In the business performance update for listed Lafarge Cement Zimbabwe Limited for the six months period covering January to June 2022.

The company said the volume of cement sold declined by 56 per cent compared to the same period last year.

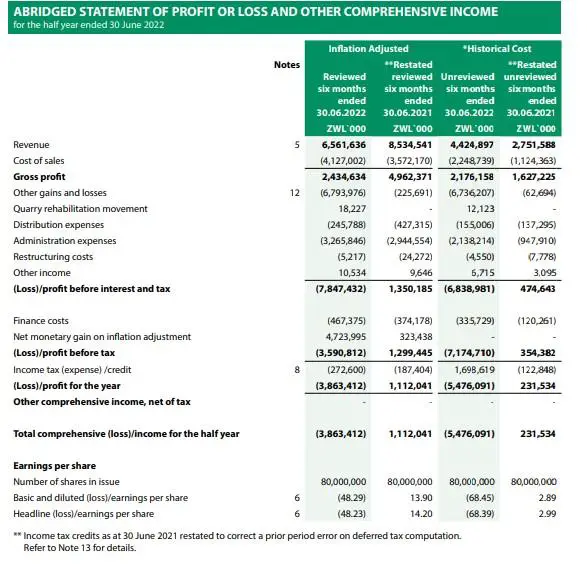

This resulted in the Company’s inflation-adjusted revenue reducing by 23 per cent to ZWL 6.6 billion compared to ZWL 8.5 billion reported in the same period last year. (bluffsrehab.com) The gross profit margin fell by 21 per cent to 37.1 per cent compared to 58.1 per cent recorded last year as the company resorted to selling clinker, an intermediary product for sustenance.

- The combination of the reduction in sales revenue, squeezed gross margins, increased operating costs and an increase in foreign exchange losses resulted in the company posting an operating loss of ZWL 7.8 billion compared to a profit of ZWL 1.4 billion for the same period in 2021.

- There are investments expected to double the company’s cement production capacity and improve raw material availability to the new DMO plant.

- Among them is the new Vertical Cement Mill (VCM) commissioning which started in Q2 2022. In addition, there is the refurbishment of silos which will help to increase the storage capacity of cement and to solve the dispatch bottle necks.

For the period under review, the combination of the reduction in sales revenue, squeezed gross margins, increased operating costs and an increase in foreign exchange losses resulted in the company posting an operating loss of ZWL 7.8 billion compared to a profit of ZWL 1.4 billion for the same period in 2021. However, the EBITDA performance for H1 2022 of ZWL 0.47 billion remains above the half-year budget for 2022.

As at the reporting date, the company’s current liabilities exceeded current assets by ZWL 1,677,572,000 (December 2021: ZWL 777,266,000) and the Company reported a net comprehensive loss for the period of ZWL 3,863,412,000 (June 2021: net comprehensive income of ZWL 1,112,041,000) and accumulated loss of ZWL 1,372,317,000 (December 2021: ZWL 2,491,095,000 retained earnings).

The company’s performance was mainly affected by several reasons, including the roof collapse in 2021 which halted production and resulted in low revenues.

Another factor is foreign currency exchange losses incurred on the related party borrowing of US $32 million and related party payables. As a result, the company has not been able to generate sufficient cash flows to settle short-term borrowings due to external parties. The decommissioning of cement mill 1 to make way for the commissioning phase of the VCM also adversely affected cement volumes.

Although the decline in revenue is partly attributed to the decommissioning one of the existing cement ball mills to make way for the installation of the new Vertical Cement Mill (VCM). The new VCM which is anticipated to be fully operational by Q4 2022 is expected to revive production and income.

If you are just wondering what a VCM is, cement mills are the milling machines used in cement plants to grind hard clinker into fine cement powders. Cement ball mill and vertical roller mill are two most widely used cement mills in today’s cement grinding plants.

The vertical cement mill (VCM) is a type of grinding machine for raw material processing and cement grinding in the cement manufacturing process. The VCM are favoured because of their features like high energy efficiency, low pollutant generation, small floor area, and more.

“The commissioning process of the new VCM started in Q2 2022. The Company will essentially double its cement production capacity and improve raw material availability to the new DMO plant. The launch of the new VCM will reposition the Company on a growth path into the future. This will have a positive effect on the Company’s revenue generation and profitability,” said K. C. Katsande, Chairman of the Board of Directors.

Read: Ruto Presidency: Time for Dangote cement factory in Kenya?

He added that they are confident that volumes will continue to grow in the second half of the year in line with strategic objectives. With demand driven by individual home builders and Government infrastructure development projects.

“Binastore and Aggregates as with Dry Motors are anticipated to post good growth in H2. The overall market demand continues to grow driven by the individual home builders’ segment as well as the ongoing major Government infrastructure development projects.”

There are investments expected to double the company’s cement production capacity and improve raw material availability to the new DMO plant.

Read: BUA Cement chair, Adbulsamad Rabiu, now Nigeria’s second richest person

These include implementation of the previously announced US$25 million capital expansion programme. Following the successful installation of alternative power infrastructure in 2020 and the successful completion of the automated Dry Mortars (DMO) Plant in 2021, the new Vertical Cement Mill (VCM) commissioning started in Q2 2022. In addition, there is the refurbishment of silos which will help to increase the storage capacity of cement and to solve the dispatch bottlenecks.

Meanwhile, as advised on October 7, 2022, the latest trading update further highlighted that Associated International Cement Limited are still working towards the consummation of the Sale and Purchase Agreement. As of June 27, 2022, shareholders and members of the investing public were advised that Associated International Cement Limited, a member of the Holcim Group, had entered into a binding agreement for the sale of its 76.45 per cent stake in Lafarge Cement Zimbabwe Limited to Fossil Mines (Private) Limited.

Read: Chinese cement giant fails to acquire Lafarge Cement Zimbabwe

Lafarge closed on November 9, 2022 at ZWL 124.00 per share on the Zimbabwe Stock Exchange (ZSE), recording a 3.3 per cent gain over its previous closing price of ZWL 120.00. Lafarge Cement began the year with a share price of ZWL 80.00 and has since gained 55 per cent on that price valuation.

According to African ‘Xchanges, Lafarge Cement Zimbabwe is the 40th most traded stock on the Zimbabwe Stock Exchange over the past three months. Lafarge Cement has traded a total volume of 89,200 shares valued at ZWL 9.54 million over the period, with an average of 1,416 traded shares per session. A volume high of 39,300 was achieved on August 16, 2022 for the same period.

Read: Cementing the Deal: Tanzania’s booming limestone industry