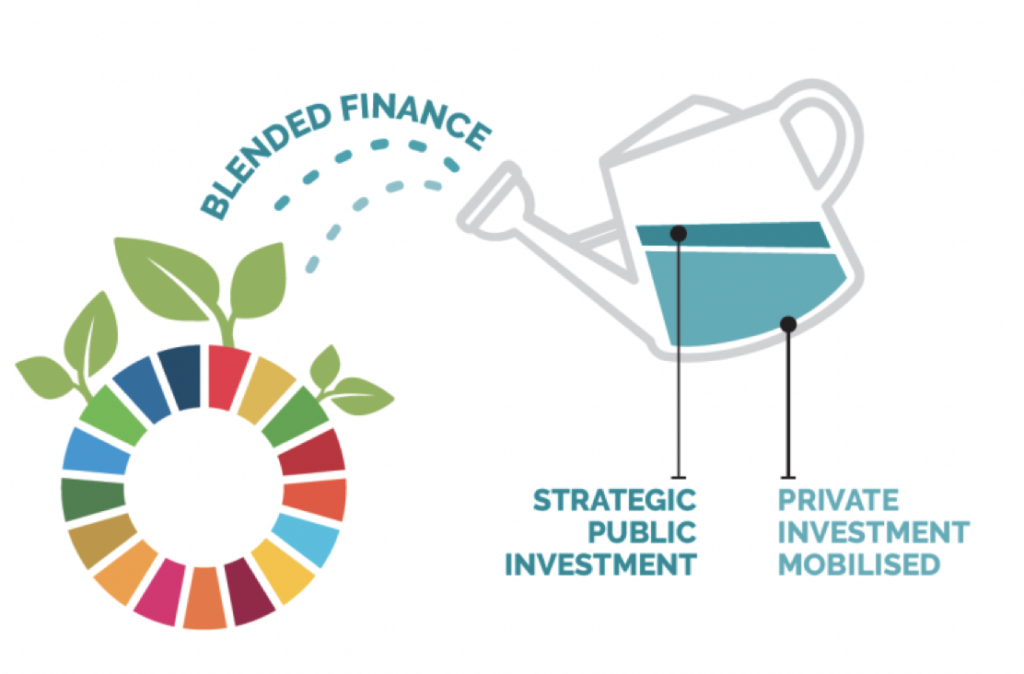

With its immense potential and vast resources, Africa stands at a critical point in its economic growth path. While the continent has promising economic prospects, it also has significant challenges that have impeded growth. A concept known as "blended finance" has gained popularity in recent years as a viable answer to assist governments in overcoming economic challenges. As a result, it is vital to look into what blended finance is, how African economies can leverage its benefits and its crucial role in supporting sustained growth across the continent.

[elementor-template id="94265"]