- Insurance firms in Kenya registered 12.2 percent jump to $2.3 billion in premiums attributable to continued economic recovery from the negative effect of COVID-19 in 2020 and 2021.

- Long-term insurance business premiums grew by 13.8 per cent to $1 billion compared to $921 million in 2021 with life assurance accounting for 25.2 per cent.

- General insurance premiums amounted to $1.2 billion with medical and motor insurance classes maintaining a leading position in terms of contribution at 32.5 percent and 31.9 percent respectively.

Insurance companies in Kenya reported a 12.2 per cent increase in premiums to $2.3 billion in the three months ending December 2022, the latest report from the Insurance Regulatory Authority (IRA) shows.

In the quarter, long term insurance business premiums increased by 13.8 percent to $1 billion compared to $921 million during a similar period in 2021. Deposit administration and life assurance classes remained the biggest contributors to the long-term insurance business accounting for 35.9 percent and 25.2 percent respectively.

The industry regulator attributes the growth to the continued economic recovery from the economic fallout triggered by the COVID-19 pandemic. In the period under review, general insurance premiums amounted to $1.2 billion with medical and motor insurance classes leading in contribution at 32.5 percent and 31.9 percent respectively.

Personal accident and miscellaneous classes are the only businesses whose premiums decreased by 2.5 percent and 12.4 percent respectively. General insurance business underwriting results improved to a loss of $27 million in Q4 2022 from a loss of $47 million in the comparable quarter with the workmen’s compensation class making the highest underwriting profit of $19 million while motor private, motor commercial and medical classes suffered the highest underwriting losses of $30 million, $26 million and $5.4 million in that order.

Under the general insurance category, claims incurred went up to $578 million during the period under review representing an increase of 10.7 percent from $522 million reported in the fourth quarter of the previous year. Medical had the highest incurred claims at 41.9 percent, followed by motor private at 24.8 percent and motor commercial at 23.4 percent.

Read: Rwanda’s Universal Health Coverage changing its economy

“Motor classes of insurance business incurred claims contributed 48.2 percent of total claims incurred compared to their business contribution of 31.9 percent of the total premium under general insurance business,” the report explains. The claims paid under general insurance increased by 12.9 percent to $538 million compared to $476 million paid during a similar quarter a year earlier.

Medical, motor private and motor commercial had the highest amounts of paid claims at 43.5 percent, 24.9 percent and 21.9 percent respectively of the total industry claims honoured under general insurance business.

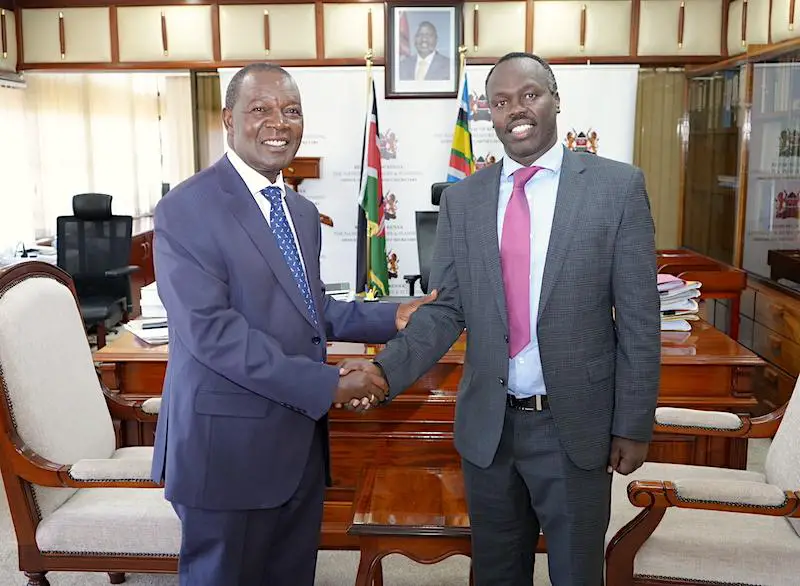

“The three classes jointly constituted 90.3 percent of all claims paid by general insurers,” Godfrey Kiptum, IRA Commissioner-General said in the fourth quarter report. The reinsurers’ business volume increased by 26.1 percent to $293 million in the quarter compared to $232 million in 2021.

Underwriting results also improved significantly to a profit of $10.2 million in Q4 2022 from a profit of $5.6 million in Q4 a year earlier.

Among the six top insurance companies, Old Mutual maintained the top position with 8.8 percent of premiums market share while APA Insurance improved to second, outpacing GA insurance, which is now commanding a similar share with CIC insurance with 8.2 per cent of the premiums market.

Regional insurance Britam maintained its market share even as Jubilee Insurance lost its grip in the industry from 6.3 percent of the premiums market share to 5.3 percent.

The uptake of insurance cover, both at the corporate and personal level in Kenya is concentrated in the motor, fire industrial, and personal accident, mainly group medical cover classes through companies and groups. Low penetration of insurance in the Kenyan market, relative to other more developed markets is attributable general lack of a savings culture among Kenyans.

Low disposable incomes for the majority of the population and well as inadequate tax incentives that could stimulate the purchase of life insurance products also hurt the industry.

A perceived credibility crisis of the industry in the eyes of the public especially with respect to the prompt payment of claims works to the disadvantage of the sector players.

The Insurance Regulatory Authority is a State Corporation established under the Insurance Act, Cap 487 of the Laws of Kenya with the mandate to regulate, supervise and promote development of the insurance industry in Kenya.