- Kenya’s appeal comes at a moment when East Africa has seen only one exit through an IPO in the past decade.

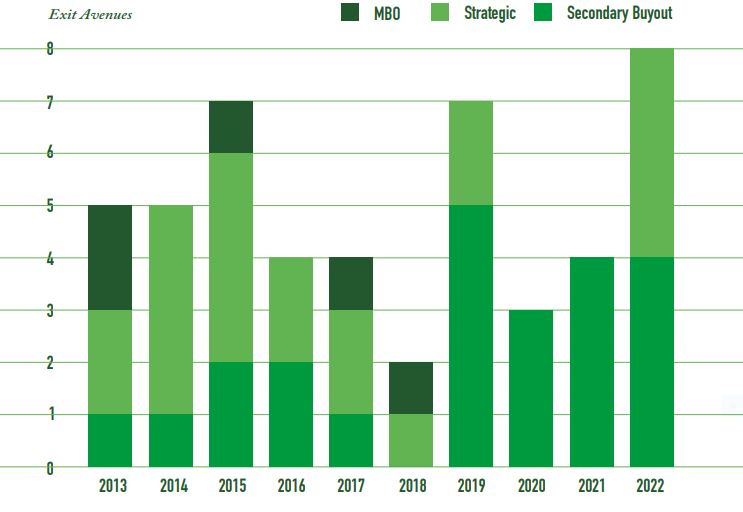

- 2022 marked the highest level of exit activity in the region in the past decade. Projections show that 2023 is poised to surpass 2022 performance.

- Private Equity investors typically opt for one of three main methods to exit their investments: selling to industry competitors, conducting secondary buyouts, or engaging in Management Buyouts (MBOs).

Kenya is urging private equity firms and venture capital companies to turn to the Nairobi Securities Exchange (NSE) as a platform to realize their deal exits.

The move is part of the Kenyan government’s broader strategy to deepen its capital markets and attract more private investments. “Once you are in, exit through our capital markets,” said Mr. Abubakar Hassan Abubakar, the Principal Secretary of the State Department of Investment Promotion in the Ministry of Trade highlighting Kenya’s dedication to attracting private equity investments.

Mr Abubakar was speaking during the seventh annual conference of the East Africa Venture Capital Association (EAVCA) held in Nairobi.

Drought in Private Equity exit IPOs

However, Kenya’s appeal comes at a moment when there has been only one exit through an Initial Public Offering (IPO) in the past decade. Historically, private equity investments in East Africa have predominantly found their way out through sales to industry players. These purchasers have typically originated from European and Asian regions.

In 2022, Kenya experienced one of the fastest growth in attracting Venture Capital and Private Equity funds, beating competing destinations South Africa and Nigeria.

However, the industry is also grappling with challenges, “for H1 2023, one of the challenges we faced as an industry from a macro perspective was rising inflation, devaluation and rising interest rates,” said David Owino, Chairman, EAVCA during the conference, which also marked the 10th anniversary of the association.

As the region continues to grow, the focus is shifting towards a critical aspect of investment: deal exits. The EAVCA report dubbed, “The Evolution of Private Capital in East Africa,” reveals intriguing insights into the dynamics of private equity exits in the region.

Last year marked the highest level of exit activity in the region in the past decade. Even more compelling is the anticipation that 2023 is poised to surpass 2022 performance. This surge in exit activity signifies the maturation of investments made over the last seven years, as fund lives come to an end.

Data shows that the financial services sector leads in terms of the highest number of exits, totaling 14, while the healthcare and energy sectors come in second and third place, with 9 and 7 private equity exits, respectively.

Disclosed exit values

A parallel pattern emerges when we consider the disclosed exit values. Just like in the case of investments, Kenya has dominated the exit landscape with a substantial count of 36 exits, followed by Uganda with 8 and Rwanda with three. Tanzania has reported two private equity exits, while Ethiopia has recorded one exit in the last 10 years. (https://atelierdetroupe.com/)

As the East African investment ecosystem evolves, exits become not only an outcome but also a vital prerequisite for first-time fund managers seeking to secure follow-on funds, particularly from Development Finance Institutions (DFIs) that are heavily invested in the region.

Private equity investors typically opt for one of three main methods to exit their investments: selling to industry competitors, conducting secondary buyouts, or engaging in Management Buyouts (MBOs).

While selling to industry competitors remains a prominent choice, the landscape of exit strategies is undergoing notable transformations.

Secondary buyouts are now gaining prominence, surpassing trade player sales in popularity, EAVCA report notes. Additionally, the profile of potential buyers is expanding to encompass pan-African and regional purchasers.

This shift towards secondary buyouts is a recent development, influenced by various factors. These include a relaxation of restrictions related to secondary buyouts, a rise in the number of funds willing to undertake majority transactions, and an increasing focus on secondary capital-only transactions.

Average holding periods and challenges

Between 2014 and the first half of 2023, the industry’s average holding period was approximately seven years. There was, however, a general downward trend until the onset of the COVID-19 pandemic.

These statistics are remarkable given East Africa’s turbulent macroeconomic environment, geopolitical instability, and drought during this period. These external factors often influence profitability and valuation, making private equity exits a complex process.

Looking ahead, it is expected that as investors increasingly focus on mature companies, driven by larger ticket sizes, the average holding periods will continue to decline. This trend aims to align more closely with the global industry average of approximately six years.

However, it’s essential to recognize that the holding period is not a one-size-fits-all metric. Sectors with high idiosyncratic risks, such as agriculture, and project-based sectors like energy, may necessitate holding periods of at least 10 years to realize significant value from investments. These extended timelines underscore the patience and commitment required for certain industries to flourish, EAVCA report notes.

Prospects for the future

The growing trend of exit activity in East Africa reflects the region’s increasing maturity in the private capital space. Investors are not only drawn to the potential for high returns but also to the prospect of successful private equity exits.

As the ecosystem continues to evolve, stakeholders are expected to adapt to shorter holding periods, driven by the desire for quicker returns on investments.

To navigate these changes successfully, market players must remain vigilant and agile, continually assessing the evolving investment landscape and responding to external factors. Developing robust exit strategies, especially in sectors with longer gestation periods, will be essential for realizing the full potential of investments.

Evolving landscape of private equity in East Africa

The East African private equity landscape has witnessed transformation since 2013. With a total of 427 Private Equity and direct DFI investments worth about $7.3 billion recorded in the region between 2013 and H1 2023, the sector has exhibited resilience and adaptability in the face of various challenges.

“Over the course of 10 years, we have witnessed an unprecedented surge in investments that target innovative startups and visionary technologies,” notes Joshua Murima, Head, Investor Relations at research and market intelligence firm Briter Bridges.

However, the growth experienced a temporary setback in 2017 due to the Kenyan elections, which caused uncertainty and a subsequent dip in investments. In 2019, the sector hit a notable peak when 59 investments were recorded.

The year 2020 marked another turning point in the region’s private equity landscape. The COVID-19 pandemic, along with economic and civil restrictions, led to a dip in investments. Additionally, uncertainty associated with elections also contributed to the decrease in investment activities.

Despite these challenges, there is optimism that the declining trend will reverse in the medium term. Investors are eyeing East Africa’s positive fundamentals, such as attractive demographics, relative political stability, and a substantial infrastructure base. The region’s resilience in the face of macro and market challenges over the last eight years supports this expectation.

Read Also: Mauritian private equity fund Shorecap buys stake in Kenyan bank

Shift towards larger ticket sizes

One notable shift in East African private equity is the focus on larger ticket sizes. While the number of deals may have decreased, the total disclosed deal values have increased. This shift is indicative of investors’ growing confidence in the region’s potential for higher returns. The rise in median and average deal sizes is evidence of this trend.

Region-specific funds have played a crucial role in this transformation. Rather than raising numerous follow-on funds, these funds are increasingly focusing on larger-scale investments. This strategy aligns with the changing dynamics of the East African private equity landscape.

Record-breaking deal values

In recent years, East Africa has seen remarkable growth in private equity deal values. The past decade has seen a consistent increase in total disclosed deal values, culminating in record-breaking figures. Notably, the previous year recorded the largest deal values in the last decade, and 2023 is on track to surpass this record.

The first half of 2023 has already witnessed a total disclosed deal value of $792 million, compared to the previous year’s total of $994 million.

This indicates sustained investor interest and confidence in the region, despite the challenges posed by the pandemic and election cycles.