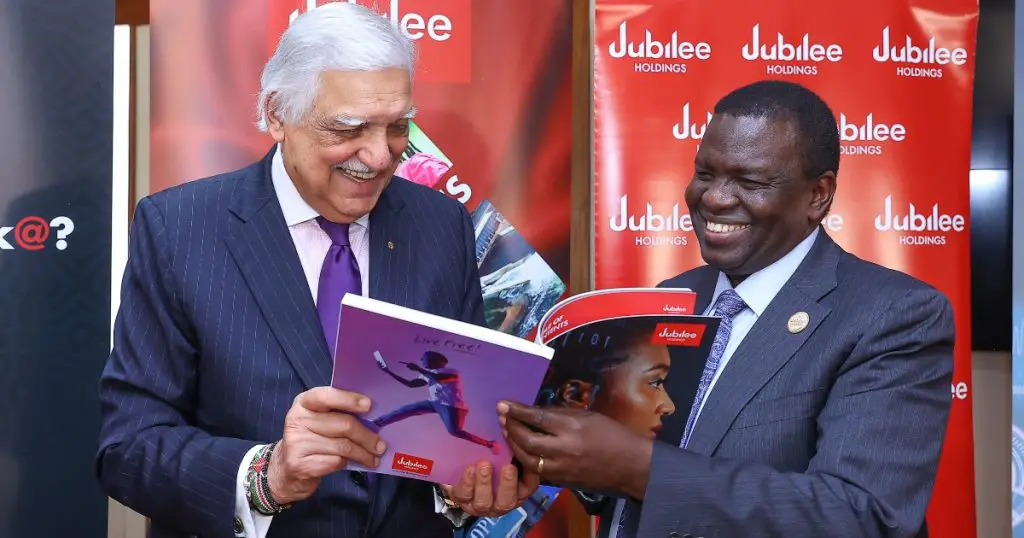

During the company’s annual general meeting, Jubilee Holdings Limited Chairman Nizar Juma said the performance was backed by tight expense control measures and improved return on investments that allowed Jubilee to reinforce its leadership position in the industry.

Jubilee insurance sells majority stake to Germany’s Allianz Group

During the year, JHL embarked on a digital transformation plan across its businesses in East Africa, dubbed Changamk@. The digital transformation agenda entails a portfolio of technology projects involving Robotics, Cloud Migration, Artificial Intelligence, enhanced CRM, and data capabilities. Changamk@ will deploy an investment of KSh 450 million per year for the next five years to position the Jubilee Group as the most digitally advanced and innovative insurer in the region.

“Retaining the regional leadership position over the years is only possible when we prioritise our customers and proactively innovate to align and deliver value to their changing needs and expectations. Our digital transformation will offer more meaningful engagement and value to all our stakeholders,” Juma said.

Partnership

The partnership between Jubilee and Allianz in the General insurance business is within its implementation schedule with Kenya, Uganda and Burundi already completed by the end of 2021.

The sale of the General insurance in Tanzania and Burundi was completed in the first half of 2022 and Mauritius will be completed in the next few months. At completion, JHL will have received approximately KSh 7.7 billion funds for the value of the shares sold.

In 2020, Jubilee announced it was selling between 51 per cent to 66 per cent stake of its operating subsidiaries engaged in short-term general insurance business across the region to Allianz Group for about $99.35 million.

The regional insurer said it was selling its general insurance units in Kenya, Tanzania, Uganda, Mauritius and Burundi while retaining full ownership of its life and health insurance businesses except in Burundi and Mauritius.

At the time, Nizar said that over the past decade, the company had been approached by a number of international insurers looking to partner with Jubilee to expand into East Africa.

“With Allianz, we have now identified a partner whose strategic aims are aligned to JHL’s and whose expertise in the general insurance business can enhance the range and depth of products and risk management solutions we can offer to our customers,” he said.

Allianz Africa Regional CEO Coenraad Vrolijk said the deal would enhance its presence in the region and continent.

“We have been on the continent since 1912, but have only started looking at Africa more seriously in 2015. We’ve been looking at how to become more meaningful,” he said.

Jubilee Holdings posts Sh5.2bn net profit in six months to June