- d.light and impact investor African Frontier Capital have joined forces on new financing to support consumer loans for solar and high-efficiency appliances in East Africa.

- The US-headquartered firm will use the new financing to enhance its PayGo consumer finance offering.

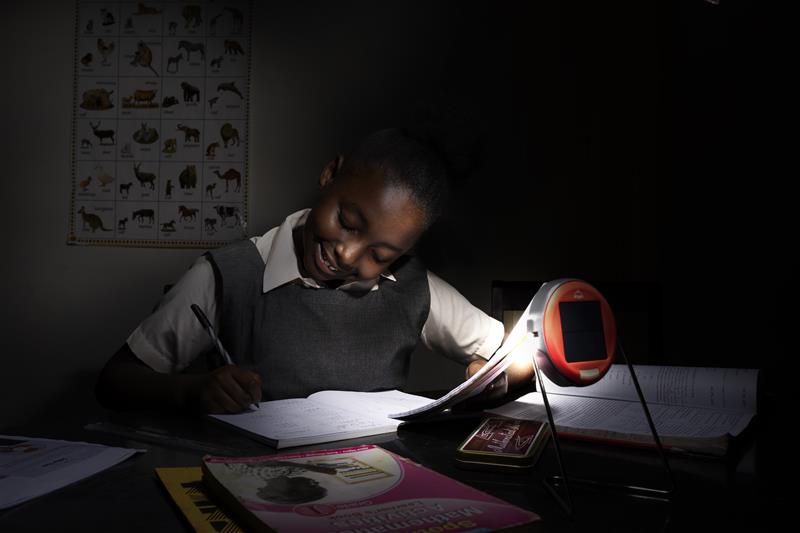

- d.light seeks to make solar-powered products available to more low-income households and communities.

Off-grid solar provider d.light, has secured a new securitization funding worth $176 million from social impact-focused asset management company African Frontier Capital (AFC) to enhance access to green energy-powered applicances in Kenya, Tanzania, and Uganda markets.

The California-based company said it will use the new financing to enhance its PayGo consumer finance offering as the firm seeks to make solar-powered products available to more low-income households and communities in the target markets.

“This new facility is another landmark step in d.light’s mission to provide people with affordable energy that is also clean, safe and sustainable. It lets us expand our reach so that millions of off-grid families across Kenya, Tanzania and Uganda can experience the benefits of solar energy,” said d.light Chief Executive Officer Nedjip Tozun.

Eric De Moudt, AFC’s Founder and CEO, said, “This milestone is a testament to how data-driven financial innovation can play an important role in bringing financial inclusion to the world’s most vulnerable communities, helping them to gain access to clean and modern energy and the ensuing social and economic benefits that come about as a result. We are grateful to d.light for its ongoing leadership in the off-grid solar sector and proud to partner with such a visionary company.”

d.light plan seeks to connect six million people with off-grid solar energy

According to d.light, the new funding is multi-currency and will enable access to reliable, renewable energy for an estimated six million people in Kenya, Tanzania and Uganda by 2027.

With the latest financing boost, d.light says it has now closed securitized financing with a total combined purchasing value of $718 million in five separate facilities since 2020. Since its establishment in 2007, d.light has sold nearly 30 million products, including solar lanterns, solar home systems, TVs, radios, and smartphones. Overall, the company says it has positively impacted the lives of over 150 million people, mainly in Africa.

“Facilities like this make possible our pioneering PayGo consumer financing model with which we are able to offer solar home systems and high efficiency appliances to the people that need them most in a way that is affordable and sustainable,” added Tozun.

Tozun continued, “With this new facility, d.light has for the first time in its history receivables-based financing facilities in each of our PayGo markets – Kenya, Uganda, Tanzania, and Nigeria. These facilities allow d.light to remain consistently cash flow positive and remove the requirement for further external equity fundraising to fund our growth.”

d.light has a proven track record in the use of securitized finance to support its solar-powered household products in sub-Saharan Africa. It has previously set up four facilities, beginning in 2020 and including two in Kenya and one each in Nigeria and Tanzania. The combined purchasing value of these existing facilities plus the new facility is $718 million.

Read also: d.light and Chapel Hill Denham ink $7.4M deal for solar projects in Nigeria

Pay-As-You-Go Solar Home System accounts

In February, this year, d.light announced that its $110 million securitization facility, Brighter Life Kenya 1 Limited (BLK1) successfully repaid its entire senior debt in full and ahead of schedule from internally generated cash flows – the first facility in the off-grid solar sector to do so.

BLK1 was a financing vehicle that was established in 2020 by AFC. During its two-year commitment period, BLK1 managed to secure over $110 million Pay-As-You-Go Solar Home System accounts from d.light’s operations across Kenya.

According to the entity’s February update, BLK1 managed to see up to 1.5 million people in Kenya living off-grid benefit from improved and reliable energy access, enjoy financial inclusion as well as offer them solutions that foster resiliency to climate change.

Additionally, BLK1 initiatives powered the creation of $67 million in additional income for the Kenyan economy and its consumers while helping prevent the emission of an estimated 460,000 tonnes of CO2.

Some of the leading lenders in the BLK1 platform were the United States International Development Finance Corporation (DFC), which acted as the original cornerstone senior lender, and the Norwegian Investment Fund for Developing Countries (Norfund).

d.light has been working with distribution partners in Kenya, Uganda and Tanzania since 2010, and has had its operations in Kenya since 2011, in Uganda since 2015, and in Tanzania since 2016.