To help poor nations recover from shocks and engage in the global green economy, the United Nations Development Programme (UNDP) Administrator Achim Steiner has proposed a two-year moratorium on official debt.

In a speech to delegates at the eighth edition of the Tokyo International Conference on African Development (TICAD8), Steiner said that to complement domestic resource mobilization, countries like Japan must take the initiative to use their leadership in major fora, such as the G7 and G20, to assist bring about debt relief and direct essential funds and resources to Africa.

- To complement domestic resource mobilization, countries like Japan must take the initiative to use their leadership in major fora, such as the G7 and G20, to assist bring about debt relief and direct essential funds and resources to Africa

- Japan’s position as a global tech leader will be vital in helping communities roll out a variety of crucial digital solutions, from expanding the use of novel approaches to combating climate change to broadening access to financial services

- Japanese enterprises should evaluate Africa’s investment potential based on facts and not on perceptions

The UNDP Administrator said that Africa does not just need foreign investors who should have access to the supply chains of the emerging global green economy since local communities across the continent need them, too. This includes clean energy and food systems.

Steiner added that as Africa moves from the “period of aid” into a new era of investment that creates development, there are nearly endless chances for Japanese enterprises to engage more actively on the ground in Africa.

He said that Japan’s position as a global tech leader will be vital in helping communities roll out a variety of crucial digital solutions, from expanding the use of novel approaches to combating climate change to broadening access to financial services.

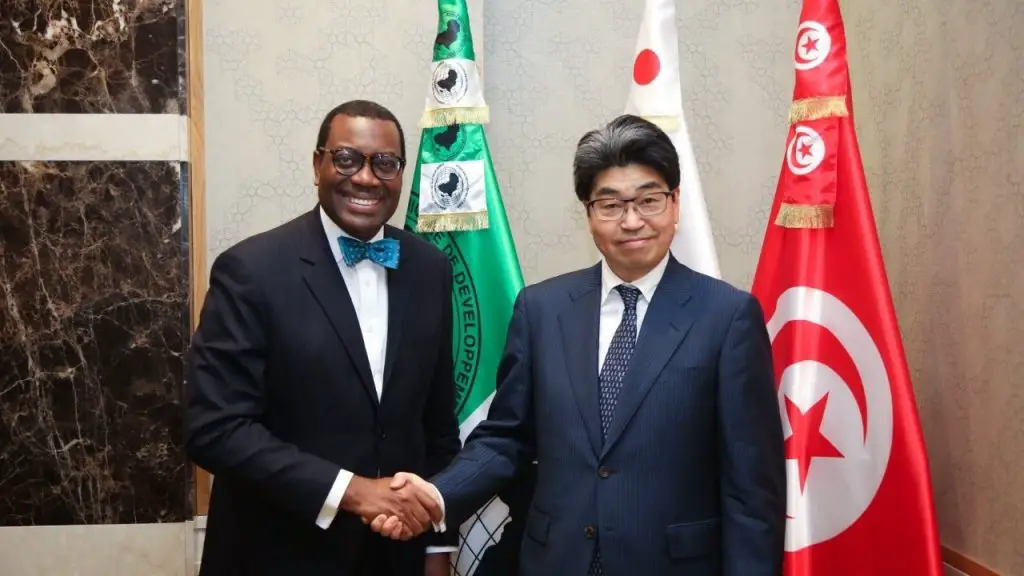

The African Development Bank (AfDB) President Dr Akinwumi Adesina has urged Japanese corporations to invest more in Africa, where investment prospects and returns are among the highest in the world.

Speaking during the just concluded TICAD8 in Tunisia, Adesina praised Japan’s government and corporate sector for supporting Africa’s development.

He said that Japanese enterprises should evaluate Africa’s investment potential based on facts and not on perceptions.

Adesina said that Moody’s Analytics assessed global infrastructure debt default rates by area in 2020 and after the Middle East, Africa has the second-lowest cumulative default rate. He added that infrastructure in Africa is robust, secure, and profitable.

A number of African heads of state and several official delegations (FMs, ministers of economics and trade, and diplomatic corps) from 48 countries attended the August 27-28 meeting in Tunis.

Japanese Prime Minister Fumio Kishida announced by video link that Japan had reached its target of providing US$20 billion to Africa in the private sector by 2019. Kishida made commitments that with the AfDB, Japan will co-finance up to US$5 billion to help Africans.

Senegal’s President Macky Sall claimed Japanese firms have the technical and financial capacity to establish up partnerships in Africa while Moussa Faki Mahamat, who is the African Union Commission chair praised Japan’s education and training achievements. He lauded a Japanese effort that taught nutrition to 1,000 young Africans.

African countries would need major financial resources to deal with Covid-19, climate change, and Russia’s war in Ukraine said the African Development Bank chief.

“Now is the time to assist the African Adaptation Acceleration Program to mobilize $25 billion for climate adaptation in Africa,” Adesina added.

AfDB’s African Emergency Food Production Facility, started in May 2022, is providing US$1.13 billion to 24 nations for emergency food production. The Bank approved the facility early in 2022 to prevent the Ukraine war’s food and fertilizer disaster.

JICA contributed US$518 million towards putting up the facility. At the same time, during a business roundtable, Adesina called for stronger Japanese engagement in bilateral trade and investment. Africa received 0.003 per cent of Japan’s US$2 trillion in worldwide FDI.

He said Japanese corporations that invested boldly in Africa were succeeding. Toyota Tsusho’s investment in South African auto manufacturing earned US$8.5 billion in March 2022. Komatsu and Mitsubishi Heavy Industries were other companies that got returns from their investments.

Adesina praised Africa’s youth, entrepreneurship, and innovation “Afri ca’s fintech ecosystem is spearheading the continent’s digital revolution and has world-leading potential. The continent has 576 young finance startups.”