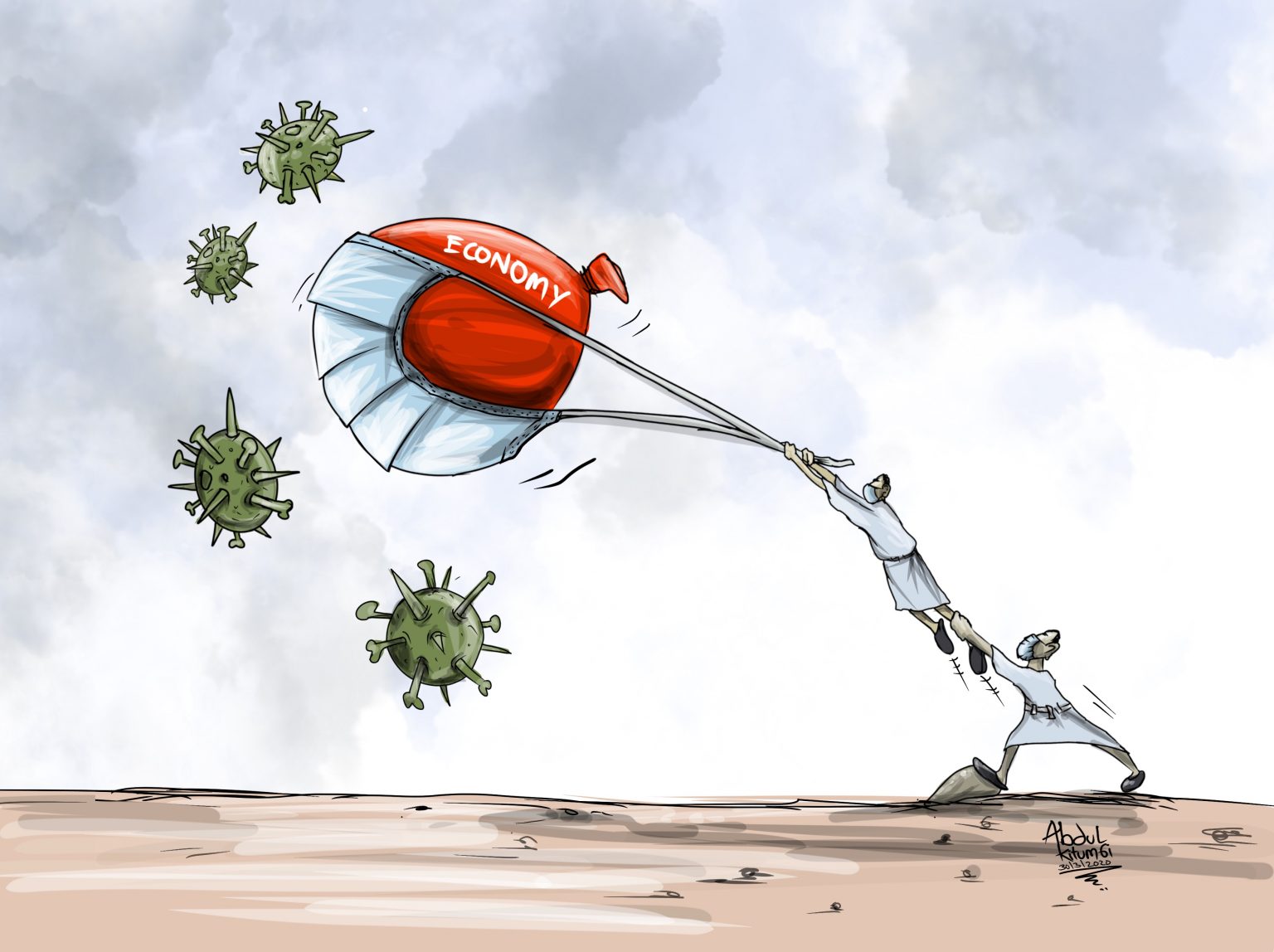

In anticipation of an extreme business environment brought about by the Coronavirus, various players in the African region are rolling out rescue plans for businesses. Economists have voiced their concerns of an extremely difficult economic situation and have urged players to brace for a rough 2020. Heeding such calls is EquaLife Capital, the East African

[elementor-template id="94265"]