- 121 African startups secured $466M, marking a 27 per cent drop from the previous quarter; women-led startups got 6.5 per cent of the capital.

- About 87 per cent of startup funding in the three months to March went to entities in Nigeria, Kenya, Egypt, and South Africa.

- Gender imbalance persists as only 6.5 per cent of the financing went to female-led startups in Africa.

The big four economies of Nigeria, South Africa, Kenya, and Egypt continue to attract the highest share of funding going to startups in Africa, even as the ecosystem suffered a 27 per cent drop in financing to $466 million in the three months to March 2024.

The latest analysis from Africa: The Big Deal shows that 87 per cent of startup funding in the three months to March went to upcoming entities in Nigeria, Kenya, Egypt and South Africa.

Attracting $160 million, Nigeria’s economy accounted for 35 per cent of the funding invested in startups in Africa, while Kenya came second in the quarter, securing 24 per cent of the funding or roughly $108 million.

In third place was South Africa, where startups received 16 per cent of startup funding in Africa, which translates to approximately $72 million. Northern African country Egypt closed the top four positions, attracting $53 million or 12 per cent of startup funding realized in quarter one of 2024.

Other countries that attracted at least $5 million in funding were Uganda ($16 million), Ghana ($10 million), Tanzania ($9 million) and Morocco ($7 million).

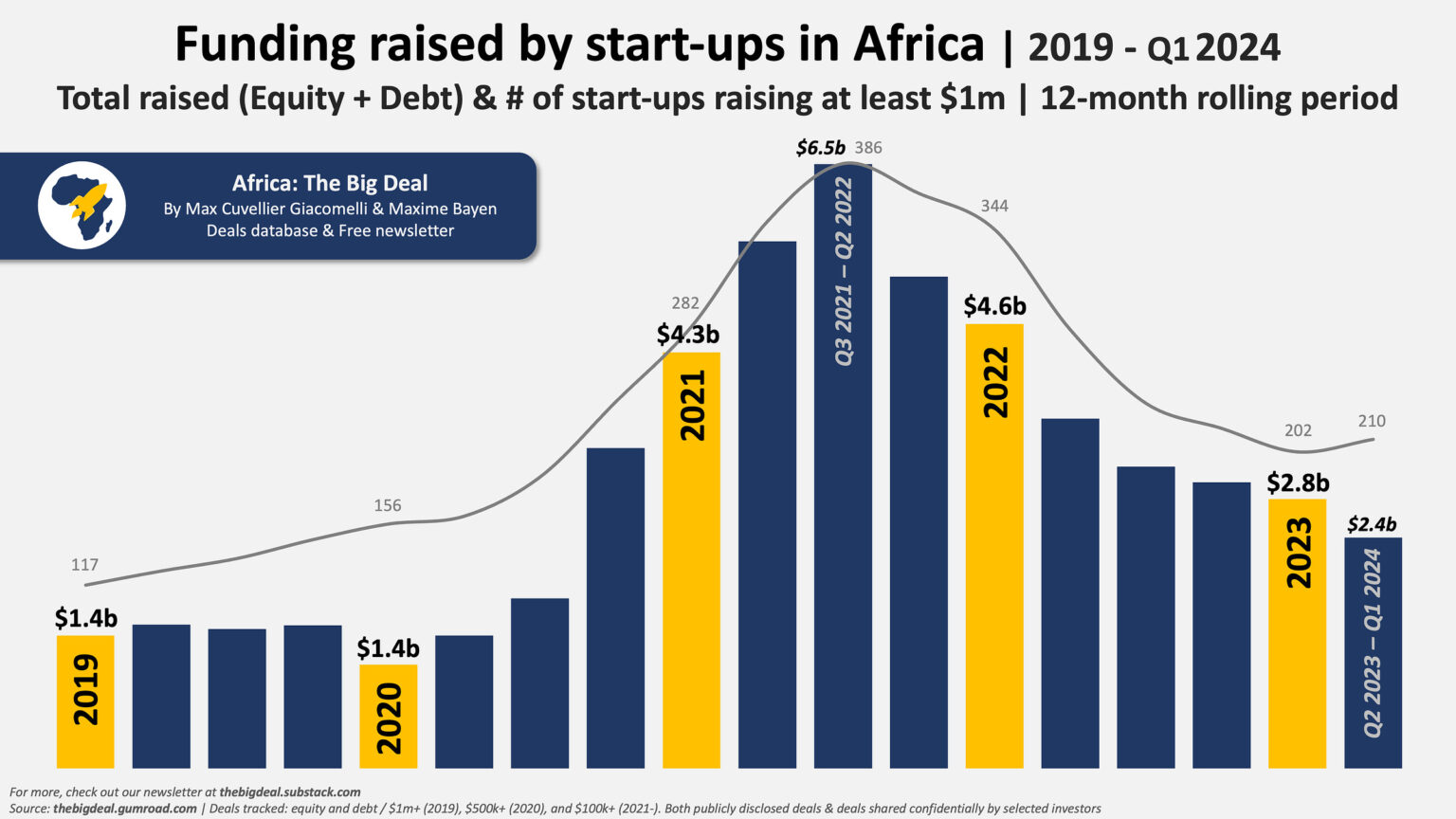

African startups witness a substantial drop in financing

However, a shift from previous trends was evident, with the African startups witnessing a substantial drop in financing during the first quarter of 2024. This move raises concerns among observers, calling for a closer look into the challenges and opportunities within the startups in the African ecosystem.

A total of $466 million was secured through deals exceeding $100,000 by 121 startups in Africa, marking a 27 per cent decline from the preceding quarter and a stark contrast to the funds raised in the same period a year ago, in Q1 2023.

“On the positive side, though, the number of start-ups who have raised at least $1 million during the quarter is higher than previous Q1s’ levels, except for 2022,” report author Max Cuvellier Giacomelli said.

The funding composition revealed a predominant reliance on equity, accounting for 71 per cent of the disclosed amounts, while debt financing constituted the remaining 28 per cent. Despite the overall downturn, equity investments remained stable quarter-over-quarter. However, the volume of disclosed debt in startups in Africa experienced a huge reduction, halving from Q4 2023 to Q1 2024.

“If we look at equity and debt separately, we notice that equity levels in Q1 2024 were quite comparable to Q4 2023 levels (with ‘only’ a -9 per cent decrease QoQ), while debt levels dipped (-44 per cent QoQ),” explains Giacomelli.

Amidst this funding dip, the ecosystem celebrated seven exits from African startups, underscoring the enduring potential for successful outcomes within the economies. Notably, the HRtech firm PaySpace was acquired by Deel for an undisclosed sum, which is said to be upwards of $100 million.

Another key transaction in the startups in Africa ecosystem saw fintech company nCino acquiring DocFox for $75 million, with both deals emanating from South Africa and underscoring the strategic importance of the continent’s most advanced economy.

What’s more, one of the standout moves in startups in the African ecosystem was Moove, a mobility-focused start-up, which attracted $100 million in total funding during the three-month period. This amount constituted a $100 million Series B round led by Uber, alongside a $100 million debt financing arrangement to power its expansion into the Indian sub-continent market.

Read also: Deel acquires rival payroll engine PaySpace, aiming to establish a presence in 100 markets

Nigeria, Kenya, South Africa, and Morocco get lion’s share

Moove’s funding alone accounted for nearly a quarter or 24 per cent of the continent’s total startup funding in Q1, significantly influencing overall financing trends.

Notably, funding distribution across the continent remained highly concentrated, with 87 per cent of investments directed towards startups headquartered in the “Big Four” African markets, notably Nigeria, Kenya, South Africa, and Morocco.

Nigeria, in particular, benefitted from Moove’s huge fundraising activities, accounting for nearly 60 per cent of the total funding, two-thirds of which was attributed to Moove’s deals.

Analysis shows that from an industry perspective, the transport and logistics sector was the leading recipient to financing for startups in Africa, primarily riding on Moove’s financing rounds.

At the same time, Fintech maintained its prominence in the number of $100,000 deals secured by startups in Africa, followed closely by emerging businesses in the agri and food sectors.

Notably, climate tech, a basket that entails multiple sectors, accounted for 31 per cent of the over $100,000 deals and 27 per cent of the total investment volume, signaling a growing interest in sustainable and environmentally focused startups.

Persistent gender disparity in startup financing

However, the funding for startups in Africa continued to exhibit a huge gender disparity, with less than 1 per cent of the funding allocated to startups without at least one male founder and only 6.5 per cent directed towards female-led ventures.

This huge imbalance highlights female entrepreneurs’ persistent challenges in accessing venture capital and calls for targeted efforts to better support and empower women in the African startup ecosystem.

The decrease in financing and the concentration of investments in specific regions and sectors also mirrors the evolving dynamics of the African startup ecosystem. While challenges such as economic uncertainty and funding disparities linger, the success stories and sectoral shifts indicate a vibrant market ripe with opportunities for innovation and growth.

As the African startup ecosystem navigates these turbulent waters for policymakers and governments, the focus should go to fostering a more inclusive, diverse, and resilient startup industry across the continent.