- Congo is working to increase its crude oil and gas production ahead of OPEC negotiations in November.

- Afreximbank is offering $300 million loan to Trident OGX Congo to increase crude oil production by 30%.

- Congo-Brazzaville’s production is expected to rise to 400,000 barrels per day by next year.

Congo is rolling out a plan to increase crude oil and gas production ahead of vital negotiations over OPEC production baselines in November. In the latest move, the African Export-Import Bank (Afreximbank) has entered into an agreement to provide a $300 million loan to Trident OGX Congo aimed at increasing the country’s crude oil production by 30 per cent.

The $300 million loan will enhance Congo’s crude oil output significantly within a year, and double gas production in two to three years, effectively stepping up the country’s 2024 output quota.

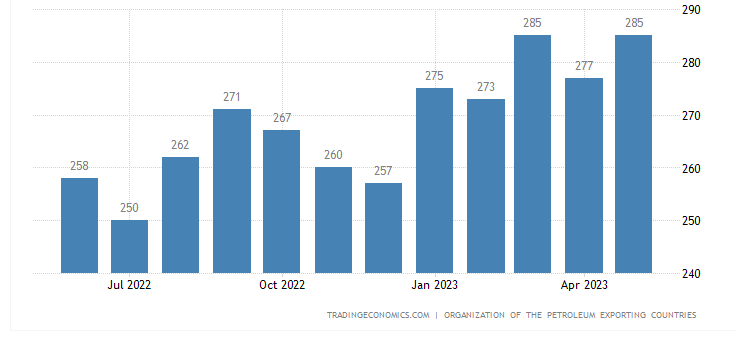

Congo-Brazzaville’s production is currently just below 300,000 barrels of oil equivalent per day (boe/d) but is expected to rise to 400,000 boe/d by next year, most of it from oil.

According to the Platts OPEC+ production survey by S&P Global, the central African country’s production quota currently stands at 310,000 boe/d but the output was 290,000 boe/d in May.

Sub-Saharan African OPEC members are currently in a race to demonstrate bigger output volumes to avoid major cuts to their production baselines.

According to forecasts from S&P Global, Congo-Brazzaville’s total oil and gas production will rise to 114.2 million boe in 2030, from 108.6 million boe in 2023, driven by a slate of new projects.

OPEC+ members have been cutting actual production and quotas in a bid to shore up prices, which have seen a muted response to recent events that threaten supply volumes.

Read also: We’re open for big business, DR Congo tells UAE investors

Economic impact of Congo’s oil production

A report by the World Bank notes that while oil accounts for 40 per cent of the country’s GDP, the sector employs only a fraction of Congo’s workforce, with three-quarters of Congolese employed in the informal sector.

The international financial institution indicates that despite such a significant contribution to the country’s economy, there is still underinvestment in health, education, and physical infrastructure largely driven by the country’s weak government institutions.

“This underscores the limits of fossil fuel-driven growth and the importance of economic diversification,” the report stated.

According to the World Bank, Congo’s oil production is expected to decline in the medium term due to the depletion of oil reserves and reduced external demand owing to global transition to a low-carbon economy.

The Mengo-Kundji-Bindi II (MKB II) oil fields

The $300 million reserve-based lending facility will enable Trident OGX Congo to implement a capital expenditure program to ramp up crude oil production from the Mengo-Kundji-Bindi II (MKB II) oil fields.

“Today is a remarkable day for the Republic of Congo, and its oil and gas sector in particular. Afreximbank is pleased to participate in this historic project with Trident OGX Congo and the Republic of Congo. This important project which promises to bring investment of about $1.5 billion into Congo’s oil and gas sector, will generate significant revenues that will enable the Government to create more jobs and provide more socio-economic infrastructure for the people of Congo,” President and Chairman of the Board of Afreximbank Prof. Benedict Oramah said.

Under the terms of the agreement, Trident OGX Congo, a fully owned subsidiary of Trident OGX International Pte Ltd, Singapore, will use the loan to partially finance and kickstart a seven-year development program on the MKB II permit area located in the coastal plains between Pointe Noire, the foothills of Mayombe mountains and the border with Angola’s Сabinda enclave.

Higher oil output means more jobs

Upon completion of the field development plan, the transaction is expected to increase the Republic of Congo’s crude oil production level by up to 30 percent and add a considerable number of jobs to the country’s economy.

“We are also pleased that operations at the Mengo-Kundji-Bindi II oil fields will be conducted in adherence with best practices of environmental standards, by hydraulic fracturing process. Our sincere appreciation to President Denis Sassou Nguesso, under whose vision the Republic of Congo as a Member State of Afreximbank, is benefitting from its support,” Oramah noted.

He noted that the current transaction would result in the creation of a significant number of new jobs in the Republic of Congo and would also open up many entrepreneurial opportunities for Congolese businesses, culminating in significant GDP growth for the country.

In addition to the Trident Group, Société Nationale des Pétroles du Congo and Orion Group also have a shareholding in the asset to be operated by Trident OGX Congo.

Congo’s future gas plans

As Congo-Brazzaville looks to boost future production, gas projects hold the most promise. One such project is the Marine XII gas project, which Congo-Brazzaville is working to launch in December.

This additional production would supply the domestic market, which relies on gas for 70 percent of its electricity, and further volumes such as Liquefied Petroleum Gas (LPG) for cooking.

Gas from Marine XII is also expected to underpin the country’s major LNG production and export plans.

Congo expects to launch LNG shipments this month and increase exports from 600,000 mt/year to 3 million mt of LNG in 2025 when a second 2.4 million mt/year floating LNG plant is commissioned.

Congo-Brazzaville was aiming to become one of the top five exporters of LNG in the world.