- Kenya, Tanzania braces for torrential floods as Cyclone Hidaya approaches

- EAC monetary affairs committee to discuss single currency progress in Juba talks

- Transport and food prices drive down Kenya’s inflation to 5% in April

- Payment for ransomware attacks increase by 500 per cent in one year

- History beckons as push for Kenya’s President Ruto to address US Congress gathers pace

- IMF’s Sub-Saharan Africa economic forecast shows 1.2 percent GDP growth

- The US Congress proposes extending Agoa to 2041, covering all African countries

- Millions at risk of famine as fuel tax row halts UN aid operations in South Sudan

Browsing: Access Bank

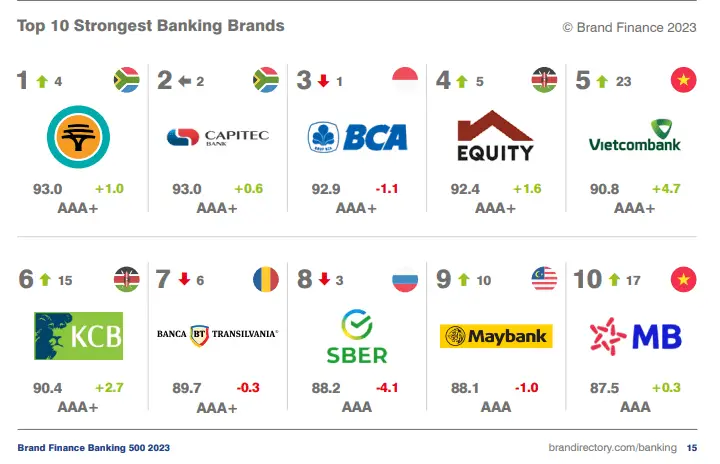

- South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

- South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

- Kenya’s Equity bank came in 6th position followed by National Bank of Egypt in 7th position while Nigeria’s Access Bank and Zenith Bank followed at 8th and 9th position respectively as Egypt’s Banque Misr closed the regional to ten list.

South African Banks topped the list of the world’s top 500 most valuable banking brands in Africa according to Brand Finance Banking 2023 report.

The report shows South Africa scooped the first top five spots in Africa headlined by First National Bank ranking at number 155 worldwide albeit a drop from 146 the previous year.

Other banks who …

- Centum Investment Company has aborted its plans to sell its majority stake at Sidian Bank to Nigeria’s Access Bank PLC after a time lapse in effecting the $34 million deal.

- The Long Stop Date of the Share Purchase Agreement has passed without all the conditions being fulfilled or waived, despite the support and guidance of the Central Bank of Kenya.

- Further, Centum has not been able to reach acceptable terms with Access Bank PLC for a further extension of the Share Purchase Agreement.

Kenya’s Centum Investment Company has aborted its plans to sell its majority stake at Sidian Bank to Nigeria’s Access Bank PLC after a time lapse in effecting the $34 million deal.

Centum Chief Executive Officer James Mworia said the Long Stop Date of the Share Purchase Agreement has passed without all the conditions being fulfilled or waived, despite the support and guidance of the Central Bank of …

- Kenya’s Centum Investments has sold its entire equity stake in Sidian Bank Limited to Nigerian lender Access Bank at a cost of $36.7 million

- Centum holds 83.4 per cent of the issued shares of Sidian, directly in its own name and indirectly through its wholly-owned subsidiary, Bakki Holdco Limited

- The two parties said Sidian would eventually be merged with Access Bank’s subsidiary in Kenya to create a stronger banking institution positioned to serve the Kenyan market

Centum Investments has sold its entire equity stake in Sidian Bank Limited to Nigerian lender Access Bank at a cost of $36.7 million.

In a statement, the investment firm, the biggest in East and Central Africa, announced it had entered into a binding agreement with the West African bank.

According to the statement, Centum holds 83.4 per cent of the issued shares of Sidian, directly in its own name and indirectly through its wholly-owned …

- The firm’s CEO Olugbenga Agboola has now come forward to address claims levelled against him in an email to employees

- This is the first time the CEO has spoken in regards to the claims reported by West Africa Weekly, a Substack newsletter written by journalist David Hundeyin

- The report highlighted several allegations against the startup and Agboola including fraud and perjury to insider trading as well as sexual harassment

Over the past two weeks, Nigerian fintech startup Flutterwave has been under fire after the firm’s Chief Executive Officer was accused of allegedly committing fraud, perjury to insider trading and sexual harassment.

The firm’s CEO Olugbenga Agboola has now come forward to address these claims levelled against him.

In an email to employees, Agboola termed the allegations as false, condemning the impact these claims had had on the firm.

“I’m writing today because I want you to know how concerned I …

So far, the platform has on-boarded a network of financing partners and over 30 vehicle brands from OEMs, including key regional players like Inchape (LandRover) and CMC (Ford and Eicher Trucks) in East Africa and Dana (Kia), Coscharis (BMW, Landrover), Globe (Mercedes Benz) , Elizade (Toyota) in West Africa.

Autochek is also working closely with indigenous manufacturers such as Innosson Motors and Nord Motors.

As part of the investment by Mobility54, Autochek has also partnered with CFAO (Toyota, Suzuki, Mitsubishi) across Africa to facilitate auto financing for all CFAO brands. …

Just a month after investing around $60 million to acquire a stake in South Africa’s Grobank, Nigeria’s biggest lender Access Bank has agreed to buy a majority stake in African Banking Corporation of Botswana for cash.

Last month, Access Bank invested both equity and debt in the South African bank, part of a regional expansion to tap into correspondent and trade banking deals on the continent.

The Bank is expanding across the African continent to counter stagflation and dollar shortages in Nigeria that have frustrated businesses, shrinking the lending market.

BancABC Botswana deal

According to completed agreements, Access Bank will acquire just over 78% of BancABC Botswana for an undisclosed cash sum of around 1.13 times book value as well as a two-year deferred payment.

ABC Holdings is a subsidiary of London Stock Exchange-listed group – Atlas Mara Limited.

Also Read: Kenya-based manufacturing giant sees dramatic increase in profits

The …

The financial sector in the Democratic Republic of Congo (DRC) has not been one of the most sought after in the continent. The DRC has 18 banks, five of which are local, four pan-African and nine foreign. The DRC’s ratio of bank assets to GDP at 7% lags regional peers, while only 7% of the population holds a bank account.

Similar to steps taken in markets such as Zambia and Ghana, the Central Bank of Congo (BCC) has directed that all banks must raise their minimum capital to $50 million by the end of 2020. Banks have a number of options, to sell and exit, to merge, to raise capital or to step down the regulatory hierarchy to be a non-bank lender or microfinance institution.

It is such a move that is seeing foreign banks seeking new partnerships and ventures to help them remain in business.

Dutch entrepreneurial development bank …

Nigeria’s largest retail lender Access Bank acquired Kenya’s Transnational Bank starting its plans to open shop in all major Eastern Africa markets.

The bank is in the process of acquiring 93.57 per cent shareholding in Kenya’s private owned Transnational Bank at an undisclosed fee as its further eyes Tanzania and Uganda.

The Kenyan acquisition is expected to be concluded in the next 30 to 60 days as it awaits regulatory approvals.

The bank said it was seeking to expand in the region through acquisitions and setting up greenfield operations so as to deepen competition for customers with local rivals.

The lender said it had drawn a five-year plan from 2018-2022 which seeks to raise its retail and wholesale banking business and position itself as the world’s most respected African bank.

Access Bank controls over $13 billion worth of assets and over 27 million customers. In its plan to track record …