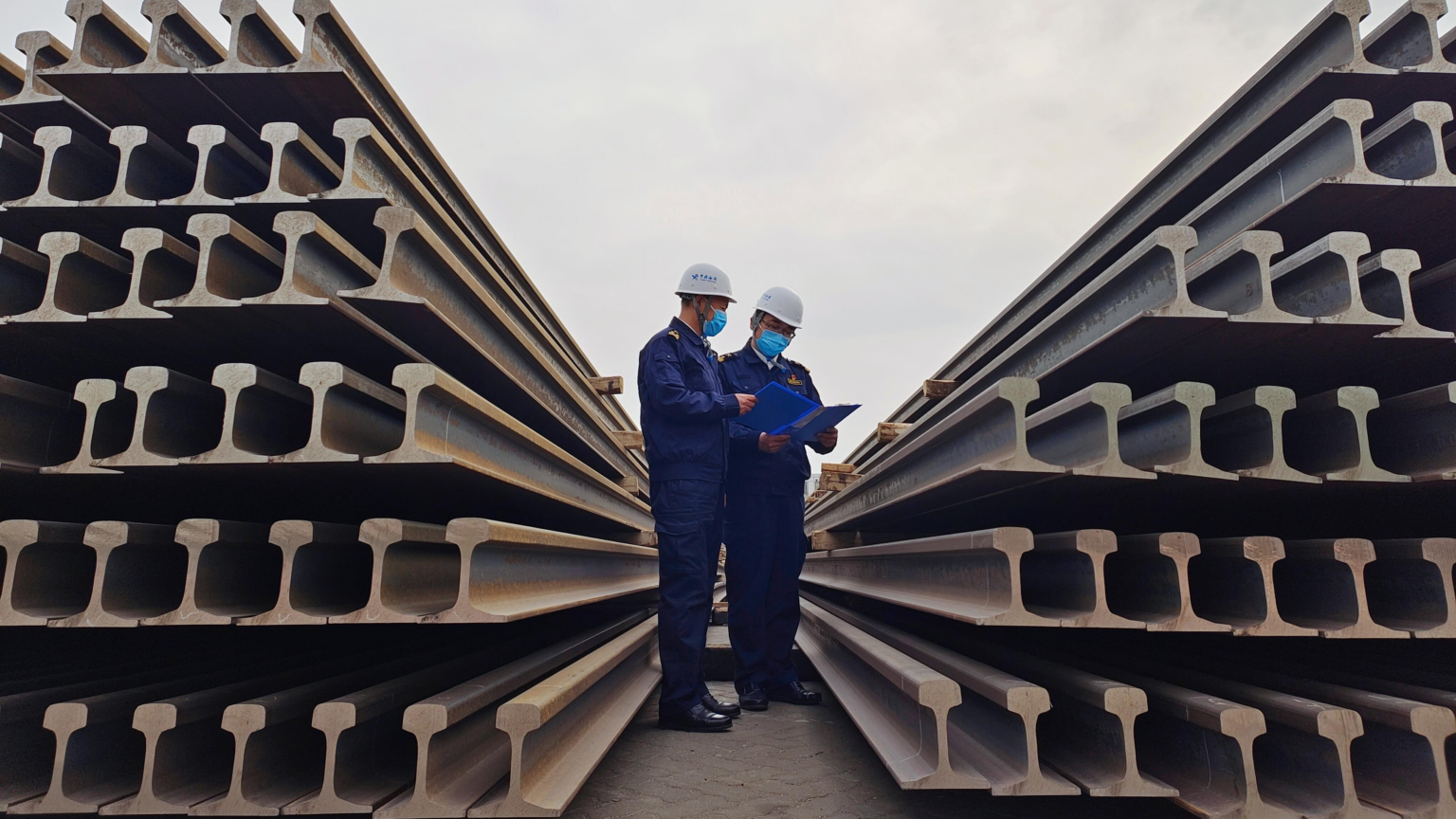

Ongoing China’s real estate crash is causing a ripple effect in the steel industry. Market prices for steel have fallen sharply in Asia amid the flood of Chinese exports. At the same time, Sub-Saharan Africa metal exports are relying on anti-dumping laws to stay afloat. China's real estate bubble has busted and with it caused

[elementor-template id="94265"]