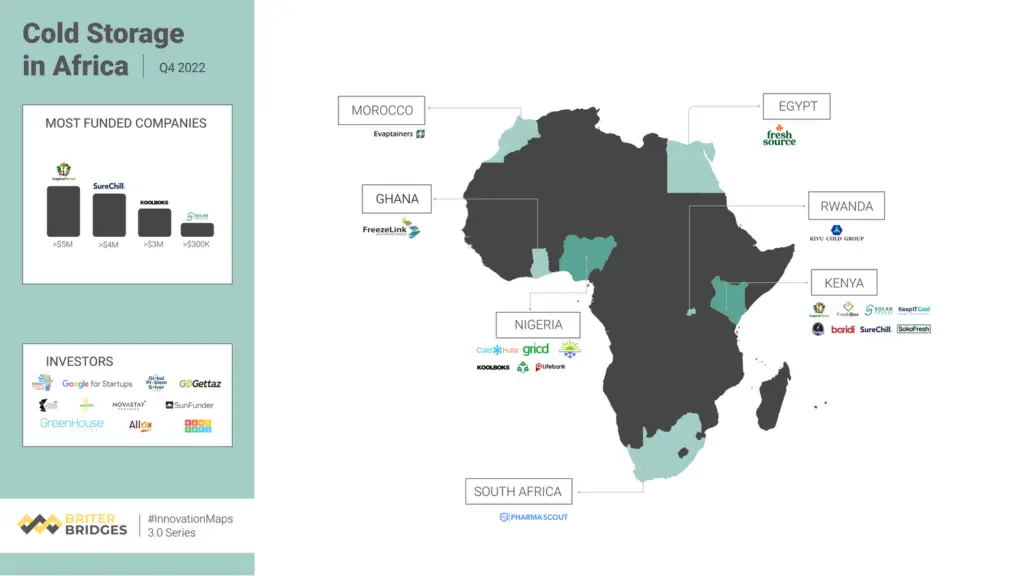

The Middle East and Africa cold chain market will expand by 7.4% to $35.1 Billion by 2028. Over one third of food from Africa is lost to spoilage or wastage partly due to poor storage capacity. Studies show that leading cause of food wastage is spoilage due to lack of cold storage systems. The demand

[elementor-template id="94265"]