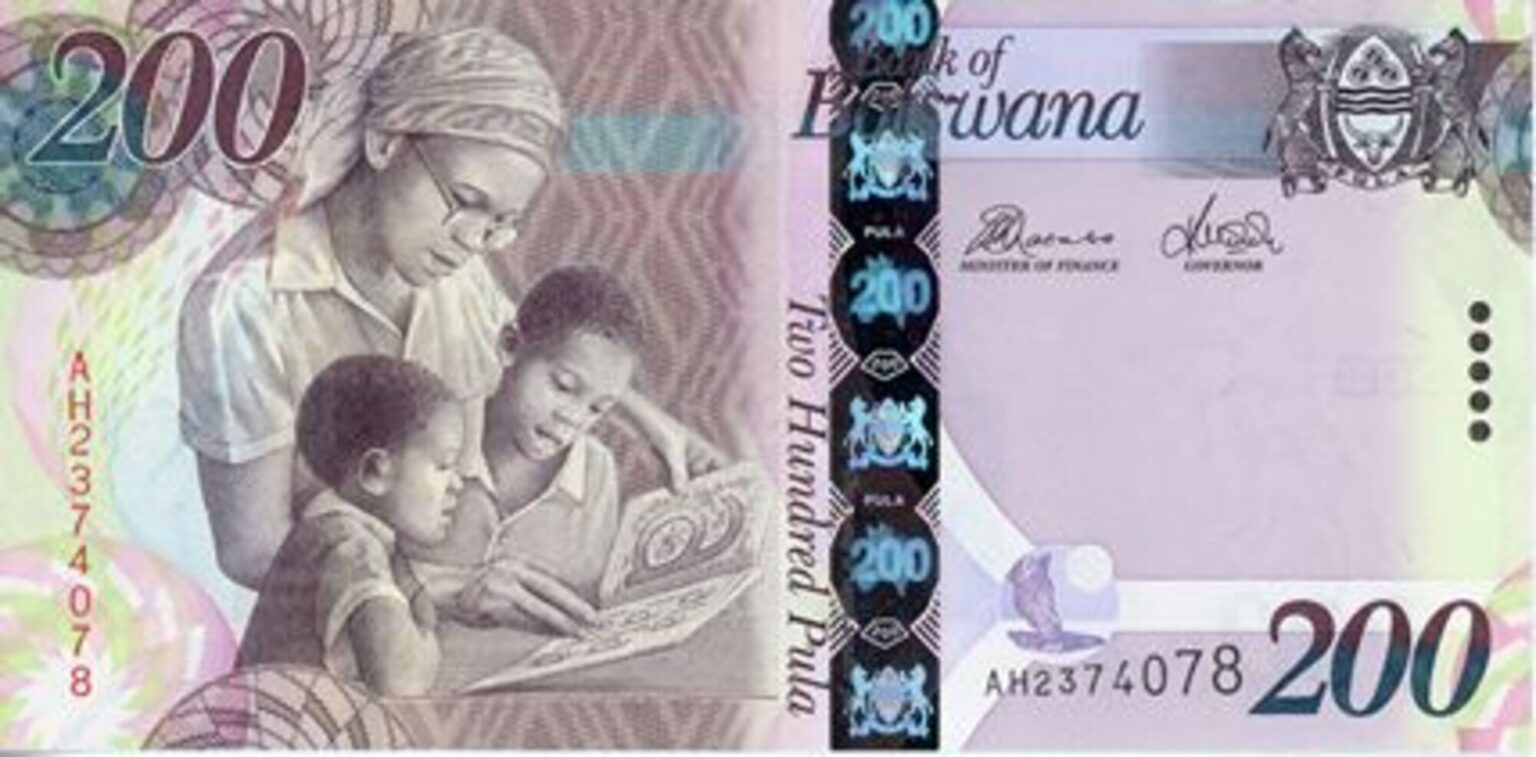

- One of the driving forces behind nation’s economic success is the Botswana Pula (BWP), the country’s currency.

- last year the local currency fell by 8.1 per cent against the US dollar, one of the single most important currencies for the local economy as it is the trading currency for rough diamonds.

Botswana, is known for its stable democracy, strong economy and of course economic transparency. The country has been rated as the least corrupt nation in Africa, a feat that is uncommon among neighbours that fall prey to bribery and graft. One of the driving forces behind nation’s economic success is the Botswana Pula (BWP), the country’s currency.

The Pula, which means “rain” in the Setswana language, was first introduced in 1976, replacing the South African Rand. It has since maintained a strong parity against major currencies, such as the US dollar and Euro, demonstrating strength in a region that generally has weak currencies. As a result of the country’s economy, which is primarily dependent on natural resources such as diamonds, copper and nickel, the country decided to invest in building its economy.

The national infrastructure has enabled an environment that has sought to improve infrastructure from tourism and hospitality to banking. This has of course added to further investments, supporting foreign exchange earnings and further bolstering the Pula.

Trade is also positively affected by the Pula. The strong currency allows Botswana to import goods at lower prices, while also making its exports more competitive on the international market. Additionally, the Pula has helped to control inflation, which is a crucial factor in keeping the economy stable.

Despite these benefits, there are also challenges and criticisms associated with the Pula. One of the main criticisms is that Botswana’s economy is too dependent on natural resources, making it vulnerable to fluctuations in the global market. Additionally, there is a lack of diversification in the economy, making it difficult for small businesses to thrive. In certain cases, the strong Pula is also a disadvantage for small businesses making it more difficult to export goods, which in turn affects their competitiveness.

Data released by the Bank of Botswana indicates that last year, the local currency fell by 8.1 per cent against the US dollar, one of the single most important currencies for the local economy as it is the trading currency for rough diamonds. While dropping against the greenback helps the export allure of diamonds for buyers in the United States, the strong US dollar gained significantly against other hard currencies during the year, which impacted the affordability of diamonds for buyers in other countries.

The Pula’s slide against the US dollar also meant more pressure on local fuel prices, which increased several times in 2022, before easing toward the end of the year.

Historically, the Botswana Pula performed well over the past five years. It has remained relatively stable against major currencies, such as the US dollar and Euro. This stability has helped to attract foreign investment and support economic growth in Botswana. According to the central bank, the Pula also shed 2.3 per cent against the Euro and two percent against the South Africa, the latter being the largest source of imports for Botswana. Inflation peaked at a 14-year high last year and while it retreated, it remains well above the BoB’s targets, with much of this attributed to food and fuel prices.

In 2022, the Pula’s only gains were against the Japanese yen, the British pound and the Chinese renminbi, by 5.8, 3.0 and 0.5 per cent respectively.

In addition to its stability, the Pula appreciated in value against other currencies. For example, in 2017 the Pula was trading at around BWP 10.5 per US dollar, but by 2020, it had appreciated to around BWP 9.5 per US dollar. This appreciation made Botswana’s exports more competitive on the international market, helping to support economic growth.

Botswana’s human capital is another important factor that has helped to attract foreign investment and support economic growth. The country has a well-educated workforce, and the government has invested in education and training programs to ensure that the workforce remains competitive. The country also has a strong infrastructure that includes well-developed transportation and communication systems.

The country is known for its political stability, which creates a favorable environment for businesses. Low corruption is also a factor that helps to attract foreign investment and create a favorable environment for business.

Regional integration is also important for Botswana’s economic growth. The country has a strong focus on regional integration and has been actively participating in the Southern African Development Community (SADC), which helps to promote trade and economic growth.

Read: Africa’s 6 strongest economies post-pandemic

In conclusion, the Botswana Pula is playing a key role in driving economic growth in the country. As globalization increases and interconnectivity between businesses expand across Africa, Botswana must focus on diversifying its economy and finding ways to support small businesses. The future of Botswana’s economy is bright, but it’s important to be aware that only if the country continues to implement sound economic policies, investing in people and continue its fight on corruption will it serve the national interest of the country.

Read: AfDB supports Botswana development finance agency with $80m