- Fintech BKN301 will significantly aid MENA region’s fintech sector, which experts project to reach $3.45 billion by 2026.

- Two of the world’s three largest remittance corridors located in the UAE and Saudi Arabia handled $78 billion in payments in 2020, 6 equating to 7 percent of the GDP of the two nations combined.

- Currently, fintech companies attracted 48.3 percent of known startups funding on the continents in 2021 and 43.3 percent in 2022.

Fintech heavyweight BKN301 is eyeing fresh growth opportunities in the Middle East/North Africa (MENA) market, where the firm seeks to deploy its leading innovations in the industry. Its entry into MENA is set to accelerate the adoption of digital currency, even as expert project that the region’s market will grow to $3.45 billion by 2026.

MENA fintech market on the rise

Africa’s digital transformation is paving the way for numerous advancements within the continent’s economy. Regional economies are fast adopting innovations such as e-commerce, fintech services and digital currency as individuals and businesses trade with global players.

With increased adoption of technology by countries, the fintech industry is providing financial inclusion to higher number of people across the region. This is fast turning MENA market to one of the most prominent regions for trade globally. Until the adoption of fintech, the vast MENA region lacked well-established financial institutions, hindering small and medium-scale businesses from trading effectively.

The MENA market brings together Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates and Yemen. But due to the diversity of the MENA market, finding adequate financial services has hindered it from truly embracing its full potential.

Read also: MENA economy to rebound to 4 percent in 2021

A secure financial landscape

Fintech BKN301 is one of the leading payments and banking-as-a-service providers that have been seeking a piece of MENA market for some time. Its entry into the zone will see BKN301 pave the way for a more efficient and secure financial landscape with innovative solutions and digital currency applications.

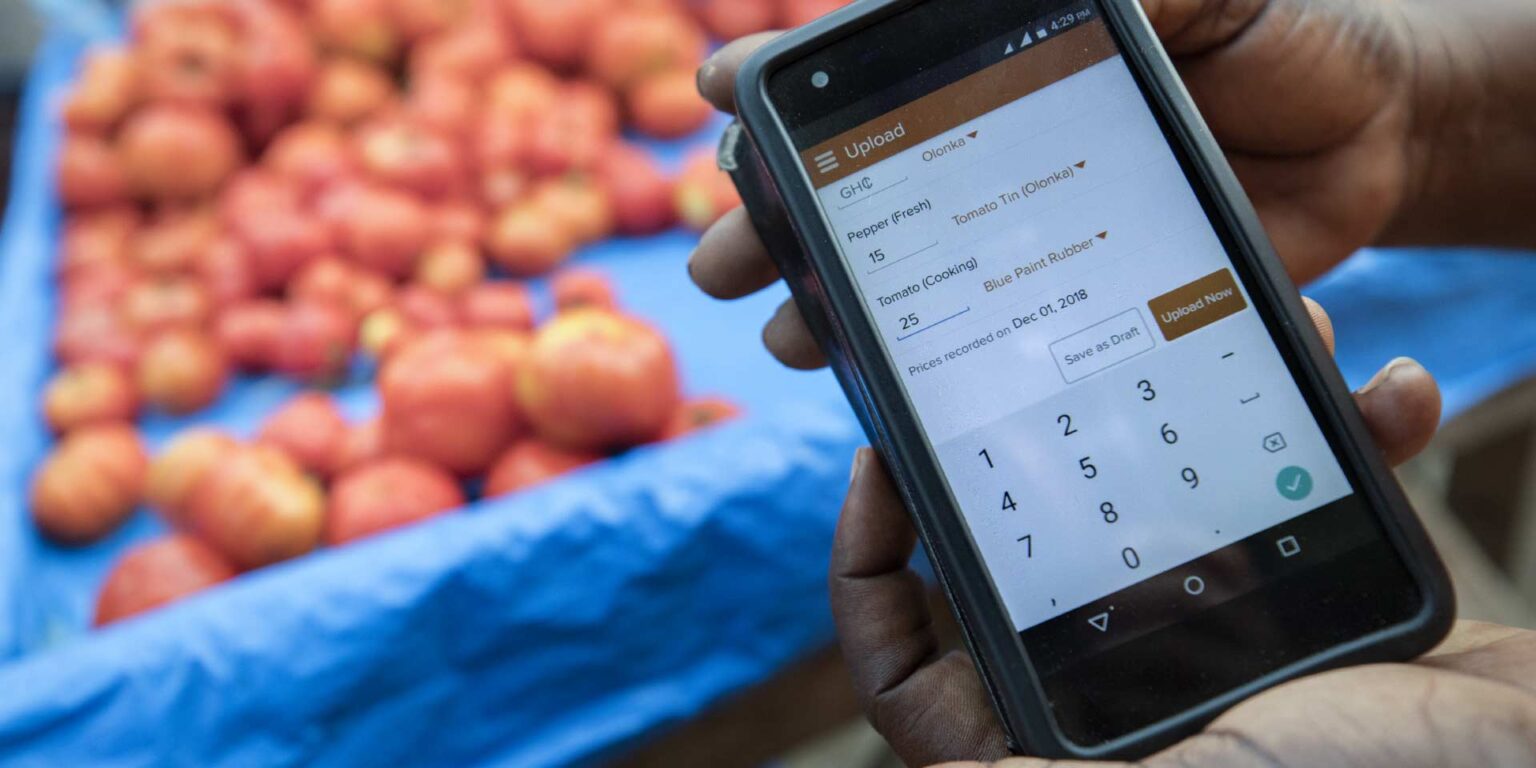

According to the World Bank, the number of unbanked traders within the region accounts for at least 50 percent of its 500 million population. This presents a huge opportunity for growth as fintechs. Fortunately, BKN301 will be rolling out cutting-edge payment products and services. From mobile wallets to remittances to peer to peer transactions, the firm looks set to stir the market.

The San Marino based company says their systems will cater to various customers’ financial demands and requirements. Furthermore, it will seek to bridge the financial inclusion gap across MENA market, allowing merchants to send and receive digital currency without the cumbersome processes of converting their funds into a common currency. The region’s fintech potential remains huge with experts projecting it will hit $3.45 billion by 2016.

Providing solutions for the MENA market

Africa’s fintech industry is rapidly growing due to its ability to widen the scope of businesses. It allows entrepreneurs, organizations and individuals to send and receive fiat or digital currency while avoiding cumbersome banking processes.

Read also: Remittance to Kenya increases but drops in Uganda

“Cross-border payments are important in the Middle East, with two of the world’s three largest remittance corridors located in the UAE and Saudi Arabia. They handled $78 billion in payments in 2020,6 equating to 7 percent of the GDP of the two nations combined,” the company said.

Convenient payment services

In Egypt, BKN301 has established itself through its partner, Damen ePayment, while in oil-rich Qatar through its commercial branch in Doha. Their efforts have emphasised cross border payments’ importance, which they note is a must-have feature in MENA markets.

Stiven Muccioli, Founder and CEO of BKN301 said: “We are excited to offer our cutting-edge payment services in the MENA region and contribute to the growth and development of the region’s fintech sector. The MENA region has seen a significant increase in the usage and adoption of innovative technologies across all domains. Customers within MENA market have turned to Africa’s fintech industry for faster and more convenient payment services. Due to this reason, we at BNK301 fintech have dedicated to providing our partners and clients with the best possible services and solutions.”

Africa’s fintech revolutionising finance

Africa’s fintech industry is a product of blockchain developers understanding the intricate functionalities of digital currency. After developers and enterprisers were awed at the success of organizations such as M-PESA, it became clear that digital currency was the next step.

Since then, organizations such as Flutterwave, YellowCard and others have flooded the economy. Currently, fintech companies account for 48.3 percent of known startups funding on the continents in 2021 and 43.3 percent last year.

Africa’s fintech revolutionising finance

Africa’s fintech industry is a product of blockchain developers understanding the intricate functionalities of digital currency. After developers and enterprisers were awed at the success of organizations such as M-PESA, it became clear that digital currency was the next step.

Since then, organizations such as Flutterwave, YellowCard and others have flooded the economy. Currently, fintech companies account for 48.3 percent of known startups funding on the continents in 2021 and 43.3 percent last year.

Read also: Agriculture ministers commit to focus on innovation, profitability of Farmers

Their applicability and lucrative momentum have gained much recognition within the continents. Today more businesses prefer using digital currency or mobile money as a payment method. This increases the scope of their reachability and improves other industries, such as the Telecommunication Industry and Ecommerce.

Africa’s fintech industry is fundamental to the continent’s digital transformation, and its economic value is evident in countries such as Nigeria, Kenya and South Africa. With BKN301 fetch taking a stand for the MENA market, it’s only a matter of time before full adoption occurs.